Massive Decline in 2024 IPOs and QIPs - 50% of Stocks Trading Below Issue Price

Source: shutterstock

The ongoing market correction has taken a significant toll on companies that raised capital through initial public offerings (IPOs) and qualified institutional placements (QIPs) in 2024. Around 40% of IPO-debuting companies and 50% of QIP-listed firms are now trading below their issue prices, reflecting the broader market downturn.

In 2024, a total of 91 companies listed on the Indian stock exchanges, collectively raising more than Rs 1.6 lakh crore through IPOs. Of these, nearly 38 companies are now facing steep declines, trading below their issue prices. A closer look reveals that 15 of these companies had already listed at a discount and have seen further value erosion, while 23 firms that initially debuted at a strong premium have seen their gains completely wiped out.

IPO Performances Under Pressure

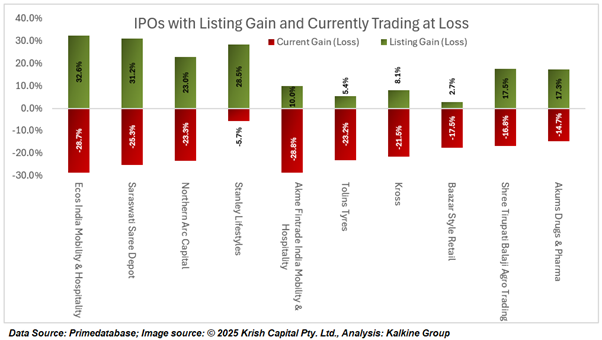

The performance of Several IPOs are facing significant declines in their post-listing performance, with a notable drop in share prices. For example, Ecos India Mobility Hospitality, which initially listed with a 32.6% premium, is now trading at a 28.7% discount to its issue price. Similarly, Akme Fintrade India, which debuted with a 10.0% premium, has seen its stock price fall to a 28.8% discount. Saraswati Saree Depot, which had listed 31.2% higher, is now trading 25.3% below its issue price. Northern ARC Capital, which saw a 23.0% premium at the time of listing, has also dropped by the same percentage.

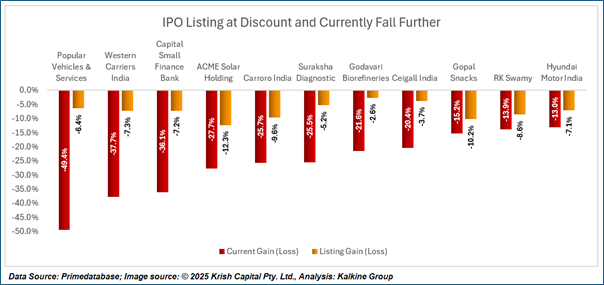

Companies that listed at a discount have been hit even harder, with their losses widening amid the ongoing market correction. For instance, Western Carriers India Ltd and Capital Small Finance Bank, which debuted at discounts of 7.3% and 7.2%, respectively, have seen their stocks plummet by over 37.7% and 36.1% from their issue prices. Popular Vehicles & Services, which had listed 6.4% below its issue price, has now experienced a dramatic decline, with its stock trading at a 49.4% discount. Additionally, other companies like Suraksha Diagnostic, Ceigall India, and Godavari Biorefineries, which initially listed at discounts of 2-5%, are now trading 20-25% lower.

QIP Market Struggles as Well

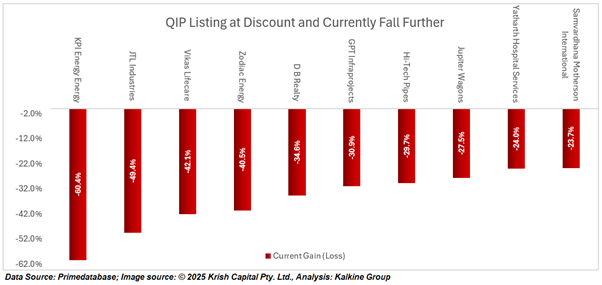

The QIP market, which experienced significant activity in 2024, has also felt the impact of the ongoing market correction. A total of 95 companies raised over ₹1.36 lakh crore through QIPs, but approximately 55 of these firms are now trading below their issue prices, with some seeing substantial declines.

Among the most affected QIP stocks, KPI Green Energy has seen its stock price fall by 60.4% from its issue price, while JTL Industries has lost 49.4% of its value. Vikas Lifecare and Zodiac Energy are both down by more than 40%, and other companies such as DB Realty and GPT Infraprojects have seen declines exceeding 30%.

Impact on Investor Sentiment

The ongoing market correction has led to growing concerns about investor sentiment, as many companies that once generated strong interest during their public offerings are now facing significant struggles. The steep drops in stock prices have raised questions regarding the sustainability of valuations and the overall market outlook. While some investors may hold onto their stocks in anticipation of a recovery, others are reconsidering their positions amid the continued market turbulence.

As the correction persists, the long-term prospects of these companies remain uncertain. The key issue at hand is whether they can recover and regain their previous momentum or if further declines are likely in the current volatile economic environment.

Conclusion

The ongoing market correction has significantly impacted IPO and QIP-listed companies in 2024, with many now trading below their issue prices. This downturn raises concerns about the sustainability of their valuations and investor sentiment. While some investors hope for a recovery, the future remains uncertain, with the key question being whether these companies can regain momentum or face further declines in the volatile economic environment.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.