India's Growth Moderation - Projected Slowdown to 6.5% in 2024-2025

Source: shutterstock

India's economic growth is expected to remain strong, with projections indicating an average growth rate of 6.7% in the coming years, maintaining its position as one of the fastest-growing large economies globally. According to the latest forecast by the World Bank, South Asia’s economic performance will be primarily driven by India's resilience, with a steady outlook through fiscal years 2025-2026 and 2026-2027.

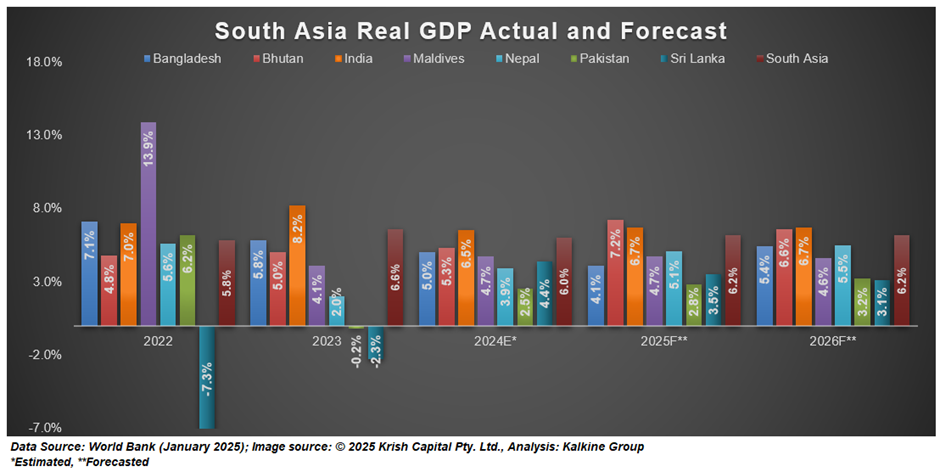

South Asia Real GDP Growth: Annual Estimates and Forecasts

In 2022, South Asia's real GDP grew by 5.8%, with a subsequent increase to 6.6% in 2023. This growth rate is expected to moderate slightly to 6.0% in 2024, with projections stabilizing at 6.2% for both 2025 and 2026.

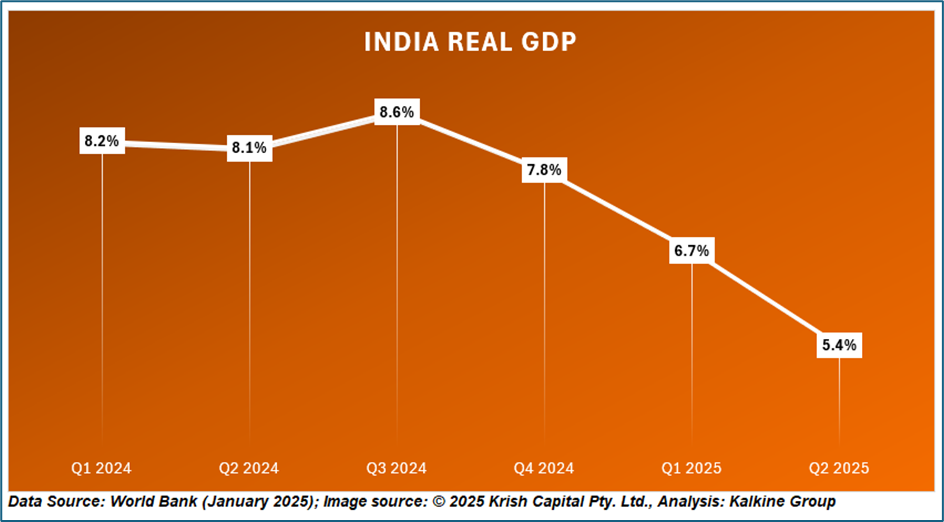

India’s economic growth is projected to moderate in fiscal year 2024-2025, with a forecasted slowdown to 6.5%, down from 8.2% in 2023-2024. This deceleration is largely attributed to a slowdown in investment activity and weak performance in the manufacturing sector. However, India’s economic fundamentals remain strong, driven by a resilient services sector and a recovery in the agricultural sector. Private consumption, particularly in rural areas, has also remained a key driver of growth, supported by rising rural income and improved agricultural output.

Excluding India, the region's growth is expected to rise to 3.9% in 2024, primarily driven by recoveries in Pakistan and Sri Lanka. These recoveries are underpinned by the adoption of improved macroeconomic policies aimed at resolving past economic difficulties.

However, in Bangladesh, political instability in mid-2024 is likely to dampen economic activity and undermine investor confidence. Additionally, supply-side challenges, such as energy shortages and import restrictions, are anticipated to weaken industrial performance and contribute to higher inflationary pressures.

Looking ahead, the growth rate for the region excluding India is projected to strengthen to 4.0% in 2025 and 4.3% in 2026. This outlook has been slightly revised downward from June, primarily due to the ongoing economic and policy uncertainties in Bangladesh.

For Bangladesh, growth is expected to decline to 4.1% in FY2025 but is forecast to recover to 5.4% in FY2026.

Strong Services and Investment Fuel India’s Growth

Inflation in India has stayed within the central bank's target since September 2023, with a brief spike in October 2024 due to food price hikes. Consumption has been varied, with rural areas seeing steady growth, while urban centres face challenges from slower credit growth and higher inflation.

Looking ahead, India’s growth is supported by a strong services sector, digitalization, and infrastructure improvements. Private investment is expected to rise, bolstered by healthy corporate balance sheets. While government consumption remains cautious, the overall investment climate remains favorable for sustained growth.

Bright Outlook for India’s Economy

India’s economy is set to maintain strong growth despite facing short-term challenges such as inflation and global uncertainties. The improving labor market, rising credit access, and declining inflation will support private consumption, driving economic expansion. While short-term obstacles may arise, India’s long-term outlook remains positive, underpinned by a dynamic services sector, enhanced infrastructure, and supportive policies, positioning the country for continued growth and significant contributions to the global economy.

Conclusion

India’s economy is well-positioned for sustained growth, with projections indicating a robust trajectory despite short-term challenges. Key drivers such as a resilient services sector, private investment, and an improving labor market will continue to propel the country forward. While the region faces varied economic conditions, India remains the standout performer, contributing significantly to South Asia's overall growth. With strong fundamentals and strategic reforms, India’s future remains bright, securing its place as a major global economic force.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.