Unimech Aerospace IPO - Why Retail Investors are Flocking to the ₹500 Crore Offer?

Source: shutterstock

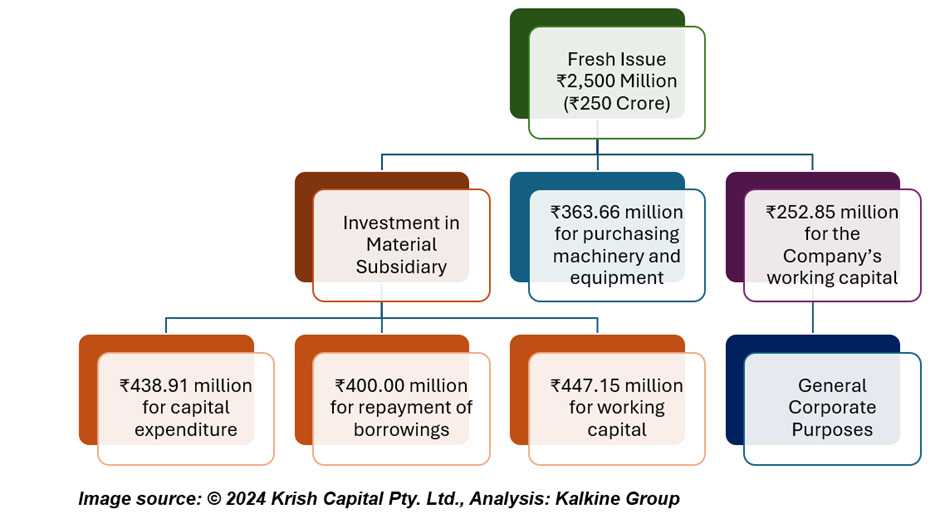

Unimech Aerospace and Manufacturing Limited's Initial Public Offering (IPO) aims to raise ₹500 crores. The IPO consists of a fresh issue of ₹250 crores, which will be used for capital expenditure, and an Offer for Sale (OFS) of ₹250 crores, where the promoters will sell their shareholding. As a result, the company will not receive any proceeds from the Offer for Sale.

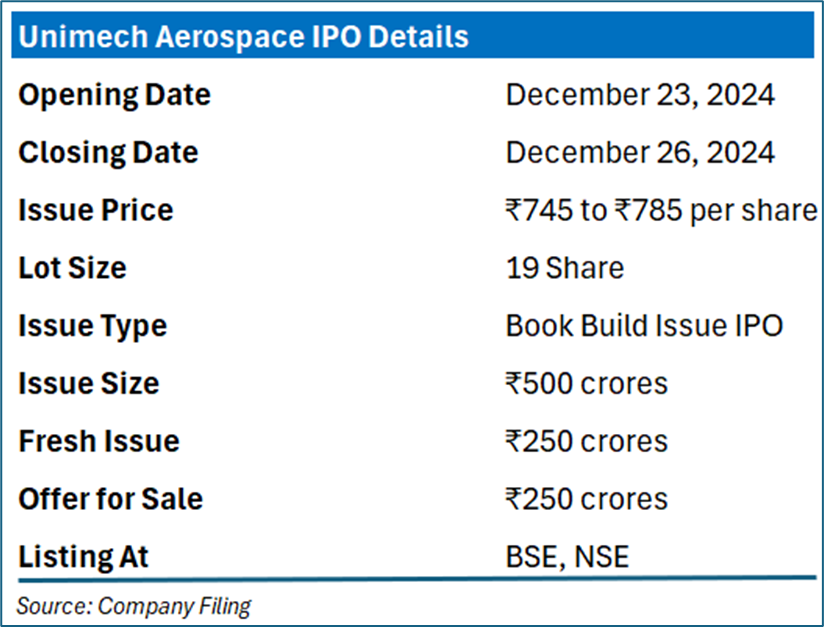

IPO Details

The Unimech Aerospace Mart will be open for subscription from 23rd December 2024 to 26th December 2024. The share allotment will be made on 27th December 2024, and the shares will be listed on the NSE and BSE on 31st December 2024.

The price band for Unimech Aerospace and Manufacturing Limited's IPO is set between ₹745 and ₹785, with a fresh issue of 31,84,712 shares and an equal number of shares being offered for sale. Retail investors can apply for a minimum of 19 shares, requiring an investment of ₹14,915. Small and Medium Investors (sNII) need to invest in a minimum of 14 lots (266 shares), totaling ₹2,08,810, while Big National Institutional Investors (bNII) must invest in at least 68 lots (1,292 shares), amounting to ₹10,14,220.

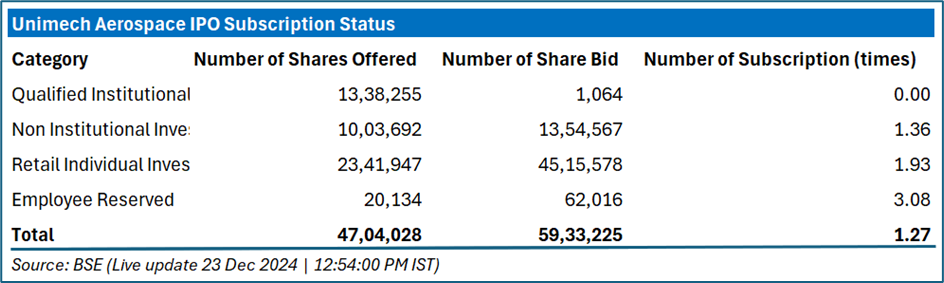

Unimech Aerospace IPO Sees 1.27x Subscription, Led by Retail Investors

Unimech Aerospace's IPO has been subscribed 1.27 times in total. The retail individual investors (RIIs) segment saw the highest demand, with a subscription of 1.93 times, as 45,15,578 shares were bid for the 23,41,947 shares offered. The non-institutional investors (NIIs) category was subscribed 1.36 times, with 13,54,567 shares bid for the 10,03,692 shares on offer. The employee reserved portion was subscribed 3.08 times, with 62,016 shares bid for 20,134 shares. However, the qualified institutional buyers (QIBs) category received no subscriptions, with only 1,064 shares bid for the 13,38,255 shares offered.

Objective of the Offer

Company Overview

Unimech Aerospace and Manufacturing Limited is an Indian company specializing in the design, manufacture, and supply of aerospace components and systems. The company primarily serves the aerospace and defense sectors, offering products such as precision-engineered parts, assemblies, and sub-assemblies for both commercial and military applications. Unimech Aerospace is known for its expertise in the manufacturing of complex components that meet the stringent standards of the aerospace industry.

Business Model

Key business models in the commercial aircraft MRO (Maintenance, Repair, and Overhaul) market.

Types of Commercial Aircraft MRO

Company Financials

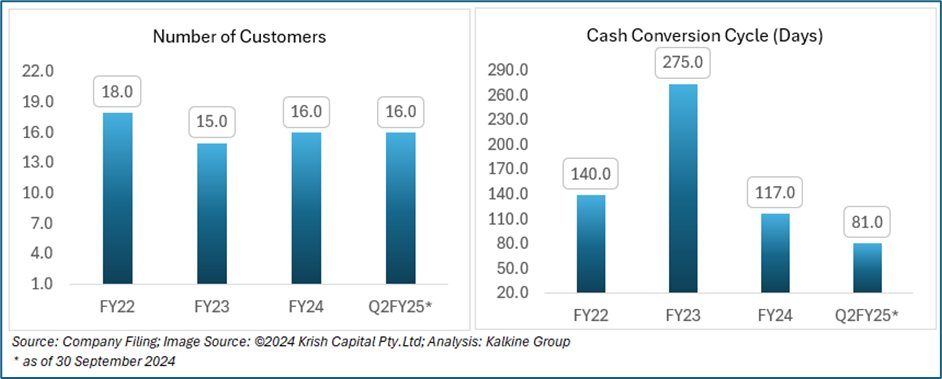

Unimech Aerospace has shown steady performance with a stable customer base, maintaining 16 clients in FY24 and Q2FY25, after a slight dip in FY23. The company has also significantly improved its Cash Conversion Cycle (CCC), reducing it from 275 days in FY23 to 117 days in FY24 and 81 days in Q2FY25. This improvement indicates better working capital management and faster cash flow conversion, signaling enhanced liquidity and operational efficiency.

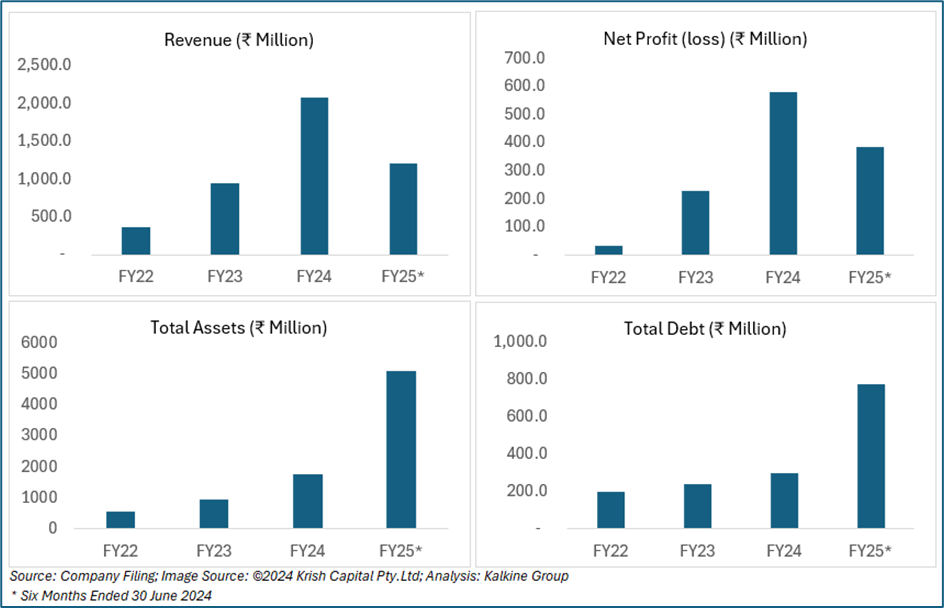

Unimech Aerospace has demonstrated strong financial growth in recent years. In FY24, the company’s revenue grew significantly to ₹2,087.8 million, up from ₹941.7 million in FY23. Net profit also showed a positive trend, increasing from ₹228.1 million in FY23 to ₹581.3 million in FY24. Earnings per share (EPS) improved from ₹5.2 in FY23 to ₹13.2 in FY24.

The company’s total assets rose from ₹933.41 million in FY23 to ₹1,756.3 million in FY24, with a notable jump to ₹5,092.7 million in the first six months of FY25. Total liabilities also increased from ₹445 million in FY23 to ₹670.4 million in FY24, and total debt rose from ₹240.3 million in FY23 to ₹298.6 million in FY24, reaching ₹776.2 million in the first six months FY25.

Cash and cash equivalents grew from ₹18.8 million in FY23 to ₹71.8 million in FY24, and further to ₹75.5 million in the first six months of FY25. These results indicate strong financial management and growth as the company scales up its operations.

Key Considerations Before Investing in Unimech Aerospace IPO

Before making an investment decision, it is crucial to assess the strengths, weaknesses, opportunities, and threats associated with Unimech Aerospace IPO. Understanding these factors can help investors evaluate the potential risks and rewards involved in the investment.

Conclusion

Unimech Aerospace's IPO offers a promising investment opportunity, backed by strong financial growth and improved working capital management. The company is well-positioned in the aerospace and defense sector, with growing demand for its products. However, the lack of interest from qualified institutional buyers (QIBs) and competition in the industry pose potential risks. Investors should carefully consider the growth prospects and risks before making an investment decision.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.