Gold Price Forecast & Investment Guide 2025 - Trends, Technical & Tax Benefits

Source: shutterstock

Gold, long considered the ultimate safe-haven asset, has had an eventful ride in 2025. After touching a lifetime high of ₹99,358 per 10 grams on 22 April 2025 on the Multi Commodity Exchange (MCX), gold prices have since corrected sharply. By 1 May, prices dipped to ₹92,055, and despite a minor rebound, gold was trading nearly 8.5% below its peak by mid-May at around ₹90,890. This decline, while notable, reflects a complex mix of global economic dynamics, shifting investor sentiment, and macroeconomic policy cues.

What Drove Gold’s Downward Turn?

Although gold is widely regarded as a stable asset during uncertain times, it remains susceptible to cyclical fluctuations. The recent decline in gold prices was the result of a blend of macroeconomic shifts and geopolitical developments.

Investment Options in Gold: A Strategic Perspective

Despite the short-term volatility, gold remains a valuable component of a diversified investment portfolio. For Indian investors, two structured instruments offer efficient and regulated exposure to gold:

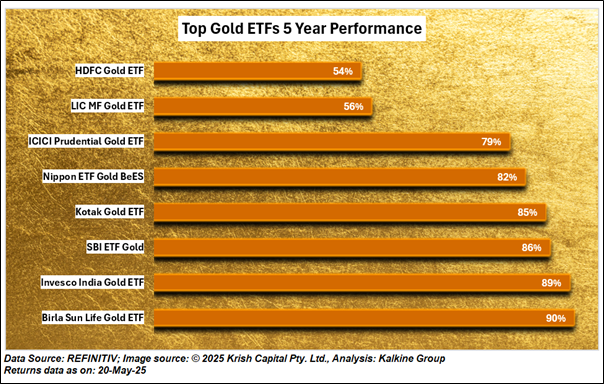

Gold ETFs: Performance and Strategic Advantage for Investors

Gold Exchange-Traded Funds (ETFs) have emerged as a preferred choice for investors seeking efficient, liquid, and cost-effective exposure to the price of physical gold without the hassles of handling the metal. Traded like shares on stock exchanges, each unit of a gold ETF typically represents one gram of physical gold held in secure vaults.

These instruments offer several advantages:

- High Liquidity: Can be bought or sold instantly during trading hours at market prices.

- Transparency: Daily disclosure of Net Asset Values (NAVs) and regular audits ensure accountability.

- Cost Efficiency: No making charges, storage, or insurance costs unlike physical gold.

- Regulatory Oversight: Managed by SEBI-regulated asset management companies, ensuring investor protection.

Gold ETFs are ideal for investors seeking short- to medium-term exposure to gold without the hassles of handling the physical commodity.

Sovereign Gold Bonds: A Secure and Tax-Efficient Long-Term Investment

Sovereign Gold Bonds (SGBs) are government-backed securities issued by the Reserve Bank of India (RBI), denominated in grams of gold. These instruments provide a dual benefit potential capital appreciation in line with market gold prices and a fixed annual interest income. The bonds have a tenure of eight years, with an early exit option available after the fifth year, exercisable only on designated interest payment dates. Investors earn a fixed interest rate of 2.5% per annum, paid semi-annually. Additionally, capital gains on redemption at maturity are exempt from tax for individual investors, enhancing their appeal as a long-term investment vehicle.

While SGBs are listed and tradable on stock exchanges, market liquidity can be limited. However, the long-term returns have proven to be significant. For instance, the SGB 2.50% April 2028 Series-I (2020–21) was issued at ₹4,589 and currently trades at ₹9,220.00, reflecting a total return of 100.92% since issuance. Similarly, the SGB 2.50% Series-IV (FY 2023–24) was issued at ₹6,213 and now trades at ₹9,502.12, yielding a return of 52.94% over the holding period.

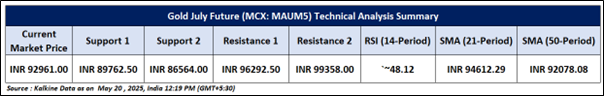

Technical Analysis

Gold is trading at ₹92,961.00, caught between the 21-SMA at ₹94,612.29 and the 50-SMA at ₹92,078.08, indicating indecision. The price slipping below the 21-SMA signals weakening short-term momentum, while holding above the 50-SMA provides near-term support. RSI at 48.12 reflects neutral to slightly bearish sentiment without entering oversold territory. Recent declining volumes suggest a lack of strong conviction among market participants. A clear break below the 50-SMA could trigger further downside, confirming a bearish continuation. Conversely, a move above the 21-SMA may reignite bullish interest. Until then, the trend remains fragile, and range bound.

Conclusion

Gold remains a vital asset for portfolio diversification despite recent price corrections driven by global economic and geopolitical factors. Investment options like Gold ETFs and Sovereign Gold Bonds offer efficient and secure ways to gain exposure to gold. While short-term technical signals suggest caution, gold’s long-term value and appeal as a haven continue to hold strong.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.