India’s Real Estate Slows in 2025, But REITs Open Doors for Smart Investors

Source: shutterstock

India’s real estate sector long considered an attraction for institutional capital, endured a 37 dip in investment exertion during the first half of 2025. According to JLL, investments totaled USD 3.07 billion across 30 deals between January and June 23, down sprucely from the same period last time.

The decline, while significant, is largely tied to global macroeconomic factors rising interest rates, uncertain geopolitical developments, and cautious deal-making all of which have delayed capital deployment timelines. But beneath the slowdown lies a story of structural strength and long-term opportunity.

India Still Among APAC's Strongest Real Estate Markets:

A parallel study by CBRE confirms that India continues to stand out among Asia-Pacific peers like Japan and Singapore, especially in the commercial office segment. Markets such as Greater China and Australia have seen steeper corrections, but India’s real estate remains underpinned by:

- Strong occupier demand

- Diverse tenant base

- Policy consistency and regulatory transparency

Together, these factors keep India firmly on the radar of long-term institutional investors.

A Look Back: Five Years of Real Estate Capital Inflows:

From 2020 to 2024, India attracted over USD 5 billion annually in institutional investments. Much of this growth was supported by reforms like:

- RERA (Real Estate Regulation and Development Act) – perfecting translucency and responsibility

- The rise of REITs – making real estate accessible to both large and small investors

- Stable macro fundamentals

Even during COVID-19, investor sentiment bounced back quickly by late 2021, driven by demand for Grade-A office space and logistics infrastructure in cities like Bengaluru, Mumbai, and Hyderabad.

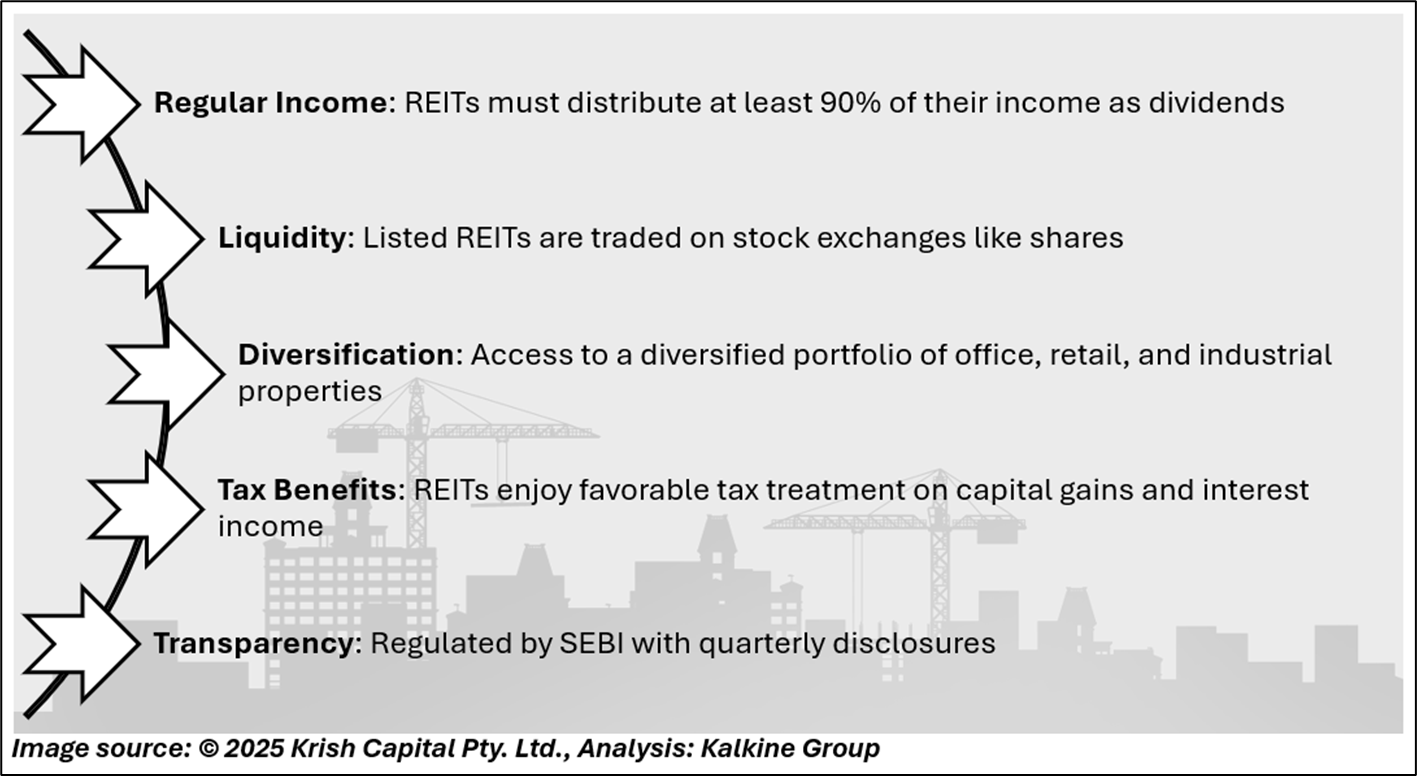

REITs in India: A Game-Changer for Everyday Investors:

Real Estate Investment Trusts (REITs) are transforming how people invest in property. With minimum investment requirements as low as ₹10,000, REITs allow retail investors to own a piece of income-generating commercial properties.

Popular REITs in India

These REITs collectively manage millions of square feet of commercial property and offer stable returns to investors.

Key Insights for Investors in 2025

- Short-term caution, but long-term outlook remains strong

- Foreign capital remains dominant (68% of H1 2025 inflows), with APAC investors leading

- Surging demand for residential real estate and logistics-backed REITs

- Data centers and warehousing expected to gain more traction

- REIT investors may find this dip an opportune moment to enter the market

Invest with a Long-Term Lens:

India’s real estate investment story is evolving, not collapsing. Short-term volatility has tempered deal activity, but the underlying fundamentals remain solid. Whether you're a high-net-worth individual, a retail investor, or a market watcher this could be the right time to explore REITs and long-term property-linked instruments.

As institutional players continue to diversify into residential and infrastructure assets, REITs offer everyday investors a front-row seat to India's real estate growth.

Conclusion

Despite short-term headwinds, India’s real estate sector remains fundamentally strong and investor friendly. With rising interest in REITs, growing foreign participation, and robust demand for quality assets, this phase offers a strategic entry point. Long-term investors can capitalize on the evolving landscape and participate in India’s real estate transformation.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.