Juspay's $150 Million Fundraise Could Push Valuation to $1 Billion

Source: shutterstock

Juspay, a leading fintech firm specializing in payment orchestration software, is reportedly planning to raise $150 million in a new funding round, which will be led by Kedaara Capital. The round will also include participation from key investors such as WestBridge and SoftBank. If successful, this funding round will push Juspay’s valuation to $1 billion, earning it a coveted place in the unicorn club.

Company Overview

Founded in 2012 by Vimal Kumar and Sheetal Lalwani, Juspay has become a key player in India’s digital payments ecosystem with its SaaS platform that optimizes payment processing for businesses. Known for advanced fraud prevention and checkout optimization, Juspay integrates various payment methods, enhancing e-commerce transactions. The company also contributed to the development of the BHIM app and its OTP-read software, which powers UPI apps and streamlines mobile payment checkouts.

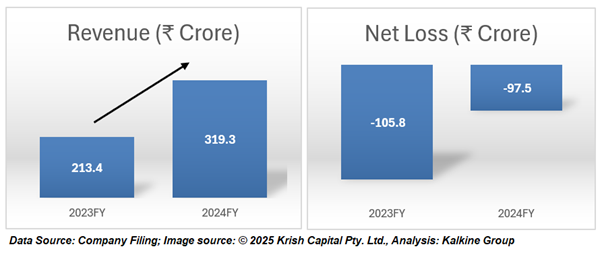

Impressive Financial Growth

Juspay’s financial trajectory has shown significant growth. For the fiscal year ending March 2024, the company reported an operating revenue of INR 319.32 crore, marking a nearly 50% increase from INR 213.39 crore in FY23. Alongside this growth, Juspay managed to reduce its losses by 10%, bringing its total loss down to INR 97.54 crore from INR 105.75 crore in the previous year. This positive performance demonstrates Juspay’s ability to scale effectively in a competitive market while controlling costs.

The company’s resilience in the face of challenges is also evident in its recent regulatory milestone. Juspay received approval from the Reserve Bank of India (RBI) in early 2024 to operate as a payment aggregator, which further cements its position as a leading player in India’s digital payment space.

Facing Growing Competition

Image source: © 2025 Krish Capital Pty. Ltd., Analysis: Kalkine Group

While Juspay’s growth trajectory is strong, the firm faces increased competition as major players in the payments industry adjust their strategies. Leading payment gateways like PhonePe, Razorpay, and Cashfree have recently cut ties with payment orchestration platforms in favor of direct integrations for their payment gateway services. This shift presents a challenge for Juspay’s business model, but the company’s cutting-edge technology and strong investor support provide a solid foundation for adapting to these industry changes.

A Strategic Funding Round Amid Competition

The upcoming $150 million funding round will push Juspay’s total capital raised to over $237 million, a significant achievement for the fintech startup. At a time when the fintech sector is seeing growing competition, including rival Easebuzz, which is also seeking to raise fresh capital, Juspay’s continued growth and strong financial performance highlight its potential for success.

The capital infusion will fuel Juspay’s efforts to further expand its offerings, attract new customers, and strengthen its leadership position in India’s rapidly evolving payments sector. As the company adapts to the shifting dynamics in the industry, it will be interesting to see how it evolves amidst the growing preference for direct payment integrations by major players.

Conclusion

Juspay’s upcoming $150 million funding round, aimed at achieving a $1 billion valuation, marks a pivotal moment in the company’s growth story. With strong financial performance, strategic investor backing, and a significant role in India’s digital payments ecosystem, Juspay is poised to maintain its competitive edge. However, the growing trend toward direct payment integrations presents a challenge that the company will need to navigate carefully. Despite this, Juspay’s ability to innovate and adapt to industry shifts positions it well for continued success in an increasingly competitive fintech landscape.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.