ONGPL Expands Green Portfolio with USD 750 million Ayana Renewable Power Deal

Source: Shutterstock

ONGC NTPC Green Pvt Ltd (ONGPL), a joint venture between ONGC and NTPC, has acquired 100% of Ayana Renewable Power in a strategic move to strengthen its renewable energy portfolio. The total value of the acquisition is between $700-750 million. The deal includes 4.6 GW of renewable energy assets, both operational and under construction. This acquisition marks a key milestone in ONGPL’s dedication to advancing green energy and sustainable development in India. It also supports India's ambitious target of reaching 500 GW of renewable energy capacity by 2030, a goal that demands significant investments from both the public and private sectors. Furthermore, the acquisition helps ONGPL reduce its dependence on fossil fuels and increase its share of clean energy sources.

About Ayana Renewable Power

Ayana Renewable Power is a leading player in India’s renewable energy sector, focusing on solar and wind power projects across the country. The Group’s operating renewable power portfolio stands at 1.592 GW as of October 2024 and 3 GW under development, comprising solar, wind, hybrid & round the clock (RTC) renewable assets with firm power purchase agreements (PPAs).

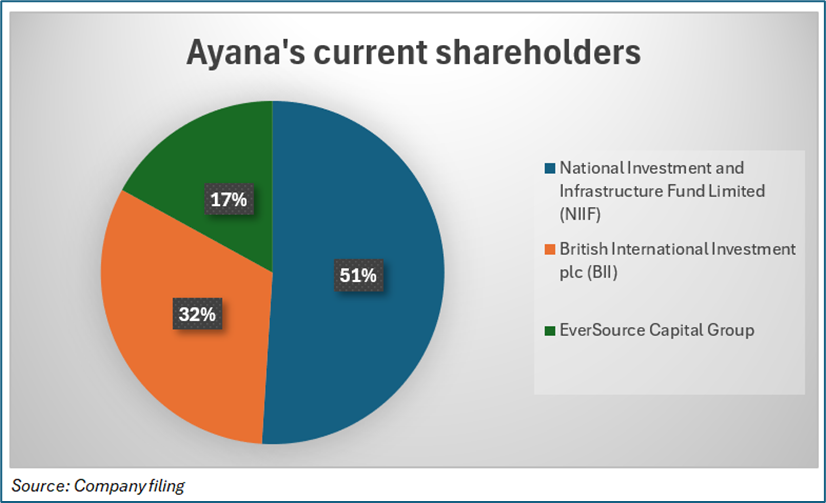

It is supported by prominent investment funds, including the National Investment & Infrastructure Fund, British International Investment, and others. Ayana is involved in a wide range of renewable energy initiatives, such as solar, wind, round-the-clock energy solutions, and green hydrogen.

Advantages of the Acquisition

This acquisition offers significant benefits for ONGPL. It strengthens ONGPL’s renewable energy portfolio by adding Ayana’s existing projects and future plans. Furthermore, it provides opportunities for collaboration, combining ONGPL’s expertise in large infrastructure projects with Ayana’s strengths in renewable energy. With Ayana’s diverse projects at various stages and a robust pipeline for future growth, this acquisition lays a strong foundation for ONGPL to accelerate its expansion in the renewable energy sector.

Public-Private Company Collaboration

ONGPL’s entry into the renewable energy market is expected to attract more investments and encourage innovation. Additionally, the collaboration between ONGPL and Ayana could serve as a model for future public-private partnerships in the energy sector.

Conclusion

The acquisition plays a crucial role in India’s shift towards green energy by helping to phase out coal and other non-renewable energy sources. Companies like ONGPL and Ayana will be instrumental in meeting India’s increasing energy demands through renewable sources such as solar and wind power. This transition not only reduces emissions but also creates new job opportunities in industries like solar panel manufacturing, wind turbine technology, and energy storage.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.