Vishal Mega Mart IPO - A Golden Opportunity or a Promoter Exit?

Source: Shutterstock

Vishal Mega Mart has filed for an Initial Public Offering (IPO) to raise Rs. 8,000 crores. This IPO is an Offer for Sale (OFS), where the promoters will sell their shareholding. As a result, the company will not receive any proceeds from this offering.

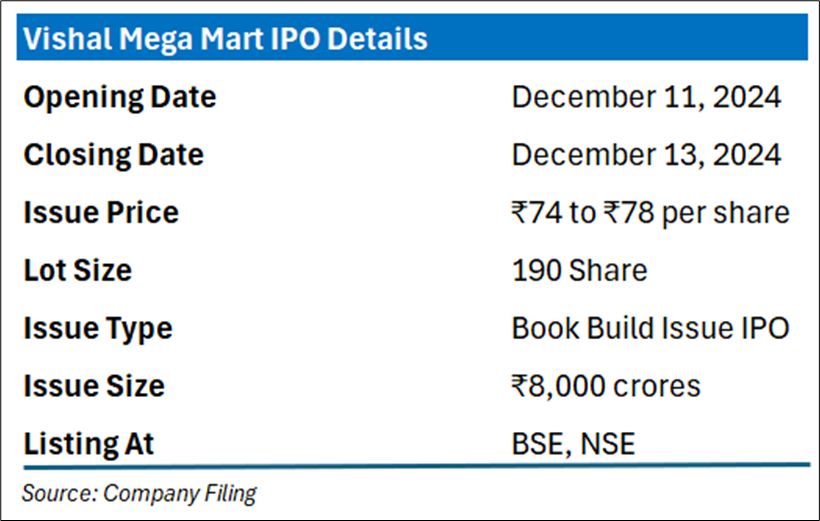

IPO Details

The Vishal Mega Mart IPO will be open for subscription from 11th December 2024 to 13th December 2024. The share allotment will be made on 16th December 2024, and the shares will be listed on the NSE and BSE on 18th December 2024.

The price band for the IPO is ₹74 to ₹78, with an offer for sale of 1,025,641,025 shares. Retail investors can apply for a minimum lot size of 190 shares, requiring an investment of ₹14,820. For Small and Medium Investors (sNII), the minimum investment is 14 lots (2,660 shares), totaling ₹207,480, while for Big National Institutional Investors (bNII), the minimum investment is 68 lots (12,920 shares), amounting to ₹1,007,760.

Company Overview

Vishal Mega Mart is a well-known retail chain in India that offers a variety of products, including clothing, footwear, home goods, and groceries. The company operates large stores that serve a wide range of customers, providing products at affordable prices. It has established a strong presence in the Indian retail market with numerous outlets in both metropolitan and tier-2 cities, focusing on providing affordable products to middle- and lower-middle-income households.

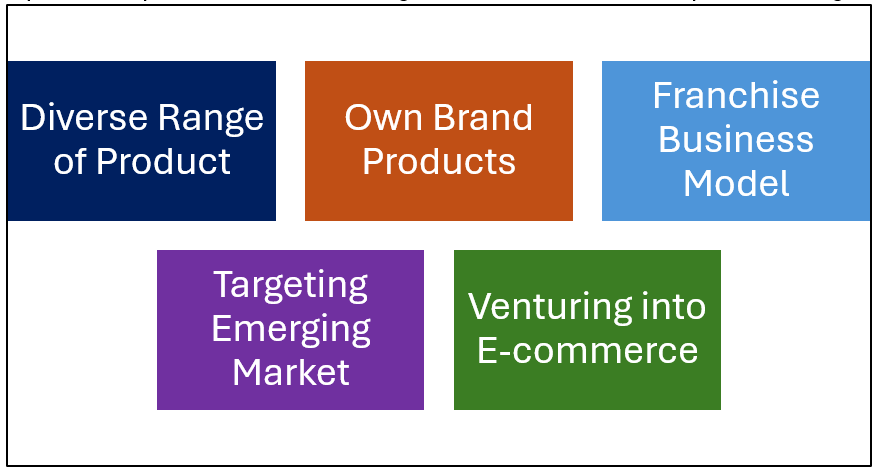

Business Model

Vishal Mega Mart follows an asset-light business model, with all distribution centers and stores leased, and its products manufactured by third-party vendors or sourced from third-party brands. The company plans to introduce new private labels and expand the presence of its existing brands across various product categories.

Analysis by Kalkine Group

Company Financials

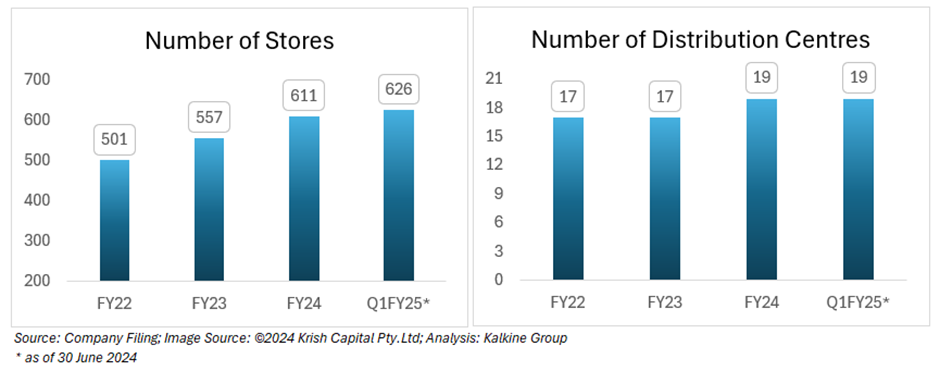

The company operate a pan-India network of 626 stores across 403 Tier 1 cities, Tier 2 cities and beyond in India, as of June 30, 2024. Currently company operate 1 central distribution centre, 1 distribution centre and 17 regional distribution centres.

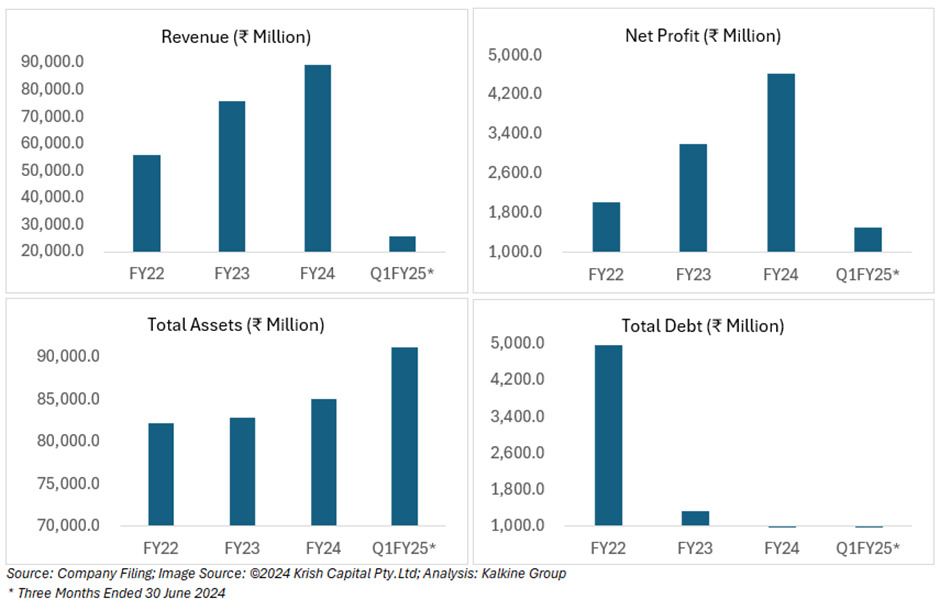

For FY2024, Vishal Mega Mart reported a revenue of ₹89,119.5 million, reflecting strong growth compared to previous years. In Q1 FY2025, the company achieved ₹25,962.9 million in revenue, marking a solid start to the new fiscal year.

The net profit for FY2024 was ₹4,619.4 million, indicating strong profitability. However, for Q1 FY2025, net profit stood at ₹1,501.5 million.

The company's total assets grew from ₹85,060.84 million in FY2024 to ₹91,148.15 million in Q1 FY2025, showing ongoing growth and asset accumulation. Total liabilities also increased, from ₹28,842.42 million in FY2024 to ₹33,360.84 million in Q1 FY2025.

Vishal Mega Mart remains debt-free, with no outstanding debt in both FY2024 and Q1 FY2025, contributing to its financial stability. Additionally, its cash and cash equivalents rose sharply from ₹869.59 million in FY2024 to ₹3,138.73 million in Q1 FY2025, demonstrating strong liquidity and effective cash flow management.

Overall, Vishal Mega Mart has exhibited strong financial performance, with impressive revenue growth, solid profit margins, and a healthy liquidity position.

Key Considerations Before Investing in Vishal Mega Mart's IPO

Before making an investment decision, it is crucial to assess the strengths, weaknesses, opportunities, and threats associated with Vishal Mega Mart's IPO. Understanding these factors can help investors evaluate the potential risks and rewards involved in the investment.

Conclusion

Vishal Mega Mart’s IPO offers a chance to invest in a well-established retail brand with rapid growth in revenue and solid financials. However, as an Offer for Sale (OFS), the company will not benefit from the raised funds, and the promoters are primarily reducing their stake. While the company shows potential with its asset-light model and liquidity, risks such as market competition.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.