SBI Life Insurance Sees 27% PAT Growth in FY25 -Bullish Sentiment Drives Stock Surge

Source: shutterstock

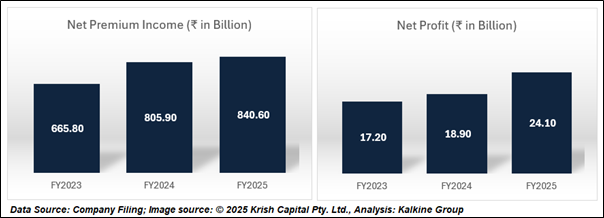

SBI Life Insurance Company reported a stable performance in Q4 FY25, with net profit marginally up at ₹813.51 crore, a 0.37% increase from ₹810.80 crore in Q4 FY24. Despite a 5% dip in net premium income to ₹23,860 crore, the company achieved a 27% surge in full-year profit after tax (PAT) to ₹2,400 crore, driven by strong growth in new business and renewal premiums. Here’s a concise analysis of SBI Life’s financial and technical highlights, supported by key metrics and visual insights.

Financial Performance: Q4 Stability, Annual Strength

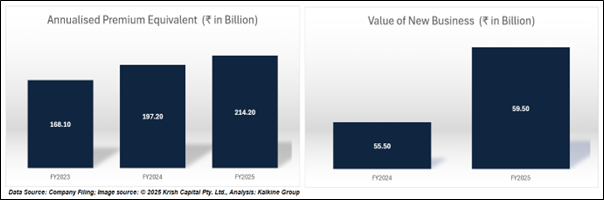

In Q4 FY25, SBI Life's net profit remained largely unchanged at ₹813.51 crore, falling short of analyst expectations of ₹860 crore, primarily due to market volatility affecting unit-linked insurance plans (ULIPs). The company's net premium income declined by 5%, dropping to ₹23,860 crore from ₹25,116 crore, reflecting its exit from the unprofitable group savings business. However, the annualized premium equivalent (APE) saw a 2.2% increase, reaching ₹5,450 crore, surpassing the expected ₹5,022 crore. Additionally, the value of new business (VNB) grew by 10%, rising to ₹1,660 crore, exceeding projections of ₹1,384 crore.

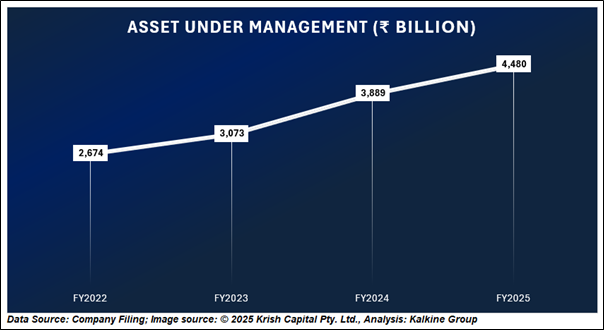

For FY25, SBI Life's profit after tax (PAT) rose by 27%, reaching ₹2,400 crore, driven by a 4% increase in gross written premium, which totaled ₹84,980 crore. The value of new business (VNB) margin improved to 30.5%, up from 27.6%, reflecting a higher proportion of non-participating products (36% compared to 33% in FY24). The company’s assets under management (AUM) grew by 15%, reaching ₹4.5 lakh crore, while its embedded value stood at ₹70,250 crore. Additionally, the persistency ratio for the 13th month remained robust at 87.41%, highlighting strong customer retention.

Technical Summary

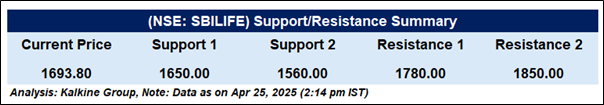

SBI Life Insurance (NSE: SBILIFE) is witnessing strong bullish momentum, trading at ₹1,693.80, up 5.32%. The stock surged as much as 8% in early trade, reaching an intraday high of ₹1,762, following the release of its Q4 FY25 earnings. The rally is further supported by bullish technical indicators, with the stock trading well above its 21-day and 50-day moving averages. Positive investor sentiment toward the company's quarterly performance is driving the upward trend.

Our Stances

SBI Life Insurance has shown significant upward momentum following the release of its Q4 FY25 earnings results. The stock’s price movement, bolstered by strong fundamentals and favorable technical indicators—trading above both the 21-day and 50-day moving averages—suggests that the momentum may continue in the near term. Investor sentiment remains positive, reflecting confidence in the company's current performance and future growth prospects. From a medium- to long-term investment standpoint, the stock seems well-positioned within the life insurance sector. Investors may consider accumulating shares during market corrections, depending on overall market conditions and sector trends.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.