Shares of Indian textile companies surged today as markets responded positively to the recommencement of trade discussions between India and the United States. Leading players like KPR Mill, Indo Count, Welspun Living, and Trident posted gains ranging from 6% to 10%, reflecting investor confidence that improved trade relations could ease export hurdles.

Trade Talks Gain Momentum

The optimism stems from the visit of U.S. trade representative Brendan Lynch to India, aimed at addressing long-standing trade concerns. The discussions are seen as a step forward in resolving tariff disputes, particularly the steep 50% tariffs recently imposed by the U.S. on Indian textile exports. Although this is not officially labeled as the sixth round of negotiations, both sides are keen on reaching a consensus that could unlock new export opportunities.

Stock Market Response

In anticipation of potential tariff relief and smoother export channels, investors reacted strongly. KPR Mill and Indo Count saw their share prices increase by about ~7%, while Welspun Living and Trident gained up to 6%. Market analysts believe that a breakthrough in negotiations would help restore the profitability of textile exports and bolster the sector’s competitive edge in global markets.

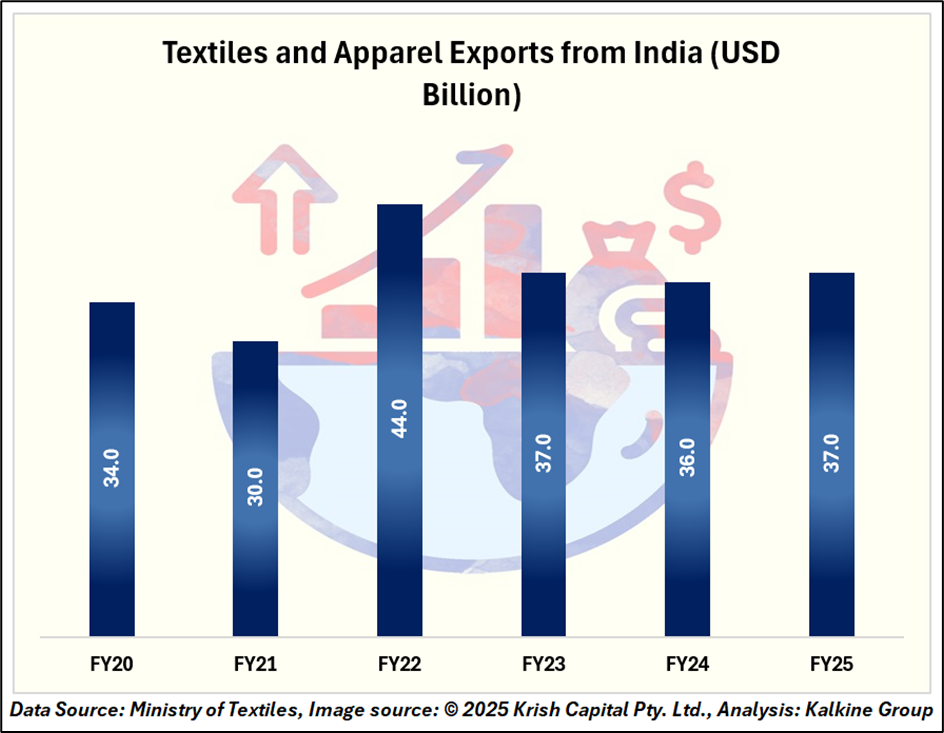

Broader Impact on the Industry

The textile sector is a major contributor to India’s exports, with the United States being one of its top markets. The existing tariffs have placed considerable pressure on exporters, affecting profit margins and supply chains. A positive outcome from trade talks could enhance the sector’s growth prospects, boost employment, and strengthen India’s position as a key global textile supplier.

What Lies Ahead

While the restart of talks has renewed hopes, stakeholders remain cautious until concrete agreements are finalized. The pace at which negotiations proceed and the terms they yield will play a decisive role in determining the sector’s trajectory. Investors and industry leaders will continue to monitor developments closely as both countries work toward resolving trade barriers.

Conclusion

The renewed trade discussions between India and the U.S. have injected optimism into the textile sector, driving stock gains. While potential tariff relief could boost exports and profitability, uncertainty remains until agreements are finalized. Continued negotiations and transparent outcomes will be crucial in shaping the industry’s long-term growth and investor confidence.