US Sanctions Bill Signals 500% Tariff Risk for Russian Oil Buyers, India in Spotlight

Source: Shutterstock

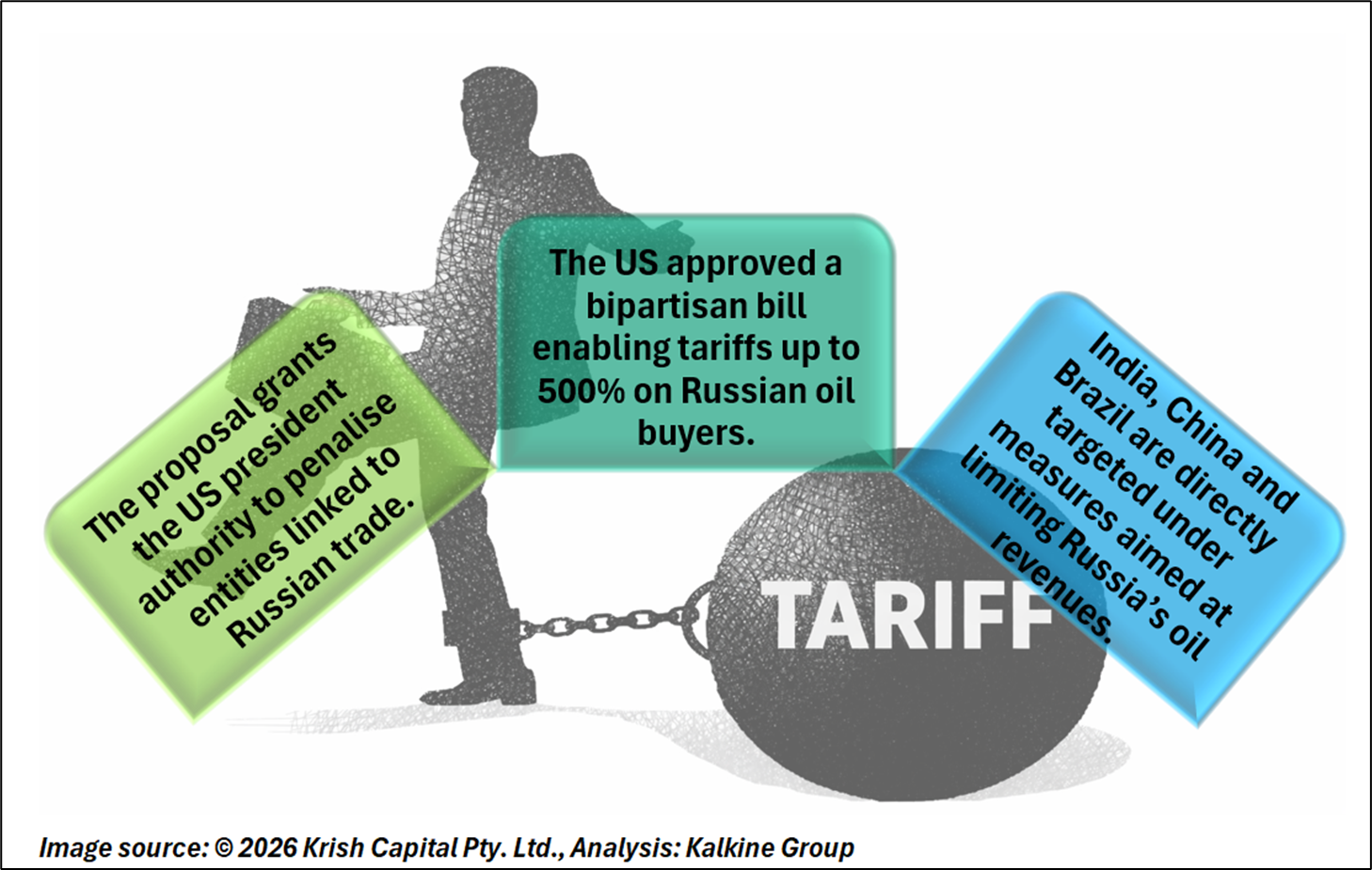

US President Donald Trump has approved the bipartisan Sanctioning of Russia Act 2025, which allows the United States to impose tariffs of up to 500% on countries that continue to buy Russian oil. The move directly targets major importers such as India, China and Brazil, marking a tougher step by Washington to limit Russia’s oil revenues linked to the Ukraine war.

Republican Senator Lindsey Graham said the bill gives the US president wide powers to penalise individuals, companies and imports connected to Russia. Under the proposal, duties on related goods and services would be set at a minimum of 500%. According to him, the law aims to increase pressure on countries that are “helping fuel Putin’s war machine.” A vote on the bill could take place in Congress as early as next week.

Sanctions Arrive Alongside Ukraine Diplomacy

The timing of the bill is notable. It comes as the US and its allies step up diplomatic efforts to bring the nearly four-year Ukraine conflict closer to an end. Recent moves include binding security guarantees for Ukraine, even as Russian military operations continue. Against this backdrop, the proposed sanctions add further strain to an already complex global energy landscape.

Impact on India’s Oil Imports

India has been among the largest buyers of Russian oil, consistently saying its purchases are based on energy security and national interest. However, the proposed US measures are expected to reduce India’s seaborne imports of Russian crude to a three-year low, adding strain to trade relations between New Delhi and Washington.

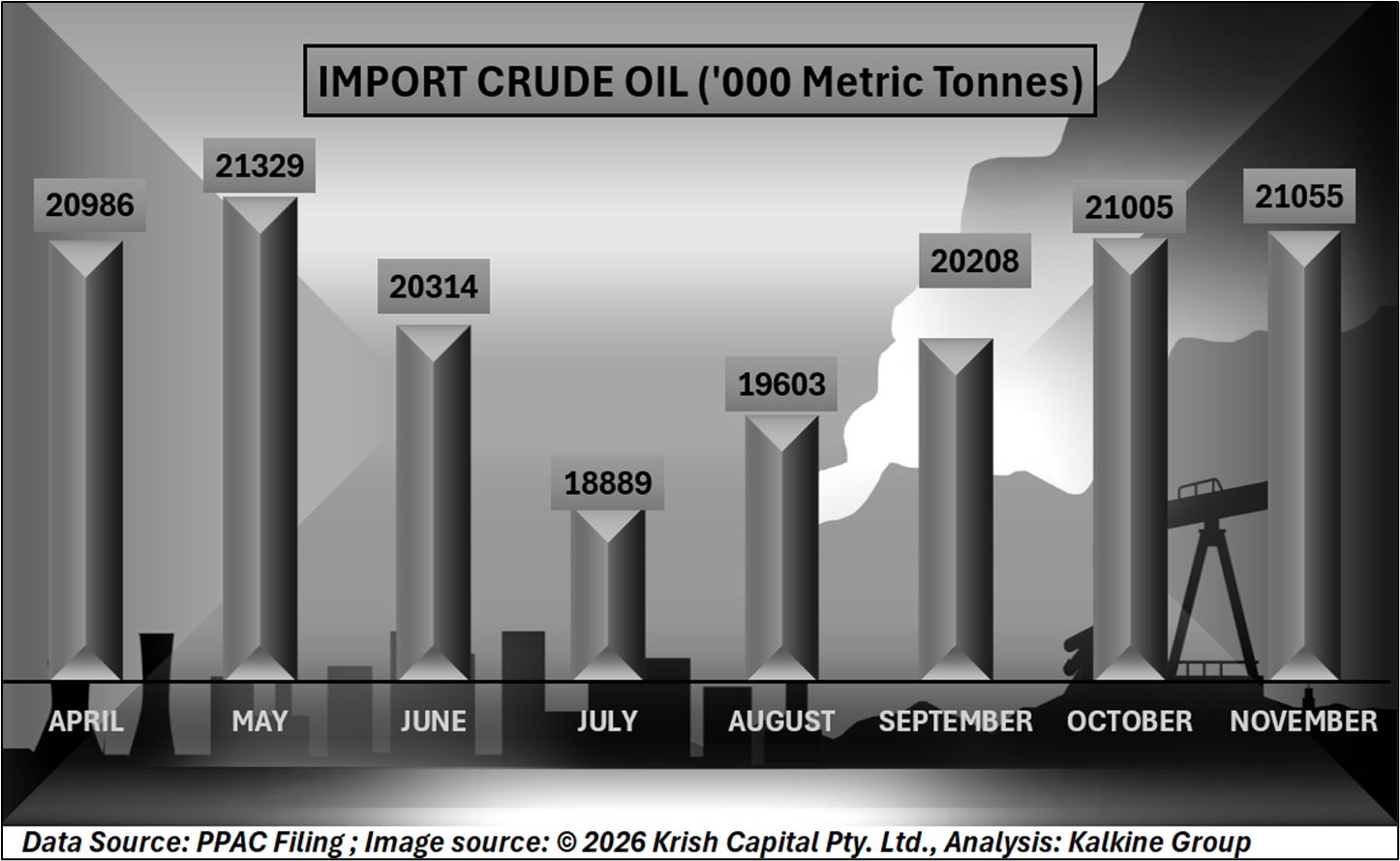

Between April and November 2025, India imported 163.4 million tonnes of crude oil, with monthly volumes ranging from 18.9 to 21.3 million tonnes. Over the same period, petroleum product imports totalled 33.96 million tonnes, covering LPG, naphtha, fuel oil, bitumen and petcoke. LPG imports averaged around 1.6 to 1.9 million tonnes per month, while fuel oil imports peaked in September.

Overall, India’s combined crude and petroleum product imports reached 197.3 million tonnes, underlining the country’s continued dependence on overseas energy supplies.

India’s Role Beyond Imports

Despite high import volumes, India also plays an important role as a supplier of refined fuels. From April to November 2025, the country exported 42.3 million tonnes of petroleum products such as diesel (HSD), petrol (MS), ATF, naphtha and LPG. Diesel made up the largest share, while petrol exports alone totalled 11.1 million tonnes during the eight-month period.

Conclusion

Overall, the Sanctions Act could disrupt global oil trade by increasing costs and shifting supply patterns. For India, it brings renewed focus on balancing energy requirements with diplomatic and geopolitical realities shaping global markets.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.