Biocon Targets Major ₹4,500 Crore Fundraise for Biologics Expansion

Source: shutterstock

Biocon Ltd has lined up a fresh capital raise of up to ₹4,500 crore and has appointed four global investment banks Kotak Mahindra Capital, Morgan Stanley, JP Morgan, and HSBC Securities as advisors for the proposed transaction. According to the company, the fund raise may be executed through various permissible instruments, including equity or equity-linked securities. Options on the table include a Qualified Institutional Placement (QIP), rights issue, preferential allotment, or private placement, depending on market conditions and investor appetite.

Timeline and Regulatory Approvals

The proposed fund raise is moving swiftly, with management preparing to begin investor roadshows shortly. A deal launch is currently targeted for January 2026. The Biocon board has already approved the proposal, and shareholder consent will be sought at an extraordinary general meeting scheduled for December 31, 2025. This step is expected to formally pave the way for execution of the capital-raising plan early next calendar year.

Focus on Biocon Biologics Integration

The primary purpose of the fund raise is to meet the cash consideration required for acquiring the remaining stake in Biocon Biologics from Mylan Inc. This acquisition forms part of Biocon’s broader strategy to fully integrate its biologics arm into the parent company. Under the arrangement, part of the consideration to Mylan will be paid in cash, while the remainder will be settled through a share swap, aligning long-term interests.

Background of Earlier Fund Raise

This is not the first time Biocon has tapped the capital markets in recent years. In June 2025, the company successfully raised ₹4,500 crore through a QIP aimed at strengthening its balance sheet and supporting innovation-led growth. The current proposal follows Biocon’s announcement of a full integration with Biocon Biologics, which valuated the subsidiary at approximately $5.5 billion, underscoring its strategic importance.

Strengthening Financial Performance

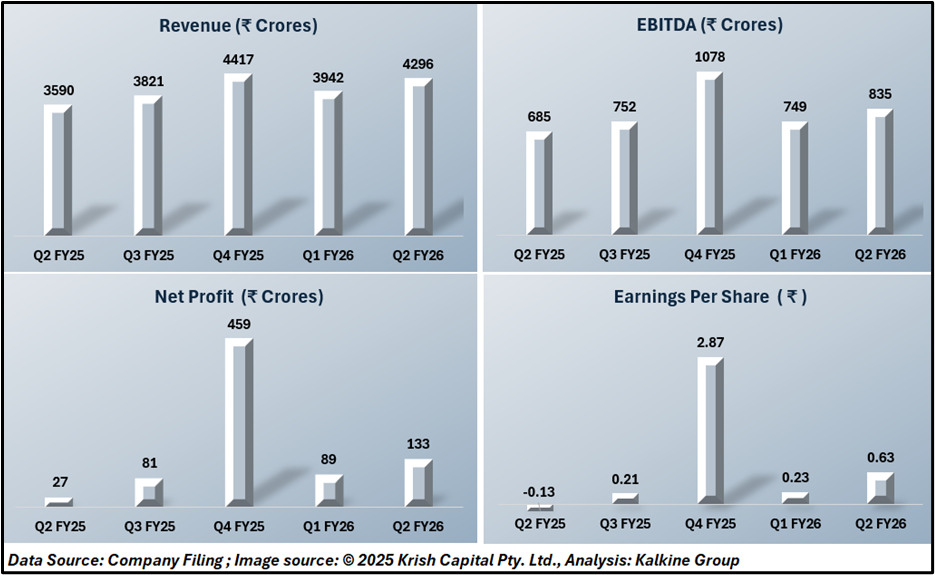

Biocon’s recent financial performance provides context to the capital-raising initiative. In Q2 FY26, the company reported consolidated revenue of ₹4,296 crore, up from ₹3,590 crore in Q2 FY25. EBITDA rose to ₹835 crore from ₹685 crore year-on-year, with margins holding steady at 19%. Net profit increased sharply to ₹133 crore from ₹27 crore, while earnings per share improved to ₹0.63 from a loss of ₹0.13 in the same period last year.

Progress Toward Full Ownership

In addition to the Mylan transaction, Biocon has also acquired the remaining stakes in Biocon Biologics held by other investors. With these acquisitions, Biocon Biologics will become a wholly owned subsidiary of Biocon Ltd. To ensure a smooth transition, the company has constituted dedicated governance and transition committees to oversee operational, financial, and cultural integration.

Conclusion

Biocon’s planned ₹4,500 crore capital raise is strategically aligned with its move to fully integrate Biocon Biologics. The fund infusion will help meet cash requirements while simplifying the group structure. With steady growth in revenue and profitability, the company appears financially positioned to support the transition.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.