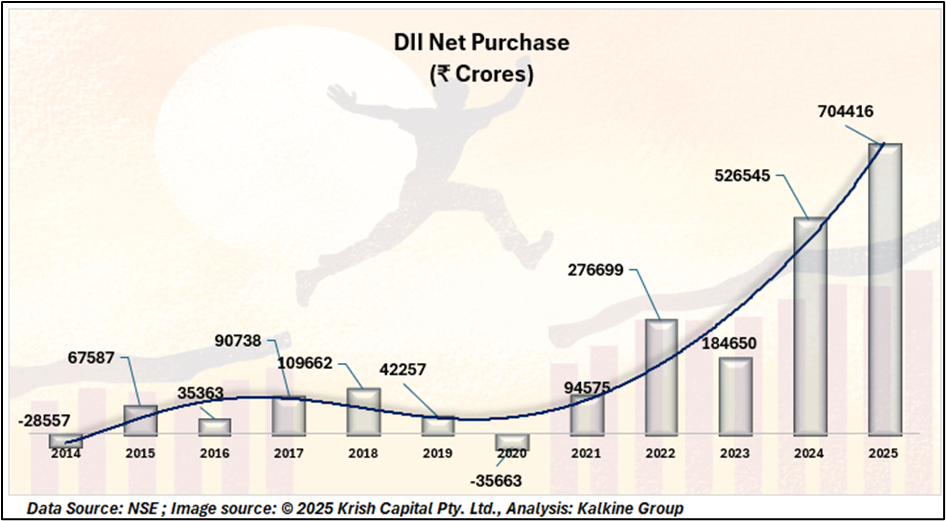

DIIs Drive Historic Rs 7 Lakh Crore Buying, Strengthening India’s Equity Markets

Source: shutterstock

Domestic institutional investors (DIIs) have reshaped the Indian equity market this year, pumping a record ₹ 7,04,416 crore into equities with a month still left in 2025. This surpasses the previous high of Rs 5,26,545 crore in 2024 and highlights the growing dominance of domestic capital in supporting market stability.

Large-Cap Outperformance

The focus of DII investments has been largely on large, liquid stocks. Large-cap indices have led the market, while midcap and smallcap segments have seen selective gains. Out of the broader indices, a portion of companies recorded positive returns, reflecting the selective nature of domestic institutional buying.

Cushion Against Volatility

DIIs have demonstrated calmness amid global turbulence, showing little inclination to react to geopolitical tensions, currency swings, or international interest rate shifts. Their steady buying has helped markets hold ground and scale new highs, offsetting continued selling by foreign investors.

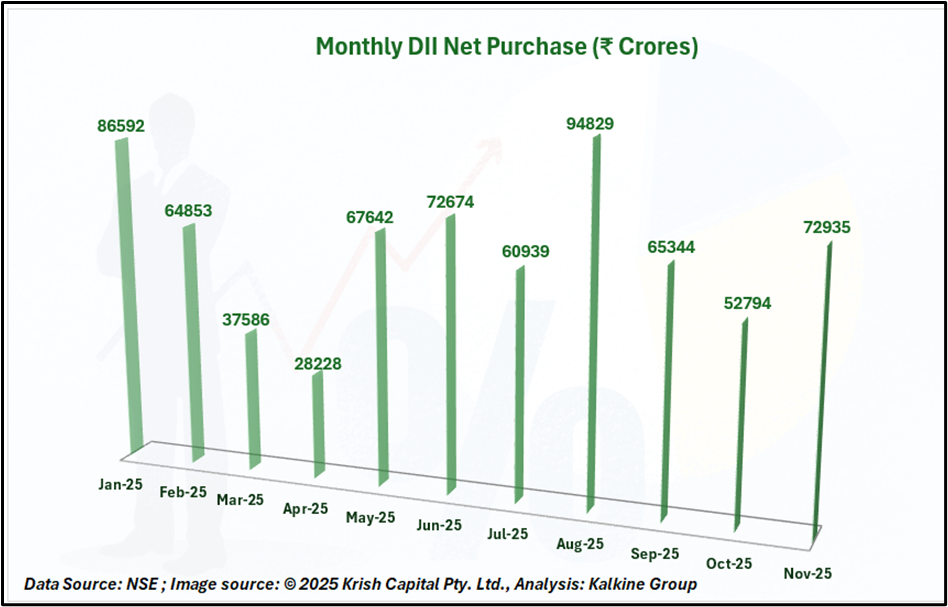

Monthly Contributions Show Consistent Momentum

The flow of funds has been steady throughout the year. January recorded ₹86,592 crore, February ₹64,853 crore, and August ₹94,829 crore, with other months also seeing substantial inflows. These regular investments reflect the increasing participation of households in systematic and disciplined equity allocation, creating a long-term pool of capital that underpins market resilience.

Selective and Strategic Deployment

DIIs are deploying capital strategically rather than indiscriminately. Investments have favored financials, industrials, capital expenditure plays, and public sector undertakings, while selectively accumulating fundamentally strong midcap and smallcap companies. This disciplined approach supports sustainable growth and aligns with India’s domestic economic story.

Market Impact and Outlook

The surge in DII inflows has strengthened the domestic backbone of Indian markets, creating a buffer against external volatility and enhancing investor confidence. As 2025 draws to a close, DIIs continue to play a pivotal role in shaping market dynamics, marking a historic milestone in India’s capital market evolution.

Conclusion

The record DII inflows in 2025 highlight the growing strength of domestic investors in shaping Indian equity markets. Steady and disciplined buying has provided a buffer against external volatility and foreign selling. Large-cap stocks have benefited most, while selective midcap and smallcap investments reflect strategic allocation. As the year closes, DIIs continue to play a pivotal role, reinforcing market stability and supporting long-term growth.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.