Domestic Strength Sets Up Nifty for a Big 2026 Leap, Says Kotak

Source: shutterstock

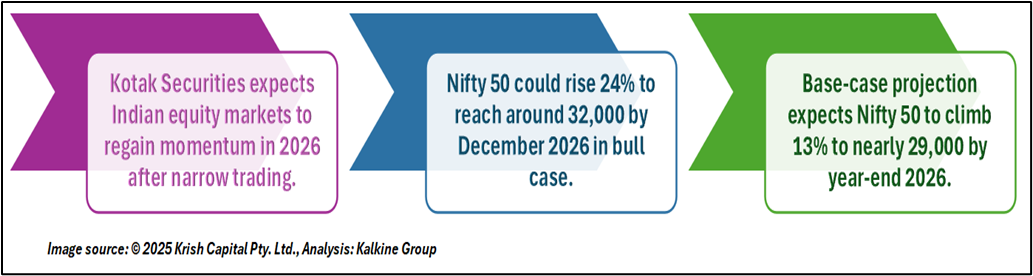

Kotak Securities expects Indian equity markets to regain momentum in 2026 after spending most of 2025 in a narrow trading range. According to its latest outlook, the Kotak believes the Nifty 50 could rise as much as 24% to reach around 32,000 by December 2026 in a bull-case scenario. The base-case projection also indicates a healthy upside, with the index expected to climb 13% to nearly 29,000.

Muted 2025 Performance Sets the Stage

The report notes that Indian markets have been largely flat for the past year, delivering what it calls “mediocre” one-year returns. Despite breaking record highs recently, the broader performance has lagged several global markets. However, Kotak believes this consolidation has reduced excess valuations and strengthened the overall market setup for the coming year.

Domestic Investors Remain Key Market Drivers

A major theme highlighted is the resilience of domestic investors. Even as foreign portfolio investors have been cautious and net sellers for months, Indian retail and institutional investors have continued to buy. Robust participation in the primary market and steady inflows into mutual funds and insurance products have helped keep the market supported. Kotak expects domestic sentiment to remain the deciding factor for market direction in 2026.

Global Challenges but a Strong Local Economy

The global backdrop is expected to remain uneven due to tariff concerns, geopolitical tensions, and softer trade growth. Despite this, India’s economic outlook appears firm. The brokerage estimates a healthy GDP growth, supported by strong domestic demand. Government measures aimed at boosting disposable incomes, reducing taxes, and generating employment are expected to cushion the economy even if global conditions stay weak.

Earnings Growth Expected to Accelerate

Kotak anticipates a modest uptick in earnings for FY26, followed by a sharper recovery in FY27. It expects profit growth of Nifty 50 companies to improve significantly as business fundamentals strengthen and macro conditions become more supportive. Importantly, the expected earnings improvement is likely to be broad-based rather than concentrated in just a few sectors, signaling a healthier market environment.

Sectors Likely to Lead the Next Leg of Growth

The brokerage remains positive on a few key sectors that are expected to benefit from both cyclical recovery and structural trends. These include banking and financial services, information technology, healthcare, and hospitality. According to the outlook, these sectors are well-positioned to deliver stable earnings and support the overall market performance in the coming years.

Technical Summary

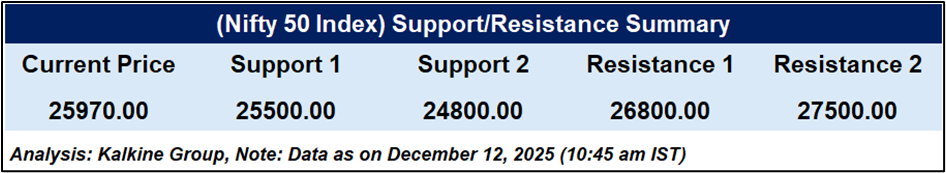

Nifty 50 continues to trade resiliently above the 50-day SMA, signalling steady underlying support despite recent consolidation. The RSI rebounded from lower levels, hinting at easing downside momentum. With prices stabilising near 25,900, the index maintains a constructive tone, and a decisive move above 26,100 could revive upward traction.

Conclusion:

Kotak Securities expects the Indian equity market to regain momentum in 2026, driven primarily by resilient domestic investors and improving corporate earnings. While global uncertainties may persist, strong economic fundamentals and targeted government measures are likely to support growth. Key sectors like banking, IT, healthcare, and hospitality are expected to lead the market’s upward trajectory, making the Nifty 50 poised for healthy gains.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.