Equity Mutual Fund Inflows Jump 21% in November as Investor Interest Rebounds

Source: shutterstock

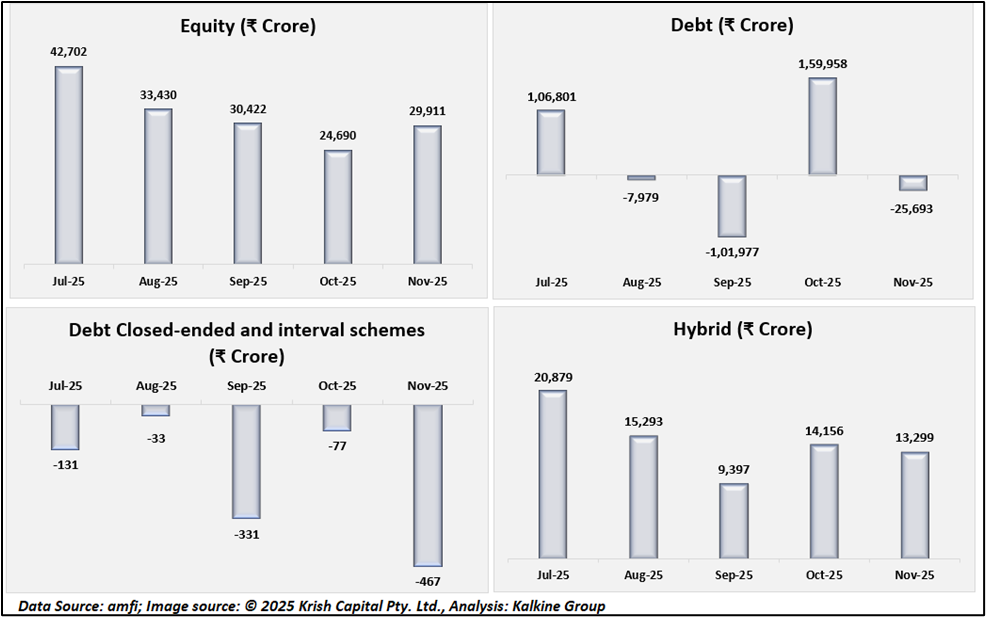

Equity mutual fund inflows rose sharply to ₹29,911 crore in November 2025, reflecting a solid 21% month-on-month increase. After a few months of cooling sentiment, investors returned strongly across most categories, helping revive overall market momentum.

The mutual fund industry’s total open-ended AUM reached ₹80.5 lakh crore, while equity AUM climbed to ₹35.66 lakh crore compared to ₹35.39 lakh crore in October. The renewed buying interest also coincided with the launch of 24 new schemes during the month, which collectively mobilised ₹3,126 crore.

Debt Funds Witness Heavy Outflows

Debt-oriented schemes saw a complete reversal in sentiment, registering a sharp outflow of ₹25,694 crore in November. This contrasts with heavy inflows seen in October, largely driven by quarter-end institutional allocations that did not repeat in November.

Liquid funds reported the highest outflow of about ₹14,051 crore, followed by overnight funds at ₹37,625 crore. Despite the broad outflow trend, some categories performed well. Money market funds drew ₹11,104 crore, while ultra-short-duration funds attracted ₹8,361 crore as investors preferred shorter-maturity, lower-risk options. Corporate bond funds and short-duration funds also saw mild positive flows.

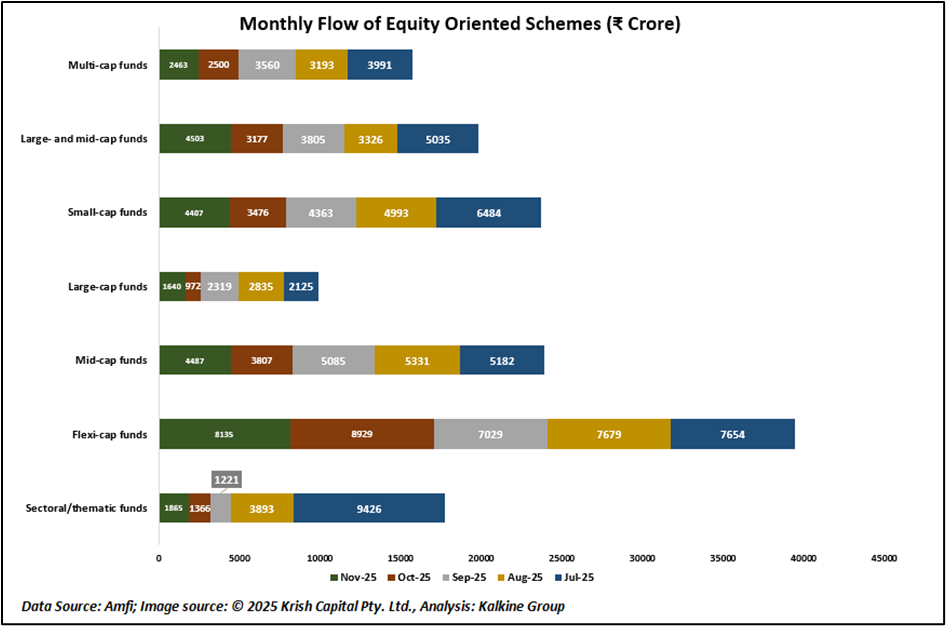

Category-Wise Performance Shows Broad Participation

Large-cap funds saw a notable rebound, bringing in ₹1,640 crore almost 69% higher than the previous month. Large & mid-cap funds, along with mid-cap funds, continued to see strong investor interest, recording inflows of ₹4,503 crore and ₹4,487 crore, respectively.

Small-cap funds continued to attract steady participation, collecting ₹4,407 crore, a healthy rise of nearly 27% compared to October. The overall trend suggests that investors remained confident about long-term equity opportunities despite short-term market volatility.

However, two categories ELSS funds and dividend yield funds recorded net outflows of ₹570 crore and ₹278 crore, signalling selective investor behaviour within the equity segment.

Conclusion

Overall, November marked a strong revival in equity mutual fund sentiment, with robust inflows driven by broad investor participation across large-cap, mid-cap, and small-cap categories. While debt funds faced sharp outflows due to shifting institutional behaviour, shorter-duration options still attracted meaningful interest, highlighting a cautious but active investment approach. The steady rise in equity AUM, strong SIP culture, and healthy traction in new fund launches collectively reflect investors’ continued confidence in long-term market prospects despite short-term volatility.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.