FPIs Pull Out ₹1.06 Lakh Crore: India Turns Laggard Among Global Markets

Source: shutterstock

Foreign portfolio investors (FPIs) have remained persistent sellers in 2025, pulling out a staggering ₹1.06 lakh crore from Indian markets by October 1. The heavy outflow has left India trailing behind its global peers, with the country emerging as the weakest among the top 10 equity markets in the September quarter.

India’s Market Slide

India’s overall market capitalisation slipped 5.6% to $5.08 trillion in Q3 2025, down from $5.38 trillion in the previous quarter. The weakness dragged frontline indices, with both the Sensex and Nifty losing nearly 4%, while the BSE Midcap and Smallcap indices fell over 4.5% each, reflecting broad-based selling pressure.

Global Comparison

While India struggled, several global markets rallied. China surged 20% to $12.96 trillion, followed by Taiwan and Hong Kong, both up nearly 12%. The US advanced 8.4%, Canada rose 8%, and Japan climbed 6.2%. Meanwhile, the UK and France eked out marginal gains, and Germany declined 2.3%, underscoring India’s relative underperformance.

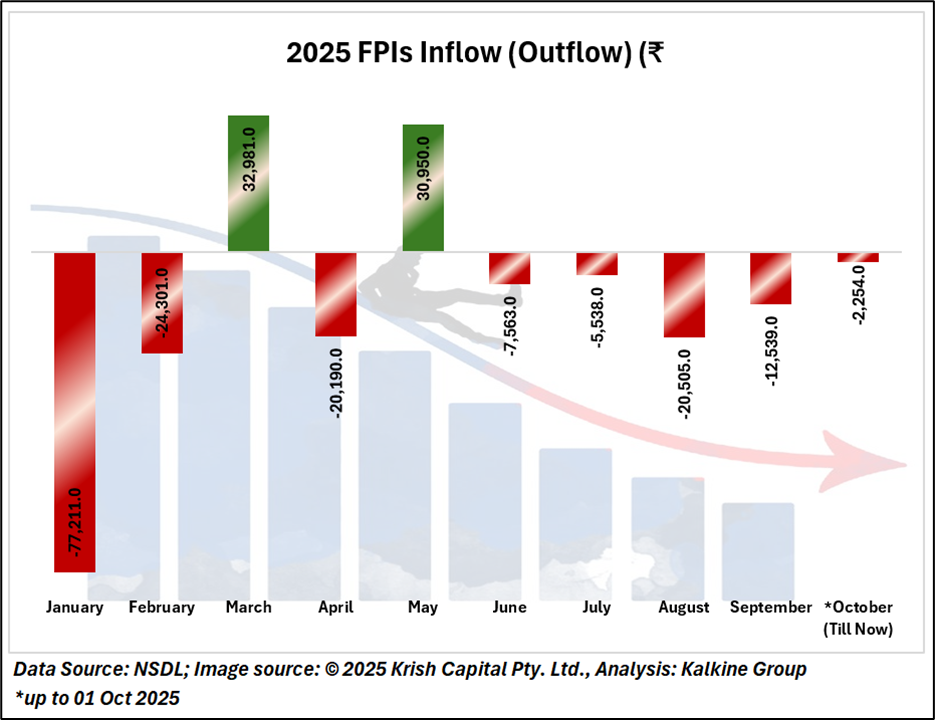

FPI Flow Volatility

The year has seen sharp swings in FPI flows. January witnessed record withdrawals of ₹77,211 crore, followed by another ₹24,301 crore in February. Inflows made a brief comeback in March (₹32,981 crore) and May (₹30,950 crore), aided by debt participation. However, selling pressure resumed in April, June, July, August, and September, with April (-₹20,190 crore) and August (-₹20,505 crore) marking the heaviest outflows. The new quarter also began on a weak note, with ₹2,254 crore withdrawn on October’s first trading day.

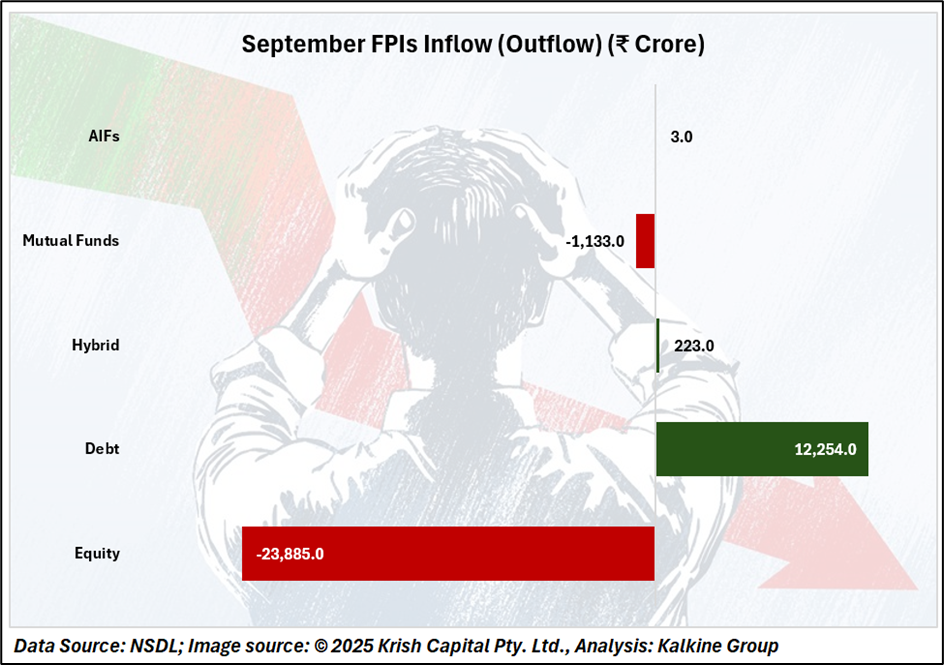

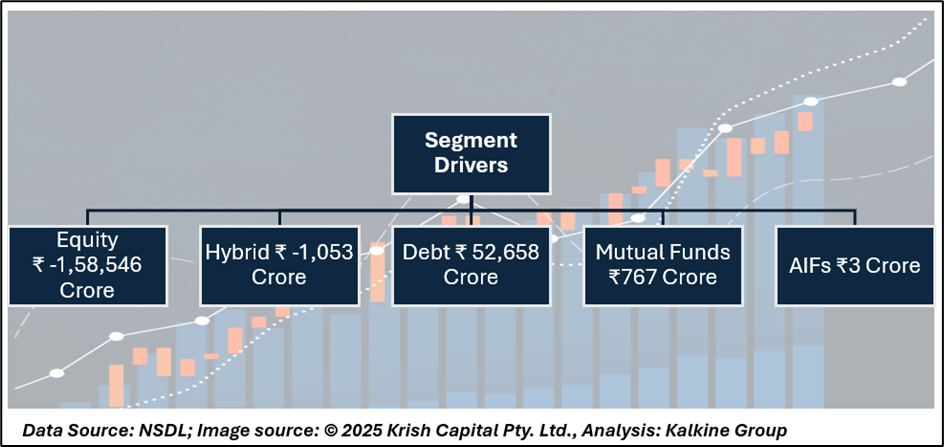

Segment-Wise Breakdown

Sentiment Drivers

Foreign selling was fuelled by stretched valuations, inconsistent earnings, and global macro headwinds. A fresh overhang emerged in late September when the US imposed 100% tariffs on branded and patented pharmaceutical imports unless companies shifted manufacturing to America, denting investor confidence further.

Outlook

Despite the turbulence, brokerages expect earnings momentum to gradually improve, supported by GST 2.0 reforms and the possibility of policy easing by the RBI. Growth opportunities remain strong in consumer discretionary, defence, renewables, technology, domestic manufacturing, PSU banks, and select NBFCs, sectors that could help India regain investor favour in the medium term.

Conclusion

In conclusion, India’s equity markets face short-term pressure from persistent FPI outflows and global headwinds, but strong domestic demand, policy support, and sector-specific opportunities provide a resilient backdrop. While near-term volatility may continue, structural growth drivers could help India regain investor confidence and re-emerge as a preferred investment destination.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.