Adani Enterprises Seeks ₹16,500 Crore Financial Support from Adani Infra to Fuel Growth

Source: shutterstock

Adani Enterprises Ltd., the flagship company of the Adani Group, has announced its intention to seek shareholder approval for raising an additional ₹16,500 crore in borrowings from its infrastructure arm, Adani Infra. This move comes on the back of the previously sanctioned borrowing limit of ₹6,000 crore for the financial year 2025-26. The proposed incremental funding signals the company’s continued ambition to scale its infrastructure and diversified business ventures while maintaining financial flexibility amid evolving market dynamics.

Strategic Rationale Behind the Funding Request

The infrastructure sector is at the core of India’s long-term economic growth, and Adani Enterprises has been aggressively investing in sectors such as logistics, energy transition, data infrastructure, and industrial projects. With the government’s push toward infrastructure-led development and increased private participation, access to larger pools of capital is crucial for companies like Adani Enterprises that are seeking to expand operations rapidly.

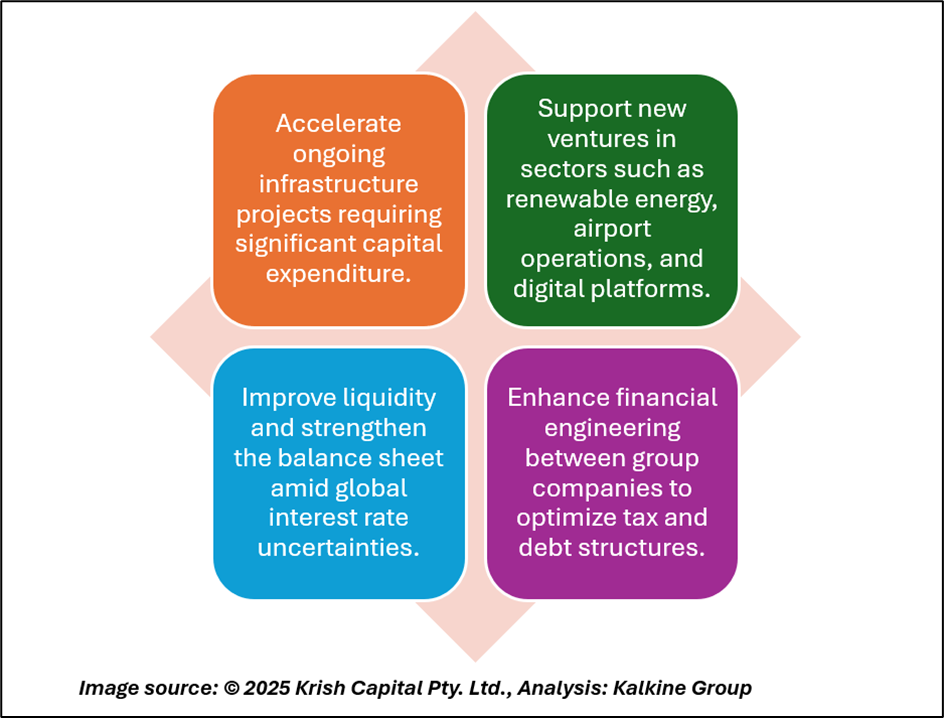

The proposed borrowing will likely be deployed to:

Risk Considerations and Governance Oversight

While the proposed funding is aligned with expansion goals, it raises governance and risk management concerns that investors are closely monitoring. The inter-company funding structure requires transparent reporting, fair valuation mechanisms, and strict adherence to regulatory frameworks, particularly in light of past scrutiny on group-level borrowings.

Investors will watch closely how the funds are allocated and whether the returns from these projects justify the increased leverage. A robust risk mitigation framework and periodic disclosures can help build confidence among stakeholders.

Outlook: Growth with Prudence

Adani Enterprises’ strategic move to raise additional capital through its infrastructure wing demonstrates its proactive approach to scaling operations in line with India’s infrastructure ambitions. However, balancing growth with prudent financial management will be key. Transparent governance practices, strategic capital allocation, and measurable project execution milestones will be instrumental in sustaining investor trust.

The next steps will involve shareholder approval, followed by detailed disclosures around the utilization of funds. Market participants and analysts will be assessing how this funding round aligns with the group’s broader roadmap for energy transition, infrastructure development, and diversification into high-growth sectors.

Technical Analysis

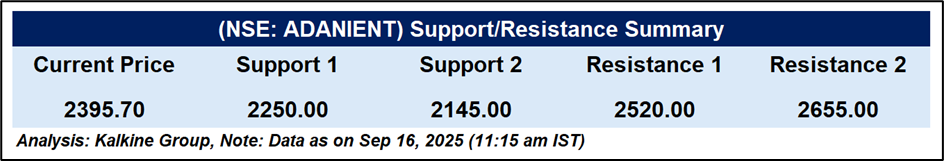

Adani Enterprises is currently trading at ₹2,395.70, slightly above its 51-day EMA of ₹2,384.47, indicating short-term bullishness. The RSI at 57.44 suggests moderate buying momentum without being overbought. Recent price action shows a recovery from lows around ₹2,200, supported by increased volumes. The stock’s trend remains cautious, with upside potential if it sustains above the EMA.

Conclusion

Adani Enterprises’ plan to raise ₹16,500 crore reflects its growth-driven approach amid expanding infrastructure opportunities. While capital deployment can boost long-term prospects, governance and debt risks remain key concerns. Transparent execution and disciplined financial management will be critical for investor confidence and sustainable growth as the company navigates market uncertainties.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.