HCL Tech Shines in Q2 FY26 with Strong Growth, Steady Margins, and Cash Strength

Source: shutterstock

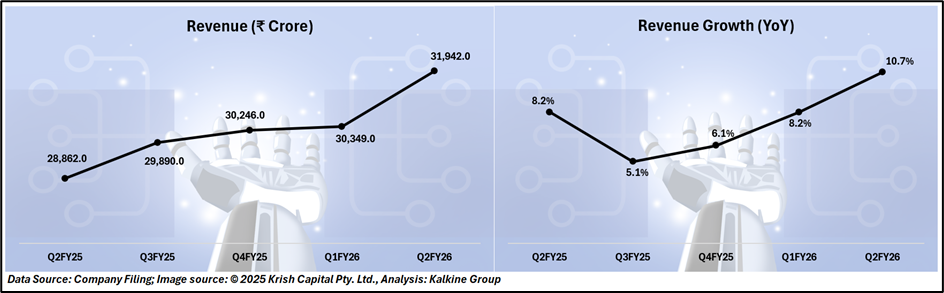

HCL Technologies Ltd (NSE: HCLTECH) has reported a 10.7% (YoY) rise in consolidated revenue for the quarter ended 30 September 2025 (Q2 FY26), reaching ₹31,942 crore, driven by strong deal ramp-ups and sustained demand across its IT and engineering services verticals. Sequentially, revenue grew 5% from ₹30,349 crore in the previous quarter.

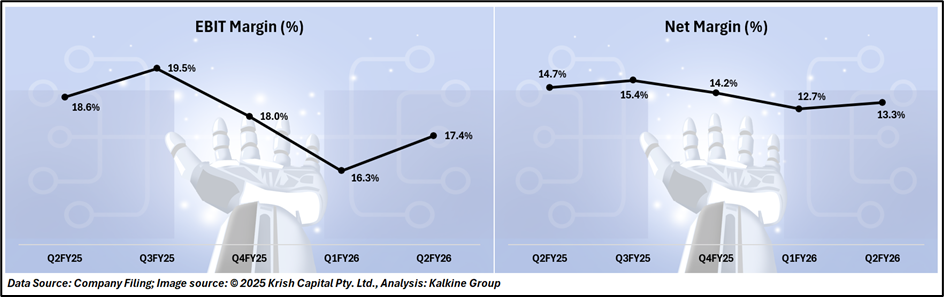

Net profit stood at ₹4,236 crore, nearly unchanged from ₹4,237 crore in the same quarter last year. Profit before tax (PBT) was ₹5,702 crore, reflecting disciplined cost management amid higher employee expenses. Operating expenses rose to ₹26,655 crore, primarily due to a rise in headcount-related costs, which climbed to ₹18,301 crore from ₹16,523 crore a year ago. Despite these pressures, HCL maintained a steady EBIT margin, supported by the ramp-up of large transformation deals and improved operational efficiency.

Healthy Cash Position and Dividend

The company remains debt-light and cash-rich, with total assets of ₹1,08,573 crore and equity of ₹71,271 crore as of September 30, 2025. HCL reported a net cash inflow from operations of ₹9,608 crore during the first half of FY26, demonstrating strong cash generation. The Board declared an interim dividend of ₹12 per share for FY26, maintaining its consistent shareholder return policy.

Business Segment Performance

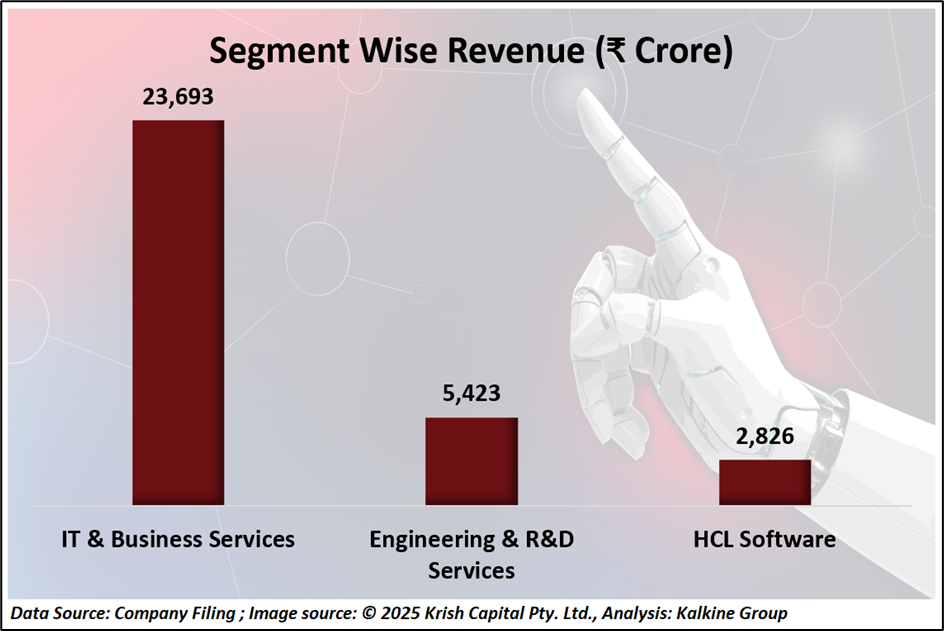

The IT & Business Services division remained the largest contributor to overall growth, while Engineering & R&D delivered the fastest expansion, underscoring HCL’s strength in next-generation engineering capabilities.

Outlook

HCL Tech continues to benefit from its broad digital, engineering, and software portfolio. Analysts expect the deal pipeline and enterprise tech spending recovery to drive revenue growth in the coming quarters. Margins are expected to remain stable as the company balances new deal execution with ongoing investments in talent and innovation.

Technical Analysis

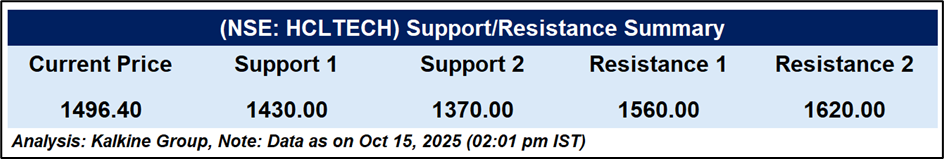

HCL Technologies trading at ₹1,496.40, holding slightly above its 51-day EMA at ₹1,475.10, indicating short-term support. The RSI at 62.23 suggests improving bullish momentum but nearing overbought territory. Sustaining above ₹1,560 could trigger further upside, while immediate support lies near ₹1,430, followed by ₹1,370 on the downside.

Conclusion

HCL Technologies delivered solid Q2 FY26 performance with steady margins and robust cash generation despite cost pressures. Strong deal momentum, expanding engineering capabilities, and a healthy balance sheet position the company well for sustained growth. Technicals indicate short-term bullishness, supported by resilient fundamentals and consistent shareholder returns.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.