Hindustan Unilever Undertakes Leadership Restructure to Accelerate Growth in India

Source: Shutterstock

Hindustan Unilever (HUL), one of India’s leading consumer goods companies, has announced a significant leadership restructuring under the stewardship of its new CEO, Priya Nair. The move reflects the company’s strategic intent to drive stronger growth in India, which ranks as Unilever’s second-largest market globally.

The reorganization is designed to streamline decision-making processes, reduce organizational bureaucracy, and provide greater agility in executing strategic initiatives. By reshaping the reporting structure, HUL aims to empower Priya Nair to concentrate on high-margin categories, particularly in the beauty and wellbeing segments, which are emerging as key drivers of profitability.

A notable focus of this strategic shift is on accelerating investments and acquisitions in the direct-to-consumer (D2C) space. With consumers increasingly gravitating toward personalized and digitally accessible products, HUL’s leadership believes that a more nimble organizational structure will facilitate faster product launches and enhanced consumer engagement.

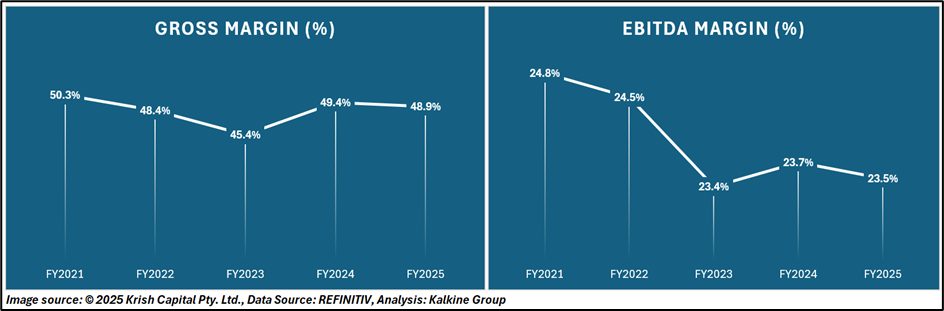

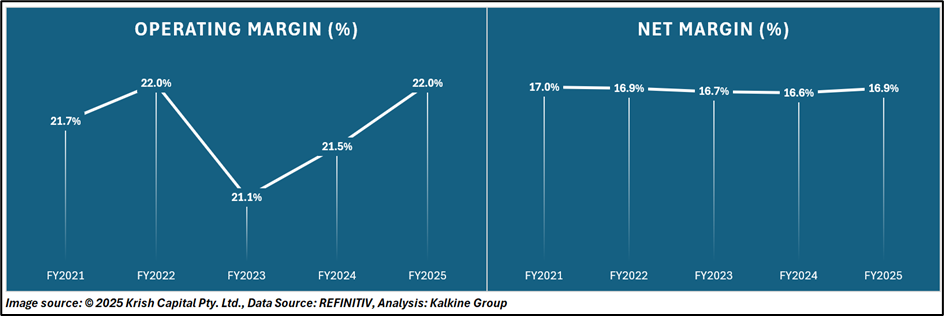

Financial Performance

Leadership Revamp for Growth and Market Edge

Industry analysts view the leadership overhaul as a proactive step to reinforce HUL’s competitive edge in India’s dynamic consumer market. By combining strategic oversight with operational efficiency, the company is positioning itself to capitalize on evolving consumer preferences while maintaining its legacy of market leadership.

Priya Nair’s appointment and the accompanying structural changes underscore HUL’s commitment to innovation, growth, and a sharper focus on premium and high-margin segments. As India continues to play a pivotal role in Unilever’s global portfolio, the company’s streamlined approach is expected to translate into stronger market performance and sustainable long-term growth.

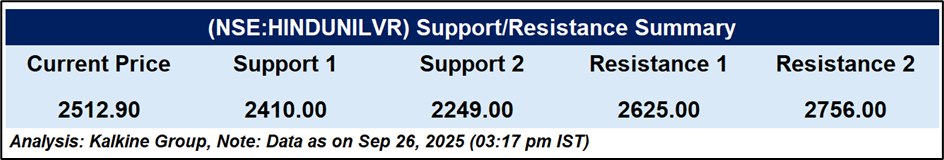

Technical Analysis

Hindustan Unilever Limited’s daily chart shows a recent correction, closing at ₹2,512.90, below the 51-day EMA of ₹2,546.96, signaling short-term weakness. Volume remains moderate at 831.74K. The RSI has dropped to 38.91, approaching the oversold zone, indicating subdued momentum. The trend suggests possible continued consolidation or further downside risk unless a reversal is triggered by an improvement in volume or a positive price action breakout.

Conclusion

Hindustan Unilever’s leadership restructuring under Priya Nair signals a decisive push toward agility, innovation, and premium growth categories. While short-term market weakness persists, the strategic focus on beauty, wellbeing, and D2C opportunities positions HUL to strengthen competitiveness, capture evolving consumer demand, and deliver sustainable long-term value in India’s dynamic market.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.