HSBC Turns Bullish: Sensex Seen Soaring to 94,000 by 2026

Source: shutterstock

Global banking major HSBC has delivered a resounding vote of confidence in India’s capital markets, upgrading the country’s equities to ‘Overweight’ from ‘Neutral’ and setting a bold target of 94,000 for the Sensex by end-2026. This projection underscores India’s growing stature as the brightest spot in Asia’s investment landscape, driven by resilient domestic demand, government policy support, and structural growth reforms.

India’s Resilience Amid Global Uncertainty

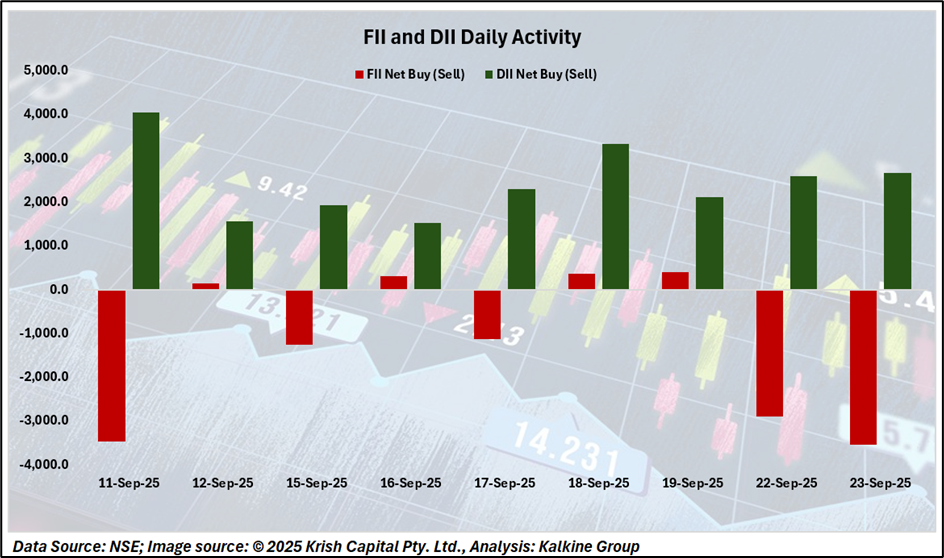

Unlike many Asian peers wrestling with political volatility, export dependence, or valuation concerns, India has remained an island of relative calm. Domestic institutional investors and a rapidly expanding retail investor base have consistently absorbed selling pressure from foreign funds, ensuring stability in the equity market. This depth of local participation has strengthened India’s ability to withstand global headwinds.

Drivers Behind HSBC’s Upgrade

According to HSBC, India’s equity story is underpinned by three pillars: macro stability, policy continuity, and corporate earnings visibility. A sustained government-led infrastructure push, robust tax collections, and favorable demographics have created a long runway for growth. Even if earnings growth moderates slightly, the supportive ecosystem ensures equities remain attractive relative to regional peers.

India’s Position in Asia-Pacific

The upgrade puts India in an elite grouping alongside China and Hong Kong the only three Asian markets HSBC currently rates ‘Overweight’. At the same time, Korea has been downgraded to ‘Underweight’, reflecting greater earnings uncertainty and policy risk. With Asia-Pacific equities already up 20% this year, India stands out not only for its fundamentals but also for the under-ownership by foreign investors, offering significant catch-up potential.

Implications for Investors

HSBC’s Sensex target of 94,000 by 2026 signals a potential 13–15% upside from current levels, creating an attractive entry window for long-term institutional and retail investors alike. Sectors such as financial services, infrastructure, consumer discretionary, and new-age technology are expected to lead the next leg of the rally. For global investors seeking both alpha and relative safety, India is now positioned as the preferred growth engine of Asia.

The Bigger Picture

India’s ascent in HSBC’s investment radar is not merely about near-term market momentum it reflects confidence in a structural transformation. With accelerating digital adoption, rising middle-class consumption, and increasing global integration, India’s market is evolving from a cyclical opportunity into a core allocation for global portfolios.

Technical Analysis

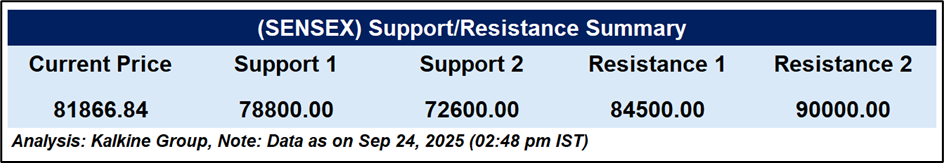

The Sensex trades near 81,866.84, holding slightly above the 50-day SMA at 81,370.59, suggesting short-term support around this level. Additional support is seen near 78,800 if the break can test the next support level at 72,600. The RSI at 52.74 indicates neutral momentum, neither overbought nor oversold. On the upside, immediate resistance is placed at 84,500, with further hurdles near 90,000. Overall, the index reflects a consolidative tone, with directional clarity emerging on a break above resistance or below key support.

Conclusion

HSBC’s bullish upgrade projects Sensex at 94,000 by 2026, highlighting India’s macro stability, policy support, and corporate earnings strength. Strong domestic demand, resilient investor participation, and structural reforms position India as Asia’s growth engine. Key sectors financials, infrastructure, and technology offer attractive long-term opportunities amid global uncertainty.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.