Infosys Steps Up Capital Return with ₹18,000 Crore Buyback

Source: shutterstock

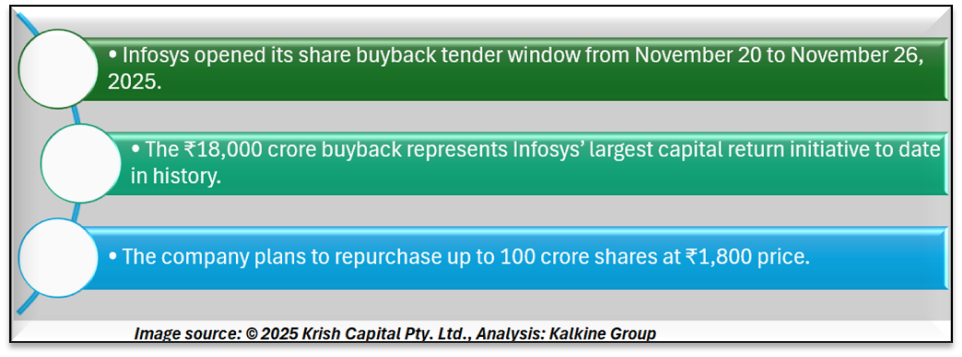

Infosys Limited has commenced its share buyback program, with the tender window opening on November 20, 2025, and scheduled to close on November 26, 2025. The company plans to buy back up to 100 crore equity shares at ₹1,800 per share, aggregating to ₹18,000 crore, making it the largest buyback in Infosys’ history. The initiative reflects disciplined capital management and a focus on returning surplus cash to shareholders.

Buyback Structure and Shareholder Entitlement

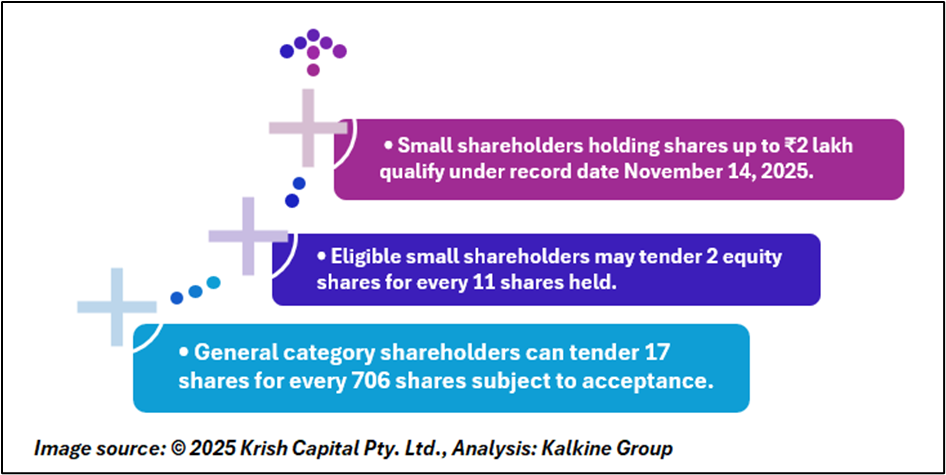

The buyback is structured across two categories—small shareholders and general shareholders. Small shareholders, defined as those holding shares valued up to ₹2 lakh as of the record date of November 14, 2025, are entitled to 2 equity shares for every 11 shares held. Shareholders in the general category are eligible to tender 17 shares for every 706 shares held, subject to final acceptance and rounding adjustments.

Promoter Participation and Retail Implications

Infosys’ promoters and promoter group, holding 14.30% stake as of September 30, 2025, have stated they will not participate in the buyback. With public shareholders owning 85.46% of the company, this decision is expected to improve acceptance ratios, particularly for retail investors participating under the small shareholder category.

Q2 FY26 Financial Performance

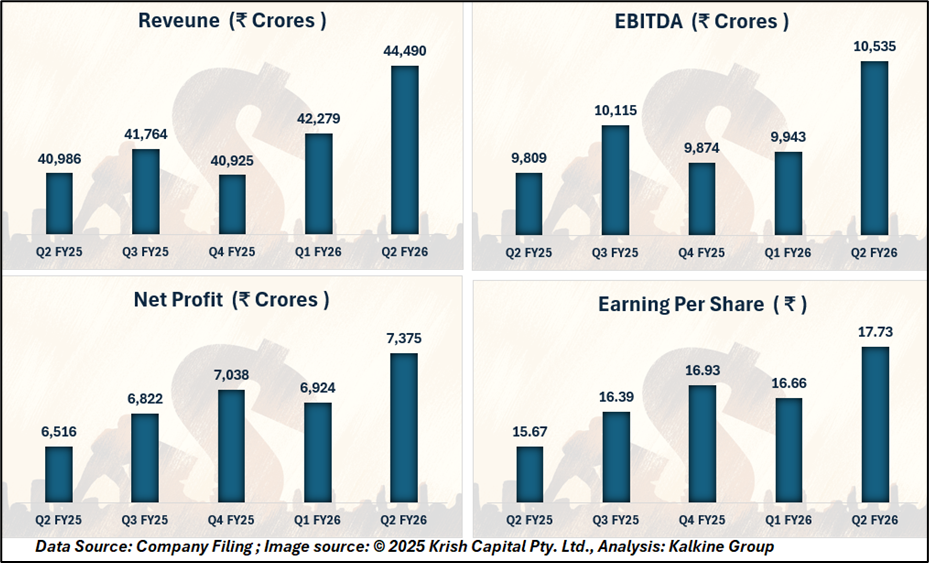

Infosys’ recent Q2 FY26 results provide a stable operating backdrop for the buyback. The company reported revenue of ₹44,490 crore, registering 8.5% growth, the strongest among the last five quarters. EBITDA stood at ₹10,535 crore, with margins steady at 24%, reflecting consistent operational efficiency.

Net profit rose to ₹7,375 crore, up 13.2%, while earnings per share increased to ₹17.73, indicating improving profitability and earnings visibility. The buyback is fully funded through internal cash reserves, underlining Infosys’ strong balance sheet.

Conclusion

Infosys’ ₹18,000 crore buyback, supported by steady Q2 FY26 financial performance and promoter non-participation, enhances participation prospects for public shareholders. The move aligns with the company’s objective of optimizing capital allocation while supporting long-term EPS and ROE metrics. Eligible investors are advised to submit tender forms before the buyback window closes on November 26, 2025.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.