Mazagon Dock Shipbuilders: Navigating Margin Pressures with Order Book Strength

Source: shutterstock

Mazagon Dock Shipbuilders Ltd. (MDL), India’s premier defence shipyard, finds itself at a pivotal stage. While near-term profitability has been squeezed by rising costs and margin pressures, the company’s unmatched order book, execution capabilities, and debt-free balance sheet continue to anchor long-term investor confidence.

Margin Pressures: Causes and Consequences

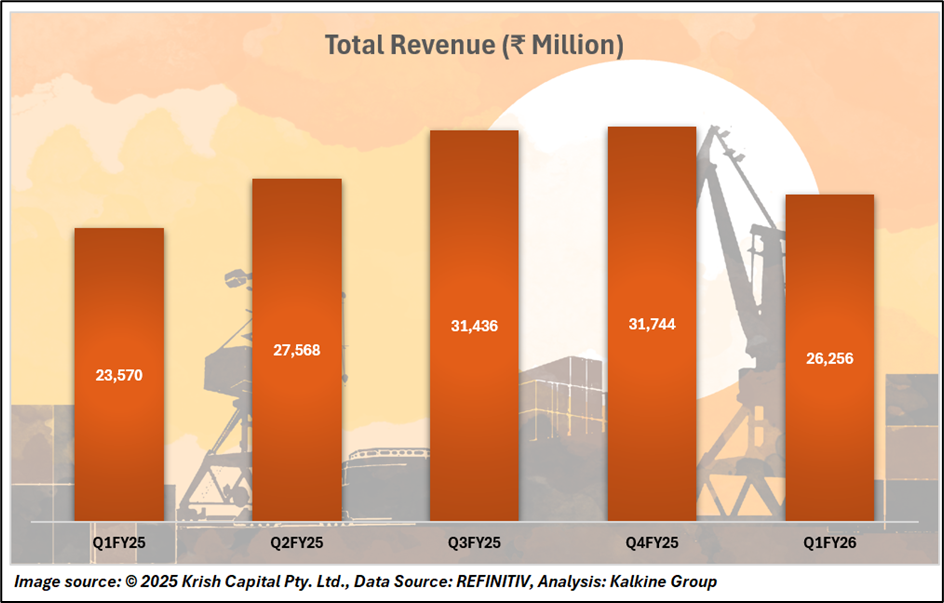

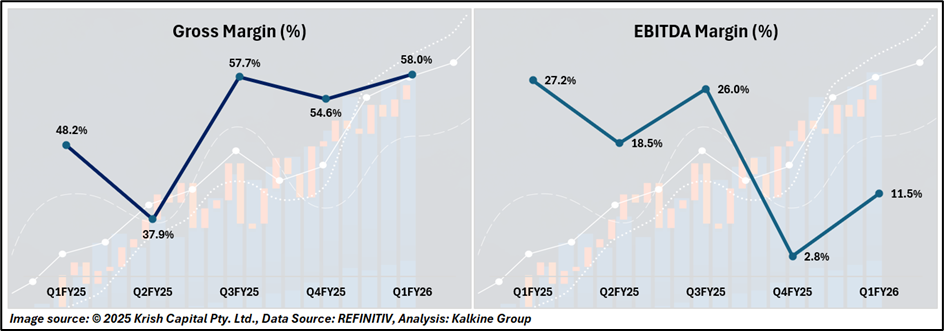

In Q4 FY25, MDL reported a steep contraction in margins as higher subcontracting charges and escalating project-related costs weighed on profitability. EBITDA margins fell to 2.8%, sharply lower than the 16.9% recorded a year earlier, reflecting cost overruns and delays in key naval projects. As a result, quarterly profit dropped 51% YoY to ₹325 crore.

However, on a full-year basis, MDL still managed to post a 26% YoY growth in PAT to ₹2,324.88 crore, aided by stronger execution and efficiency gains across projects. This contrast underscores the company’s ability to deliver growth despite short-term operational turbulence.

Mazagon Dock Shipbuilders entered FY26 with strong execution, posting 11.4% YoY top-line growth in Q1, but the quarter underscores the ongoing impact of cost inflation and project mix shifts on profitability. The company’s net profit slipped 35% YoY to ₹452 crore, as EBITDA margins shrank from a high base to just 11.5%. Management attributes this to rising input prices, larger provisions, and slower absorption of fixed costs factors expected to normalize in the coming quarters.

Order Book Strength and Growth Visibility

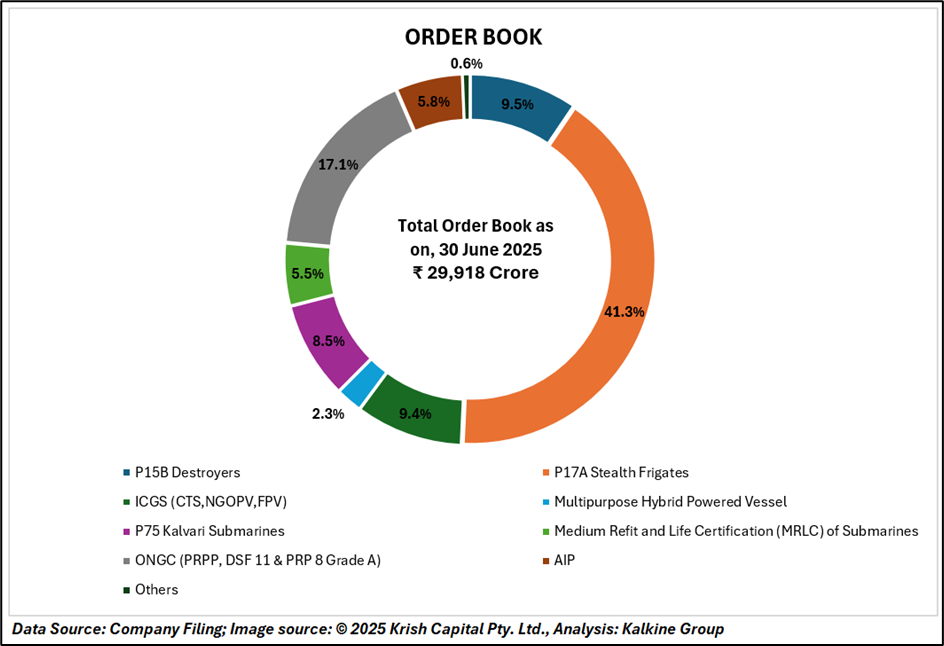

Mazagon Dock Shipbuilders entered Q1 FY26 with an order book of ₹29,918 crore, providing exceptional revenue assurance and long-term growth visibility. The backlog is anchored by major naval programs such as P17A stealth frigates, P15B destroyers, and Kalvari-class submarines, alongside contracts from ONGC, reflecting a diversified portfolio across defence and heavy engineering.

Recent milestones, including the delivery of Nilgiri-class frigates and ahead-of-schedule completion of destroyer projects, reinforce MDL’s strong execution track record. As the only Indian shipyard building both destroyers and conventional submarines for the Navy, MDL enjoys a strategic advantage that ensures a steady flow of government-backed orders.

Supported by a zero-debt balance sheet, regular dividends, and new project wins in next-generation vessels and offshore support craft, the company remains well-positioned for sustained topline growth and multi-year revenue stability.

Strategic Execution and Industry Leadership

MDL’s competitive edge stems from its proven ability to deliver ahead of schedule, notably with the P-15B destroyers, which generated cost savings and reinforced client confidence. The company has also diversified into exports and long-term maintenance contracts, broadening its revenue base.

Technical Analysis

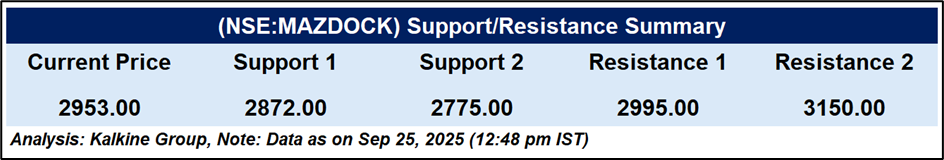

Mazagon Dock is consolidating near ₹2,950 after rebounding above its 51-day EMA, with the RSI stable at 61 indicating bullish undertones but mild overbought risk. Sustained closes above ₹2,995 can trigger further momentum, a drop below ₹2,870 may attract selling pressure.

Conclusion

Mazagon Dock Shipbuilders faces near-term margin headwinds, yet its record order book, strategic naval contracts, and debt-free balance sheet ensure sustained growth visibility. Strong execution, dividend consistency, and sector leadership underpin long-term investor confidence, while cost management and timely deliveries remain crucial for margin recovery and valuation stability.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.