Nifty IT Index Under Pressure as Tariff Fears and Global Slowdown Hit Sentiment

Source: Shutterstock

Global Demand Weakness Dampens Growth

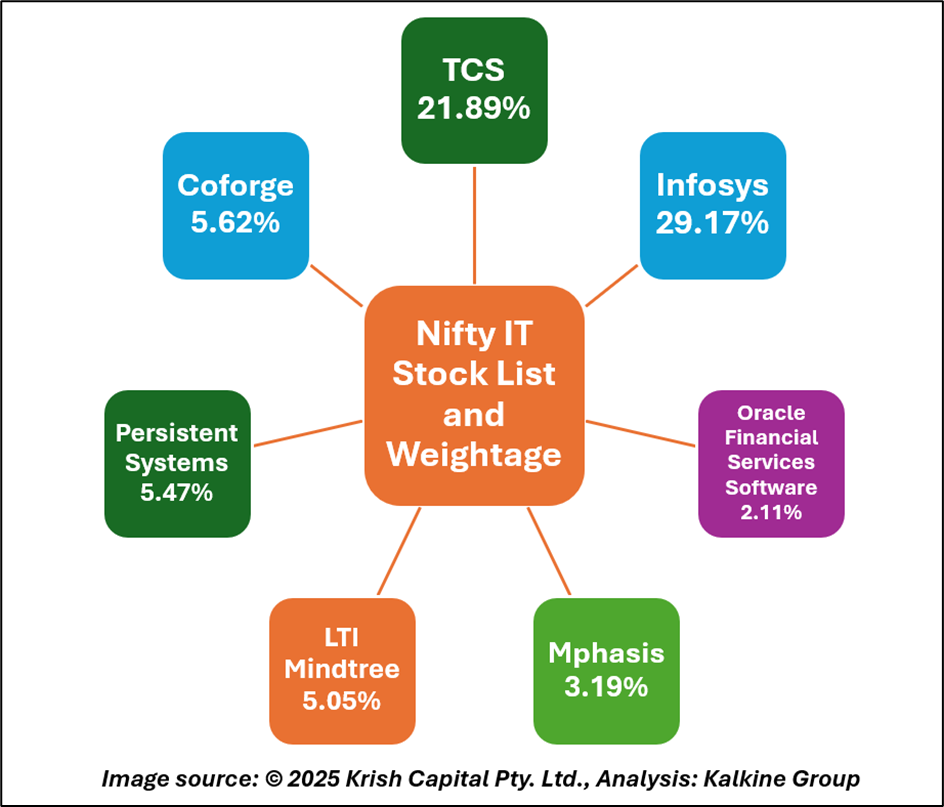

The Nifty IT index has fallen over 16.84% in one year, underperforming the broader market as sluggish global tech spending and delayed client decisions hurt revenue visibility. Demand softness in the U.S. and Europe key markets contributing nearly 80% of sector exports has led to slower deal ramp-ups and project deferrals across large players including Infosys, Wipro, and LTIMindtree. Even industry leader TCS has reported muted growth as clients focus on cost optimization over new digital initiatives.

Tariff Concerns Add to Investor Anxiety

Speculation around potential U.S. tariffs on imported software and outsourcing services has further weighed on investor sentiment. Though no concrete measures have been implemented, such policies could increase compliance costs and effectively double-tax Indian IT exports. Visa fee hikes and local hiring mandates have already inflated operational costs, eroding the traditional margin advantage of the offshore model.

Selective Opportunities Amid Caution

Despite near-term headwinds, analysts see value emerging in firms with diversified client exposure and stronger digital capabilities, such as HCLTech and Tech Mahindra. A potential stabilization in global growth, easing policy risks, and resilient domestic digital demand could help the sector recover gradually in FY26.

Technical Analysis

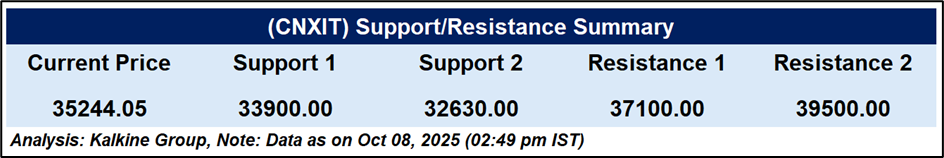

Nifty IT Index rebounded from an ascending trendline support near 33,900, indicating buyer interest at lower levels. Resistance is seen at the 51-day EMA around 35,450; a decisive close above this level could extend gains. RSI at 52 suggests improving momentum, but failure to cross immediate resistance may invite another round of selling pressure.

Conclusion

The Nifty IT index faces pressure from weak global demand and tariff concerns, leading to slower revenue growth and margin pressures. However, firms with diversified clients and strong digital capabilities may benefit from stabilization, while technical support near 33,900 offers potential buying opportunities for a gradual sector recovery in FY26.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.