Indian equities edged higher on Thursday, 23 October 2025, supported by optimism over a potential India–U.S. trade accord and steady foreign institutional inflows. The Nifty 50 opened higher and approached its all-time high, while the Sensex moved close to its peak, reflecting positive investor sentiment.

Broad-Based Market Strength

Technology and financial heavyweights led the advance, with Infosys, HCL Technologies, Axis Bank, Tech Mahindra, and Tata Steel gaining up to 4%. Market breadth remained broadly positive 1,871 stocks advanced, 1,413 declined, and 182 remained unchanged reflecting widespread participation across sectors and capitalization tiers.

Key Drivers of the Rally

Negotiations between India and the U.S. appear to be nearing a breakthrough. The proposed deal may slash U.S. tariffs on Indian goods from 50% to around 15–16%, while India could gradually reduce Russian oil purchases, currently incurring a 25% penalty. Additionally, increased imports of genetically modified (GM) corn from the U.S. could lead to reciprocal tariff cuts on Indian exports.

If finalized, the agreement would likely enhance India’s trade competitiveness, particularly in textiles, where exporters could gain market share over Vietnam and Bangladesh, potentially fueling the next phase of the market rally.

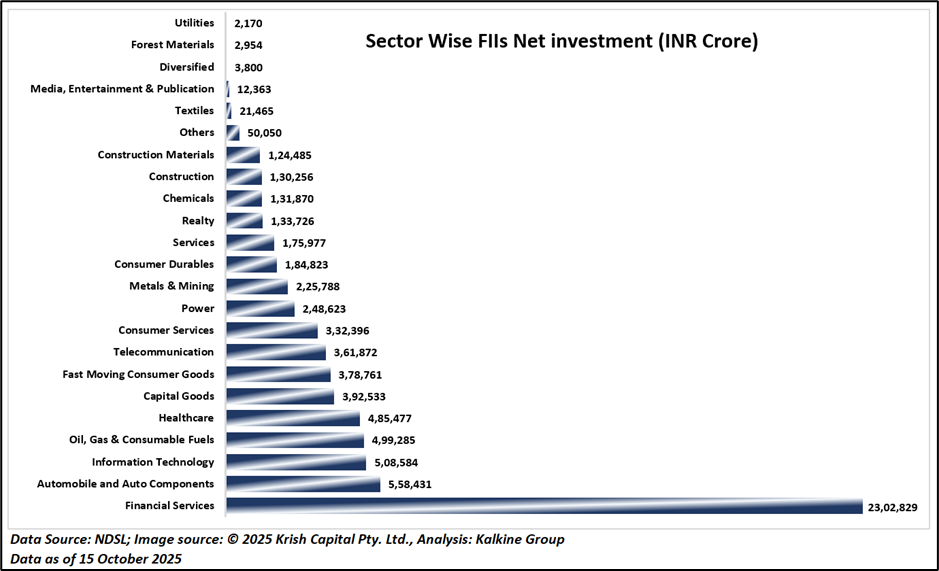

Foreign institutional investors (FIIs) remained consistent net buyers through October, providing strong liquidity support.

The steady inflows underscore renewed foreign confidence in India’s economic trajectory, anchored by macro stability, corporate earnings visibility, and policy continuity.

The Indian rupee strengthened by 13 paise to ₹87.80 per U.S. dollar in early Thursday trade, supported by buoyant domestic equities and optimism surrounding the prospective trade deal. The currency’s resilience further bolsters India’s appeal as a stable investment destination amid global market volatility.

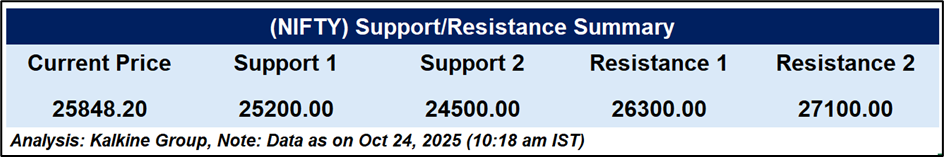

Technical Analysis

The Nifty 50 remains in a strong uptrend, trading well above its 51-day EMA at 25,142.57. The index is consolidating near record highs after touching 25,944, with key support seen at 25,670. The RSI at 70.47 signals overbought but strong bullish momentum; sustained strength above 25,500 could extend gains toward 26,300–27,100.

Conclusion

Indian equities remain firmly positioned in a structural uptrend, supported by trade optimism, robust FII inflows, and currency stability. Technical indicators reinforce bullish sentiment, with Nifty likely to extend gains above 25,500. Broader participation and improving global trade prospects continue to underpin India’s medium-term market outlook.