PVR INOX Kicks Off Festive Season with Strong Footfalls, Expanding Screens, and Rising Premium Demand

Source: shutterstock

India’s largest multiplex chain, PVR INOX Ltd, has started FY26 on a strong note, capitalizing on festive fervor, diverse film content, and strategic expansion. The company reported total admissions exceeding 8.5 lakh during the Dussehra–Gandhi Jayanti weekend, achieving over 50% occupancy across its theatres nationwide a clear signal that the big screen magic is back in force.

“This quarter has started on a high note, with audiences across India returning to the big screens in large numbers,” said Gautam Dutta, CEO – Revenue & Operations, PVR INOX Ltd. “The response across Bollywood, Hollywood, and regional films is very encouraging and sets the tone for a strong festive season ahead.”

Strong Start to FY26: Admissions Rebound and Pricing Steady

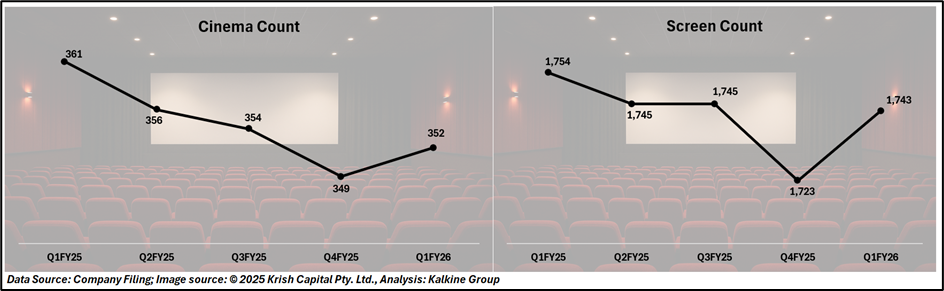

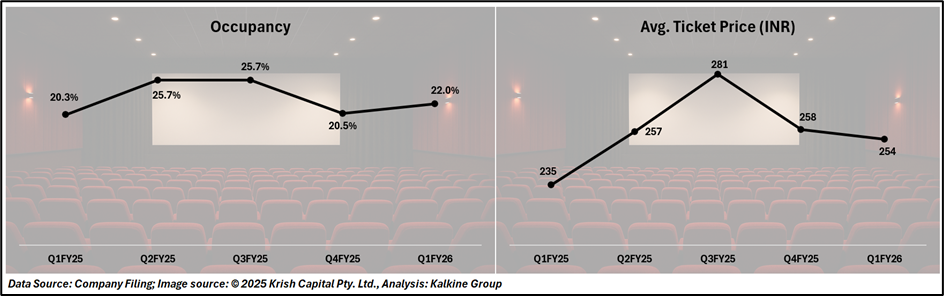

PVR INOX recorded an occupancy rate of 22% in Q1 FY26, up from 20.5% in Q4 FY25, signaling a gradual but consistent recovery in footfalls. While average ticket price (ATP) moderated slightly to ₹254 from ₹258 in the previous quarter, it remains comfortably above pre-pandemic averages reflecting sustained consumer willingness to pay for the premium theatrical experience.

The company’s screen portfolio rose to 1,743 screens across 352 cinemas, marking steady expansion despite a disciplined focus on operational efficiency through FOCO (Franchise-Owned Company-Operated) and Asset-Light models.

Strategic Expansion and Enhanced Experiences

In Q1 FY26, PVR INOX added 20 new screens, with 14 under FOCO and Asset-Light models demonstrating its capital-efficient expansion strategy. The company plans to add 127 more screens through FY26, maintaining focus on profitability while expanding reach.

Ongoing investments in upgraded sound systems, digital projection, and reimagined food offerings are designed to elevate the overall movie-going experience, catering to an increasingly experience-driven urban audience.

Technical Analysis

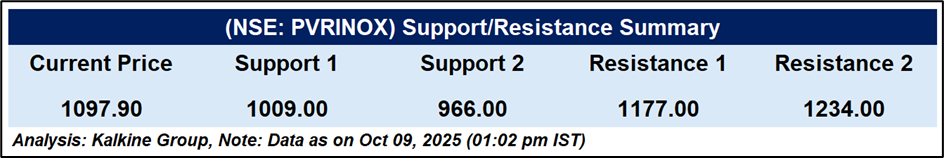

PVR Inox is consolidating near ₹1,100, with price above its 51-day EMA showing moderate strength. Volume is subdued, lacking strong breakout momentum. RSI (14) is neutral around 48, suggesting limited bullish or bearish bias. The stock remains range-bound, offering no clear trend signal, and needs higher volume or RSI momentum for a decisive move.

Conclusion

PVR INOX began FY26 on a strong note with rising footfalls, steady pricing, and network expansion. Regional and premium formats drove growth, supported by 20 new screens in Q1. The stock consolidates near ₹1,100, awaiting volume confirmation for breakout amid improving festive season momentum.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.