TCS Unveils $6–7 Billion AI Data Center Expansion to Power India’s Digital Future

Source: shutterstock

Tata Consultancy Services (TCS) has unveiled a bold plan to invest $6–7 billion in building 1 gigawatt (GW) of next-generation data center capacity across India over the next five to seven years, marking one of the largest technology infrastructure initiatives in the country’s history.

The initiative is a cornerstone of TCS’s ambition to become the world’s largest AI-led technology services company, enabling scalable, high-performance infrastructure for artificial intelligence, quantum computing, and digital transformation workloads.

Strategic Push: AI and Sovereign Data Centers

To spearhead this vision, TCS will establish a wholly owned subsidiary dedicated to managing its new AI and sovereign data center business. These facilities will be designed to store, process, and secure data within India, supporting hyperscalers, deep-tech enterprises, government programs, and domestic corporations.

CFO Samir Seksaria added that the subsidiary will have an independent management structure but remain aligned with TCS’s broader operational ecosystem.

“We expect the first revenues to flow within 18–24 months,” he noted, emphasizing that most of the capacity will comprise passive data centers, offering scalable backup and compute support for clients’ AI model training and analytics workloads.”

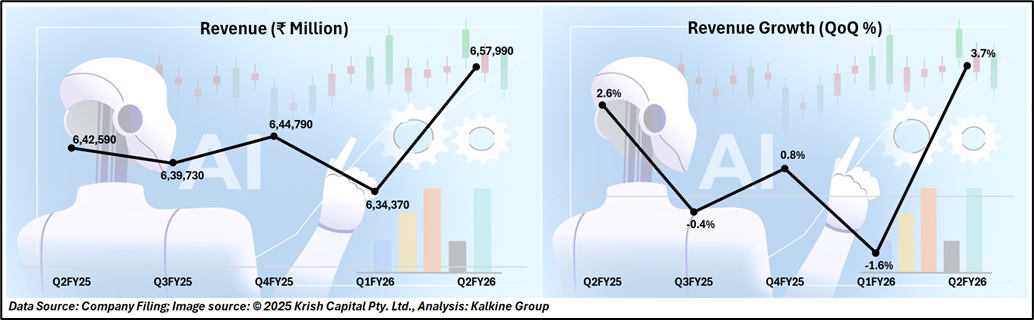

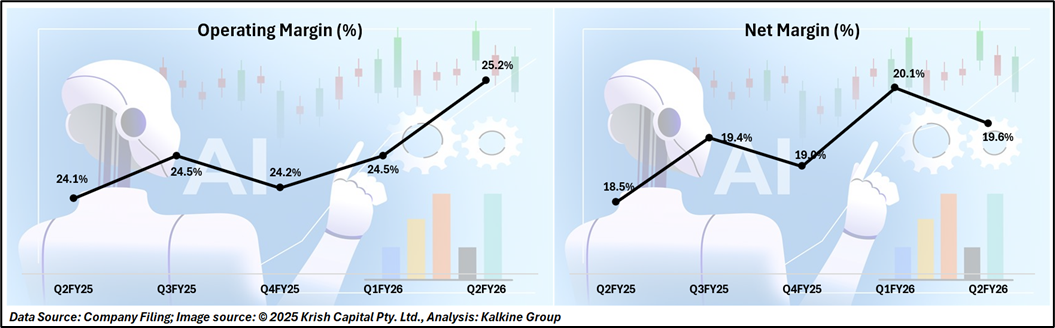

Financial Performance Q2FY26

Part of TCS’s Larger AI Strategy

The data center investment is part of TCS’s bigger push in artificial intelligence (AI), quantum computing, and next-generation technologies. In August, TCS created a new AI and Services Transformation Unit, led by Amit Kapur, to combine all its AI teams under one global unit.

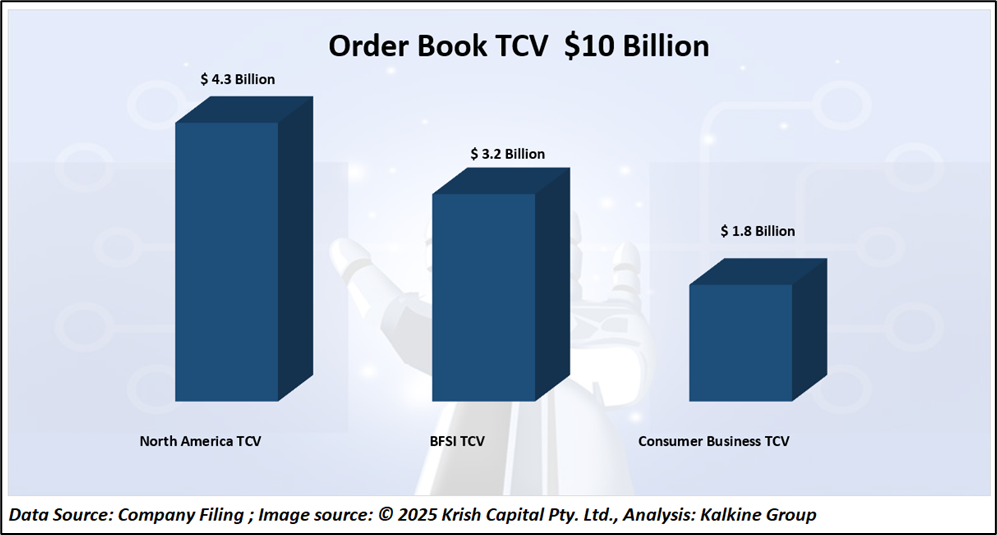

Order Book

TCS’s order book remained strong at $9.4 billion, driven by key verticals and regions—North America contributed $4.4 billion, followed by BFSI at $2.5 billion and the Consumer Business segment at $1.6 billion. The company also continued to expand its client base, adding 9 new clients in the $10 million-plus category and 26 new clients in the $1 million-plus range, while the $100 million-plus client count declined by one compared to the previous year.

Financing and Industry Outlook

Backed by a robust balance sheet and consistent cash generation, TCS plans to fund the project through a mix of equity and debt. India currently has an estimated 1.2 GW of operational data center capacity, but industry projections suggest tenfold growth over the next decade, fueled by surging AI adoption and cloud computing demand.

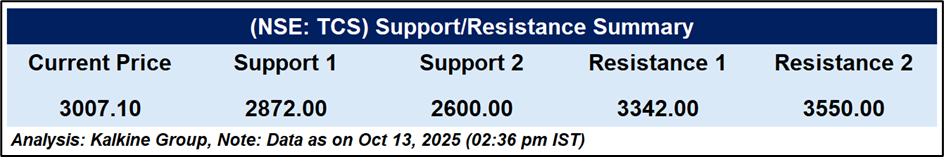

Technical Analysis

Tata Consultancy Services (TCS) is trading at ₹3,007.10, down 0.70%, after facing resistance near ₹3,050. The stock remains in a consolidation phase but continues to hold above its key support at ₹2,950, indicating stability despite recent weakness. The RSI at 47.46 signals neutral momentum with scope for recovery if buying interest strengthens. In the near term, maintaining levels above ₹2,872 and ₹2600 will be crucial for a constructive setup, while resistance is seen at ₹3,342 and ₹3,550 on the upside.

Conclusion

TCS’s $6–7 billion AI data center investment underscores its long-term commitment to driving India’s digital and AI transformation. Supported by a strong balance sheet, resilient operations, and a robust order book, the company is strategically positioned to strengthen its global competitiveness and capture the growing demand for AI-driven infrastructure.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.