Waaree Renewable Technologies Ltd Hits Fresh Record High Following Strong Q2FY26 Results

Source: shutterstock

Waaree Renewable Technologies Ltd witnessed a sharp rally of 13.6% on October 13, 2025, as the stock surged to a new all-time high of ₹1,287 after the company reported its strong Q2FY26 financial results.

On October 14, 2025, the stock opened at ₹1,239, touched an intraday low of ₹1,219.10, and later climbed to a fresh all-time high of ₹1,326.60, extending its post-results momentum.

Financial Performance

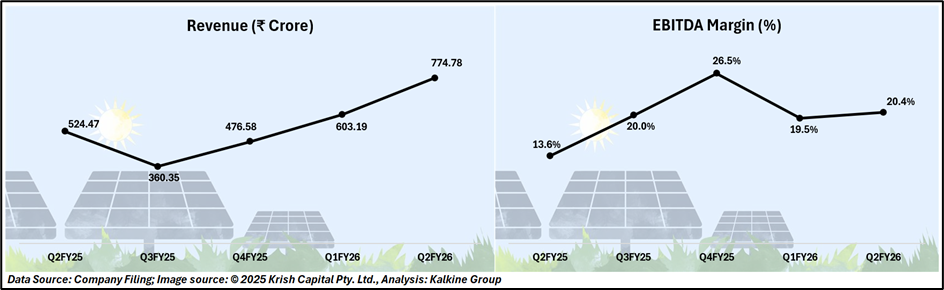

For the quarter ended September 2025, Waaree Renewable Technologies Ltd reported a strong financial performance, supported by robust project execution and improved operational efficiency. Revenue from operations surged 47.7% year-on-year (YoY) to ₹774.78 crore, compared to ₹524.47 crore in Q2FY25. Net profit more than doubled, rising 117.4% YoY to ₹116.34 crore, from ₹53.52 crore in the same period last year.

Operating profitability also witnessed significant improvement, with EBITDA soaring 120.7% YoY to ₹157.94 crore, while the EBITDA margin expanded to 20.39%, up from 13.65% a year earlier. The margin improvement highlights the company’s effective cost control measures and higher project execution efficiency.

For the first half of FY26, Waaree Renewable maintained its strong growth trajectory, with revenue increasing 81.1% YoY to ₹1,377.97 crore, and profit after tax (PAT) surging 148% to ₹202.73 crore. The PAT margin improved to 14.7%, underscoring enhanced cost efficiencies, operating leverage, and scale benefits across its renewable energy projects.

Balance Sheet & Liquidity

The company reported a substantial improvement in its financial position, with net worth rising to ₹657.62 crore, compared with ₹318.15 crore in the corresponding period last year. Cash and cash equivalents stood at ₹68.33 crore as of September 2025, more than three times higher than the previous year’s level, supported by a positive operating cash flow of ₹83.73 crore.

Order Book & Execution Strength

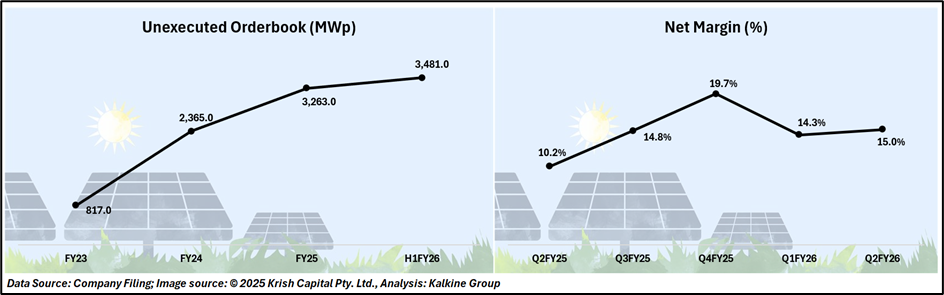

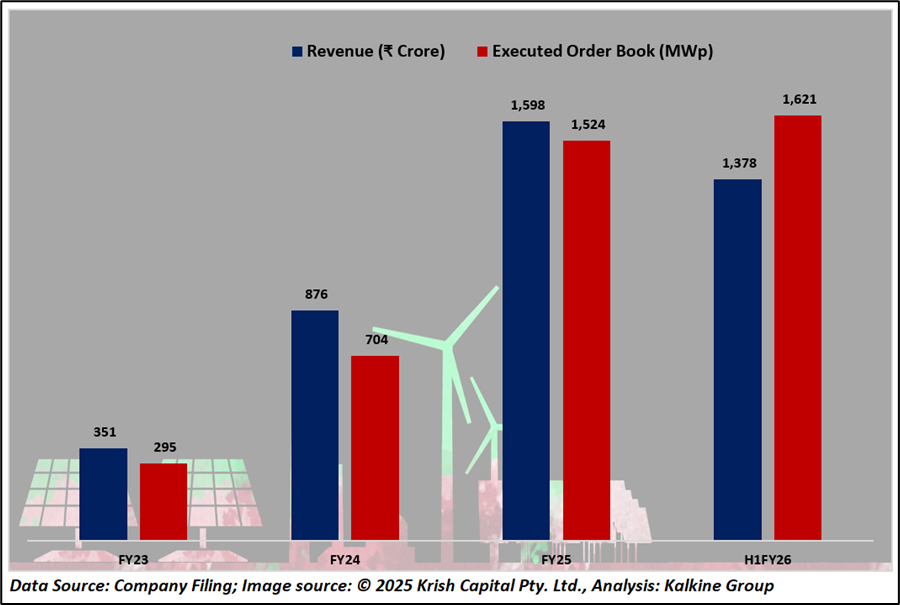

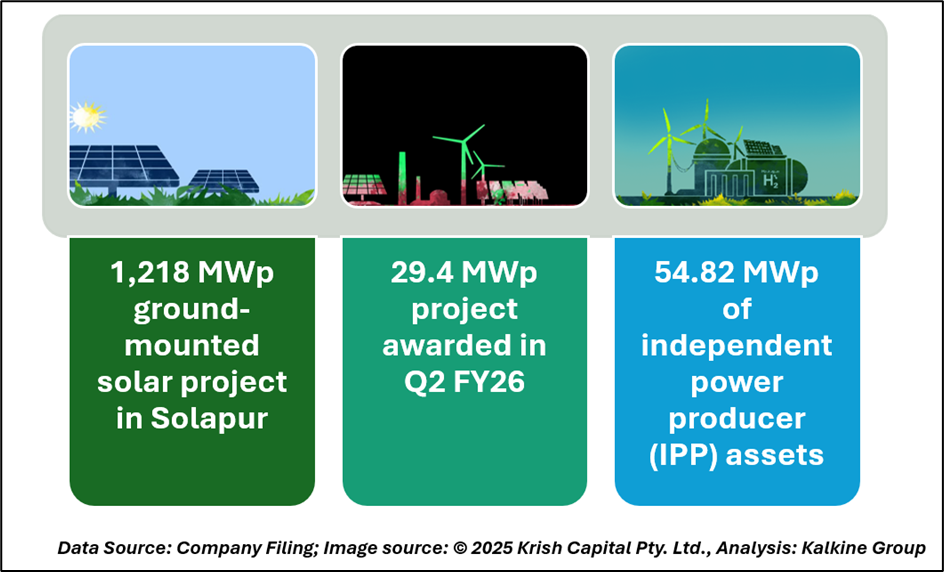

Waaree Renewable Technologies continued to strengthen its project portfolio during the quarter, securing multiple large-scale EPC orders. These include a 1,218 MWp ground-mounted solar project in Solapur, Maharashtra, and a 29.4 MWp project awarded in Q2 FY26. Earlier wins comprise 435 MWp, 131.6 MWp, and 255 MWp ground-mounted solar projects, along with a 40 MWh battery energy storage system, underscoring the company’s growing presence across the renewable value chain.

To date, Waaree has commissioned over 3.95 GWp of solar capacity and maintains a robust unexecuted order book of 3.48 GWp, providing strong revenue visibility for the coming quarters. The company also operates an operations and maintenance (O&M) portfolio of around 769 MWp, while owning 54.82 MWp of independent power producer (IPP) assets and developing an additional 107.1 MWp.

Strategic Expansion

The company is diversifying beyond traditional EPC services into battery storage systems, operations & maintenance (O&M), and independent power production (IPP). The company leverages strong synergies with its parent, Waaree Energies Ltd, one of India’s largest solar module manufacturers, enabling it to offer end-to-end renewable solutions from solar module supply to full project commissioning.

Technical Analysis

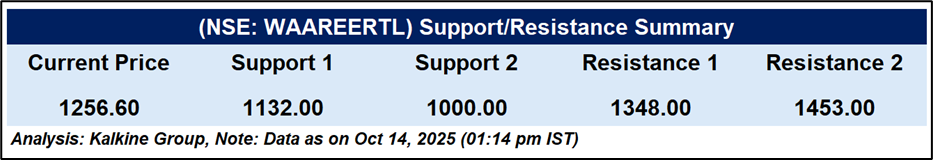

Waaree Renewable Technologies Ltd shares extended their rally, trading at ₹1,256.60, up 2.14%, after hitting a fresh all-time high of ₹1,326.60. The stock remains firmly above its 51-day EMA (₹1,067.43), indicating strong bullish momentum. The RSI at 77.01 signals overbought conditions, suggesting potential short-term consolidation, though the broader trend remains decisively positive following robust Q2FY26 earnings.

Conclusion

Waaree Renewable Technologies Ltd surged to record highs following strong Q2FY26 results, with revenue up 47.7% YoY and net profit more than doubling. Robust project execution, improved margins, and a healthy order book of 3.48 GWp underpin growth. Technicals show strong bullish momentum, though short-term consolidation may occur amid overbought conditions.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.