Can Adani Ports Maintain Market Leadership Amid Global and Logistics Push?

Source: shutterstock

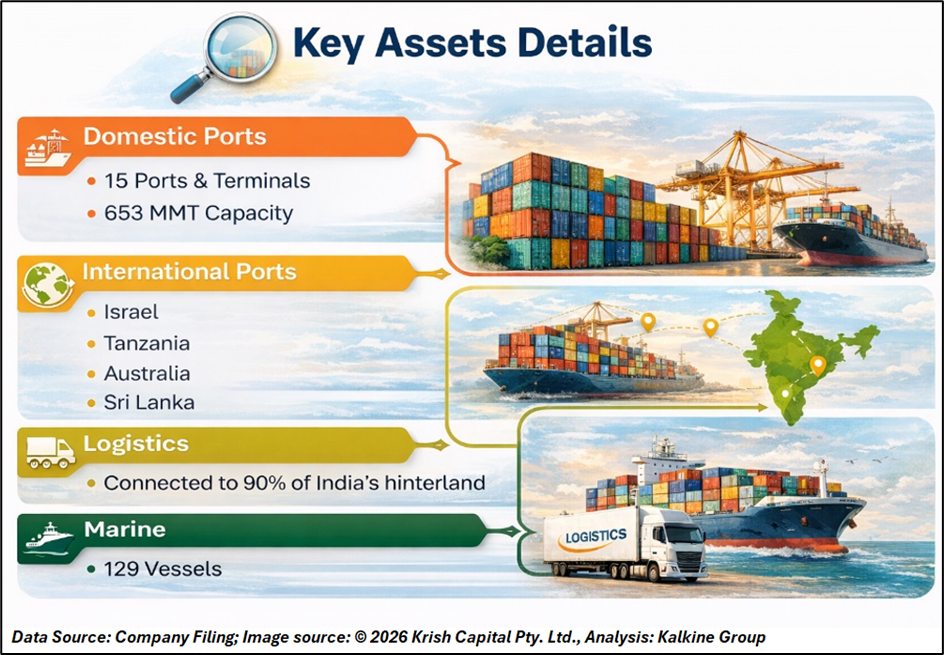

Adani Ports and Special Economic Zone (APSEZ), India’s largest private port operator, has strengthened its growth outlook for the current financial year, driven by robust cargo volumes, expanding global presence, and improving operational efficiency.

According to the company’s latest financial disclosures and investor presentation, APSEZ has raised the upper end of its FY26 EBITDA guidance by ₹800 crore to ₹22,800 crore, reflecting stronger-than-expected business momentum and the consolidation of its newly acquired Australian asset.

Strong Q3 Performance Lifts Confidence

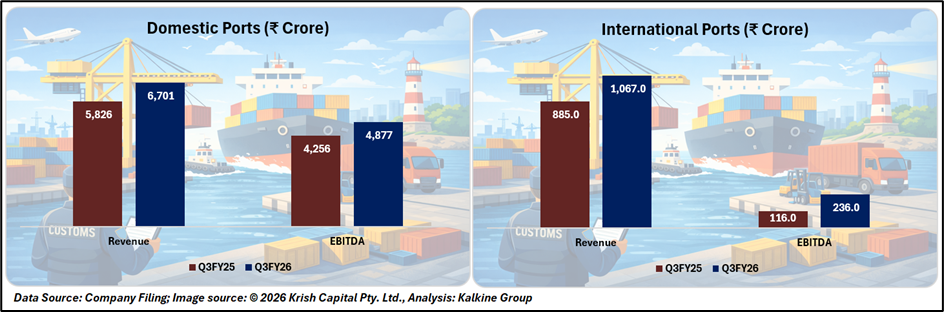

For the quarter ended December 2025, Adani Ports reported solid financial growth across key parameters. Revenue rose 22% year-on-year to ₹9,705 crore, while EBITDA increased 20% to ₹5,786 crore. Net profit grew nearly 21% to ₹3,043 crore, supported by higher cargo volumes and improved asset utilisation.

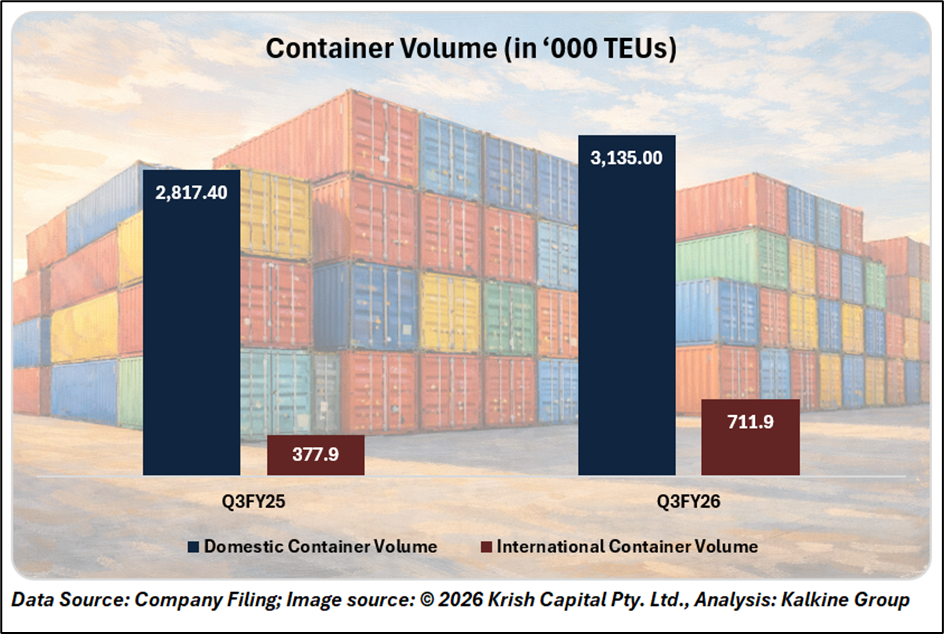

During the quarter, cargo handled increased 9% to 123 million metric tonnes, underlining sustained demand across container, bulk, and liquid cargo segments. On a nine-month basis, revenue climbed 24% to ₹27,998 crore, while EBITDA grew 20% to ₹16,832 crore, highlighting consistency in performance.

A key driver behind the upgraded earnings forecast is the acquisition of Australia’s North Queensland Export Terminal (NQXT) in December 2025. With an annual capacity of 50 million tonnes, NQXT is a strategic, cash-generating asset that enhances APSEZ’s presence along major global trade routes.

The integration of this deep-water export terminal is expected to contribute meaningfully to earnings from the final quarter of FY26 onwards, strengthening the company’s international portfolio across Australia, Israel, Sri Lanka, and Tanzania.

Logistics and Marine Segments Drive Diversification

Adani Ports’ transition into an integrated transport and logistics utility continues to gain momentum, with non-port businesses emerging as key growth engines.

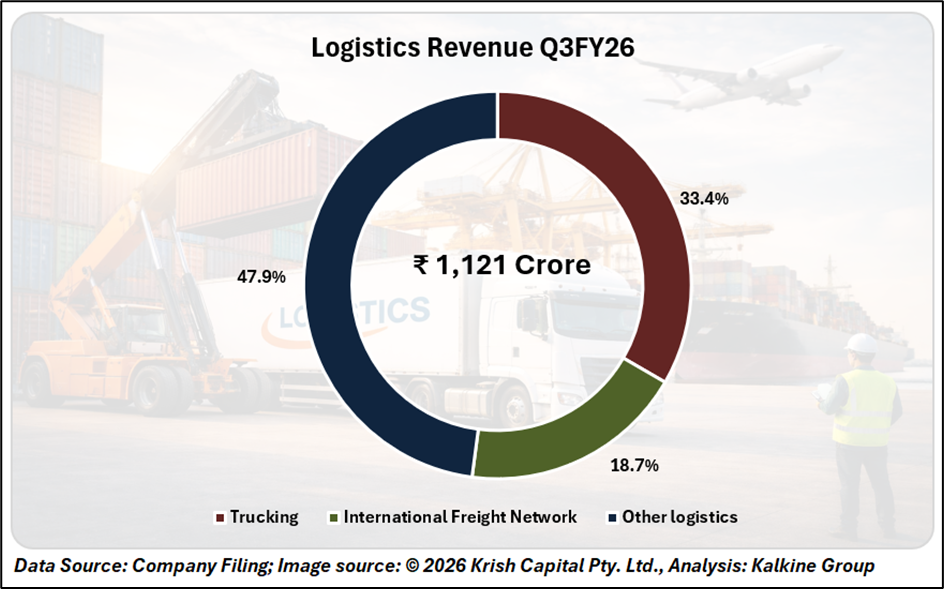

The logistics segment recorded a 62% year-on-year jump in revenue to ₹1,121 crore in Q3 FY26, driven by asset-light trucking services and the international freight network. The company aims to scale logistics revenue to ₹14,000 crore by FY29, supported by expanding multimodal parks and warehouse infrastructure.

Meanwhile, the marine business delivered exceptional performance, with revenue rising 91% year-on-year and EBITDA surging 135%. The expansion of the fleet to 129 vessels has improved service coverage across the Middle East, Africa, and South Asia, providing stable, contract-backed revenue visibility.

Ambitious Long-Term Growth Vision

Looking ahead, APSEZ has outlined an ambitious roadmap focused on scale and efficiency. The company is targeting cargo throughput of 1 billion tonnes by 2030, supported by capacity expansion at key ports such as Mundra, Vizhinjam, and Dhamra.

Management also aims to double revenue and EBITDA by FY29 to ₹65,500 crore and ₹36,500 crore, respectively, backed by integrated logistics, marine services, and international operations.

Broker Consensus View

Broker sentiment on Adani Ports & Special Economic Zone Ltd remains highly optimistic, with most analysts maintaining a “Strong Buy” outlook. Of the coverage, 14 analysts recommend strong buy, while 9 suggest buy. The average target price of ₹1,773 indicates an upside potential of around 15%.

Technical Analysis

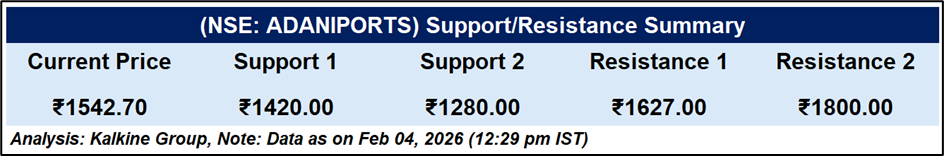

Adani Ports & Special Economic Zone Ltd maintains a constructive technical setup, trading above its upward-sloping 50-day EMA, which signals ongoing trend strength. The recent recovery toward ₹1,627 suggests renewed buying interest. With the RSI around 62, momentum remains favourable. As long as the stock stays above ₹1,420, the outlook remains cautiously optimistic.

Conclusion

Adani Ports remains well positioned for sustained growth, supported by strong financial performance, expanding global assets, and rapid diversification into logistics and marine services. Upgraded earnings guidance, positive broker sentiment, and supportive technical indicators reinforce confidence in its long-term prospects. While near-term market volatility may persist, the company’s integrated business model and strategic investments underpin a constructive outlook.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.