From Aggressive Easing to Watch Mode: What’s Next for India’s Economy?

Source: shutterstock

India’s economic environment is moving into a phase of stability following a year of significant monetary easing. After cutting the policy repo rate by a cumulative 125 basis points, the Reserve Bank of India (RBI) has shifted its focus from rate reductions to monitoring how earlier policy actions are transmitted through the financial system. Recent data on inflation, growth, bond yields and capital flows provides a clearer picture of where the economy currently stands.

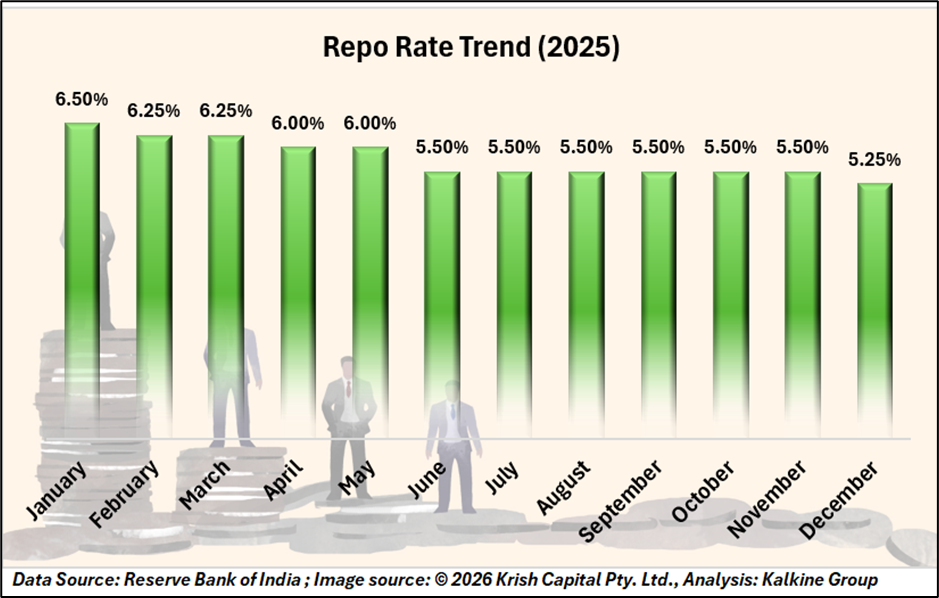

Policy Rates Have Declined Sharply Over the Year

The RBI reduced the repo rate steadily through the year, beginning at 6.50% in January and ending at 5.25% in December. Most of the easing occurred during the first half of the year, with the rate falling from 6.25% in February–March to 5.50% by June. After mid-year, the pace of rate cuts slowed, culminating in a smaller reduction in December.

This pattern indicates that the central bank front-loaded monetary support when inflation risks were receding and has since adopted a more cautious stance.

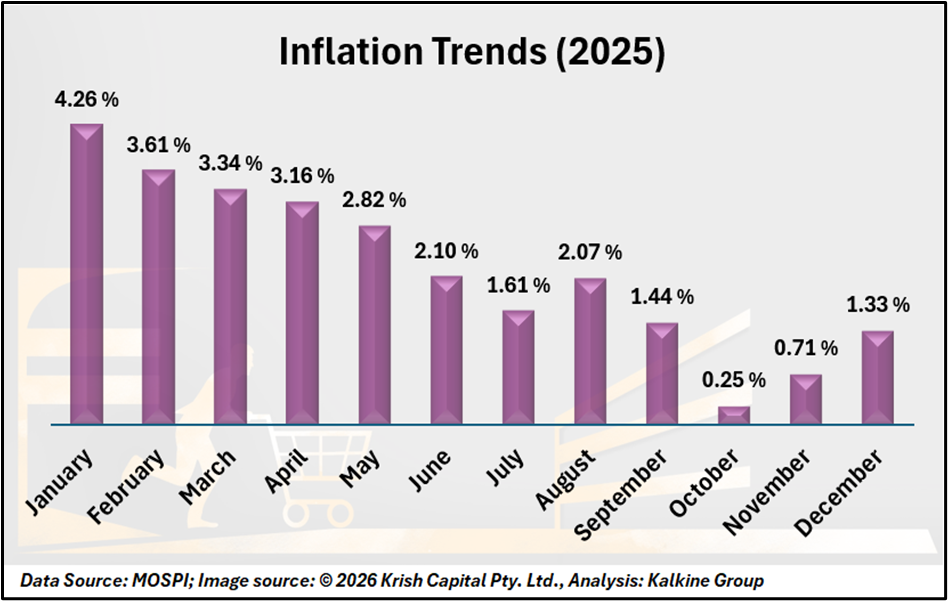

Inflation Trends Point to Significant Price Stability

Consumer price inflation moderated sharply over the course of 2025. CPI inflation declined from 4.26% in January to 1.33% by December, remaining well below the RBI’s medium-term target for much of the year. Inflation readings fell particularly rapidly between May and October, touching a low of 0.25% in October before recovering modestly in the final months.

These trends suggest that price pressures have eased across the economy, giving policymakers room to prioritise other aspects of monetary management.

Bond Yields Indicate Limited Policy Transmission

Despite the decline in policy rates, long-term borrowing costs have not adjusted proportionately. India’s 10-year government bond yield stands at 6.703%, showing only a marginal change over the period. The gap between the repo rate and benchmark bond yields has therefore remained wide.

This development indicates that the transmission of monetary easing into broader financial conditions has been uneven, potentially affecting credit pricing for banks and corporates.

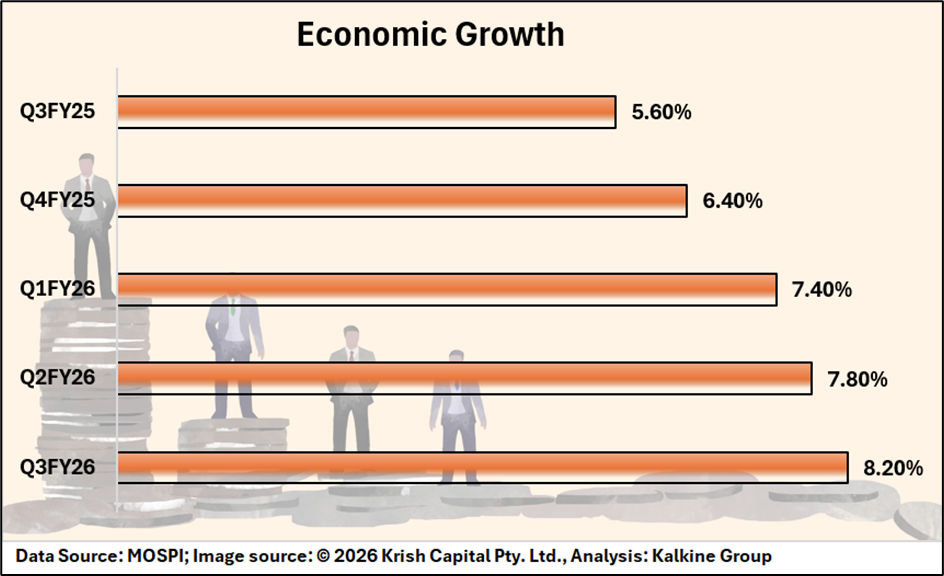

Economic Growth Remains Steady but Moderate

India’s quarterly GDP growth data points to a clear and sustained improvement in economic momentum. Growth accelerated steadily through FY26, rising from 5.6% in Q3FY25 to 6.4% in Q4FY25, before strengthening further to 7.4% in Q1FY26, 7.8% in Q2FY26, and 8.2% in Q3FY26. This progression reflects a broad-based recovery, with growth consistently gaining pace over successive quarters.

The upward trend in quarterly growth indicates improving domestic demand conditions and continued support from public investment, while also highlighting the economy’s resilience amid uncertain global conditions. The absence of sharp volatility across quarters suggests that growth has been expanding in a measured manner, without signs of macroeconomic overheating.

Capital Flows Show Volatility Through the Year

Foreign direct investment inflows have fluctuated considerably. Monthly inflows rose to $8.74 billion in April but declined sharply in the second half of the year, falling to $1.06 billion by November. The variability in inflows reflects shifting global sentiment and cautious cross-border investment conditions.

Current Economic Position

India’s economy is currently in a steady phase. Inflation has come down sharply, which has reduced pressure on households and businesses. Economic growth is continuing at a stable pace, showing that the economy is neither slowing too much nor overheating.

While interest rates have been cut significantly, lower borrowing costs have not fully reached the wider economy yet, as bond yields remain relatively high. At the same time, foreign investment flows have been uneven, reflecting global uncertainty. Overall, the data shows an economy that is stable, with the focus now on how effectively earlier policy steps translate into real economic benefits.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.