From Biopharma to High-Speed Rails: What’s Driving India’s Strategic Budget Push?

Source: shutterstock

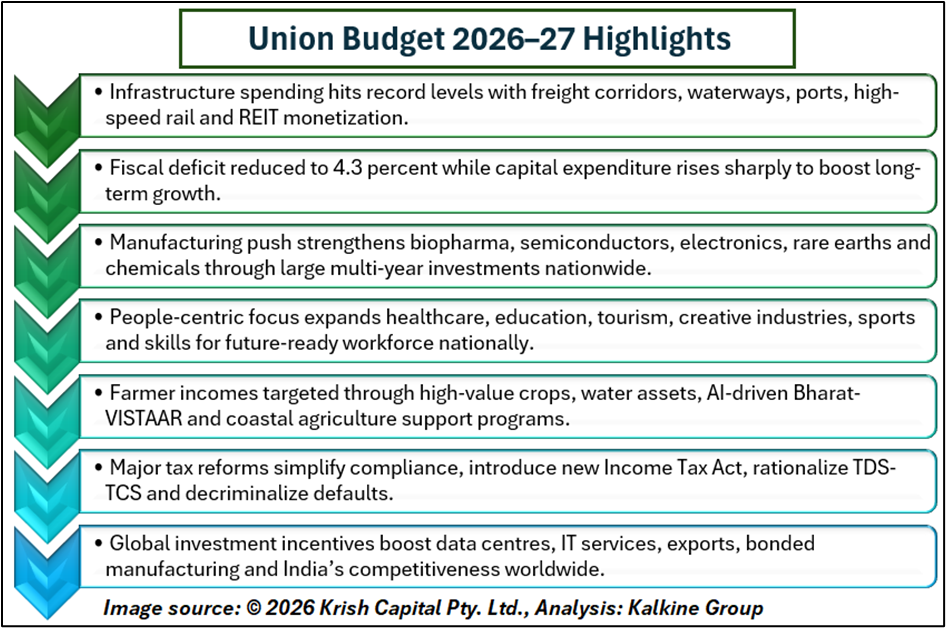

The Union Budget 2026-27, presented by Finance Minister Smt. Nirmala Sitharaman, marks a symbolic and strategic milestone as the first Budget prepared in Kartavya Bhawan. Anchored in the philosophy of Kartavya, the Budget is guided by three core duties: accelerating economic growth, fulfilling people’s aspirations, and ensuring inclusive development under the vision of Sabka Sath, Sabka Vikas. Together, these principles aim to position India on a resilient and sustainable growth path amid volatile global conditions.

Manufacturing Push in Strategic and Frontier Sectors

To accelerate economic growth, the government announced large-scale interventions across seven strategic sectors. The Biopharma SHAKTI initiative, with an outlay of ₹10,000 crore, aims to make India a global biopharma manufacturing hub through new NIPERs and a nationwide clinical trials network.

Semiconductor self-reliance gains momentum with the launch of India Semiconductor Mission 2.0, while electronics manufacturing receives a ₹40,000 crore boost. Dedicated rare earth corridors and chemical parks further strengthen industrial depth.

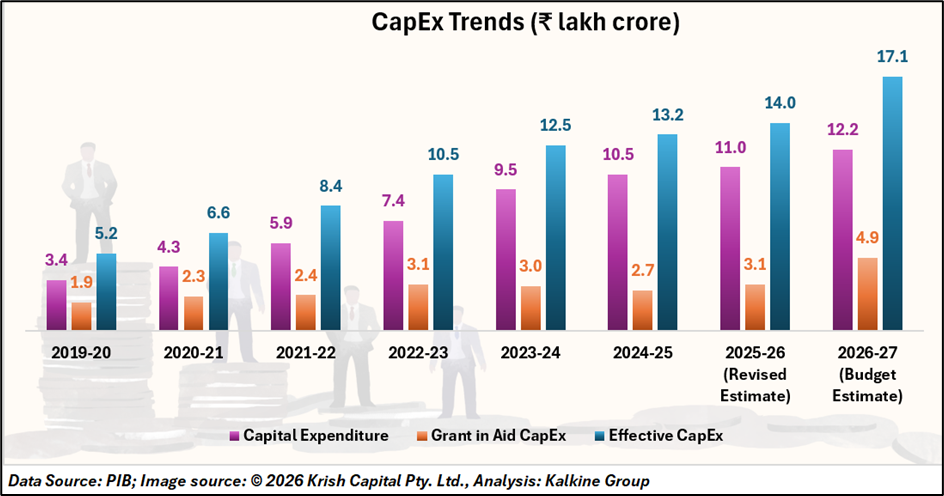

Strong Fiscal Framework with Growth Orientation

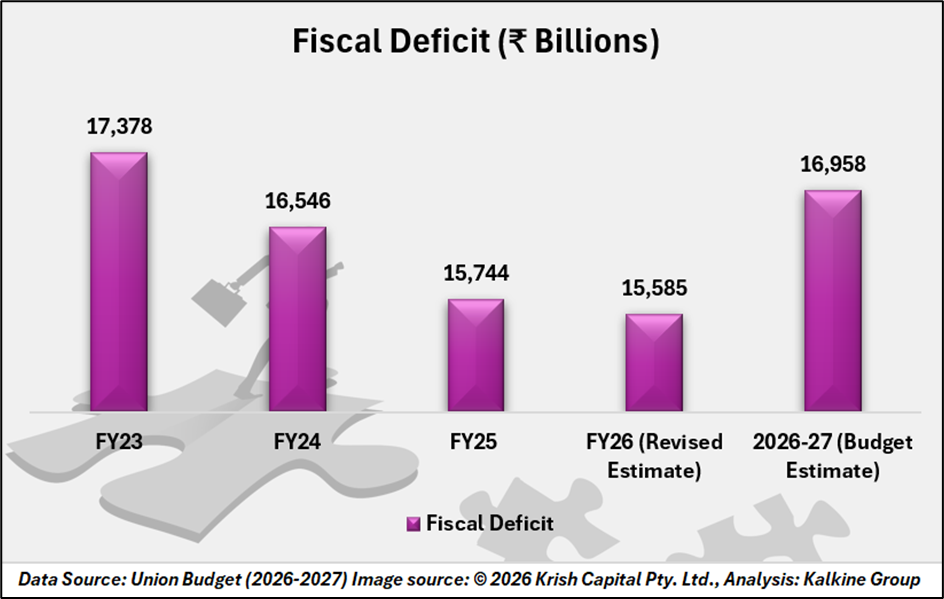

The Budget outlines a balanced fiscal roadmap with total expenditure estimated at ₹53.5 lakh crore and non-debt receipts at ₹36.5 lakh crore. Capital expenditure has been sharply prioritized, reaching ₹12.2 lakh crore in FY 2026-27, reinforcing the government’s commitment to asset creation. The government expects the fiscal deficit to narrow to 4.3% of GDP, with the debt-to-GDP ratio falling to 55.6%, signaling sustained fiscal discipline while supporting economic growth.

Infrastructure as the Engine of Economic Expansion

Major investments include Dedicated Freight Corridors connecting Dankuni to Surat, 20 new national waterways, and a Coastal Cargo Promotion Scheme to increase inland waterway share from 6% to 12% by 2047. A proposed Infrastructure Risk Guarantee Fund will attract private developers.

Seven high-speed rail corridors—Mumbai-Pune, Pune-Hyderabad, Hyderabad-Bengaluru, Hyderabad-Chennai, Chennai-Bengaluru, Delhi-Varanasi, Varanasi-Siliguri—will act as growth connectors. Asset monetization via CPSE REITs, inland ship repair facilities, and seaplane VGF schemes enhance multimodal connectivity and sustainable economic growth.

Empowering People through Education, Health and Skills

Union Budget 2026-27’s second Kartavya focuses on human capital. A High-Powered “Education to Employment and Enterprise” Committee will align skills with services-led growth. 100,000 Allied Health Professionals will be added over 5 years, supported by five Regional Medical Hubs and three new All India Institutes of Ayurveda.

University townships and one girls’ hostel per district will expand higher education. The Indian Institute of Creative Technologies will set up 15,000 school AVGC labs, while tourism, heritage sites, and Khelo India initiatives promote skills, sports, and cultural engagement nationwide.

Inclusive Growth for Farmers, Divyangjan, and Regions

The third Kartavya focuses on inclusive development. Initiatives include high-value agriculture for coconut, sandalwood, cocoa, and cashew, and integrated development of 500 reservoirs and Amrit Sarovars. Bharat-VISTAAR, an AI-enabled multilingual tool, will integrate AgriStack portals for smarter farming.

Regional development targets Purvodaya and North-Eastern states with East Coast Industrial Corridor, 5 new tourism destinations, 4,000 e-buses, and Buddhist Circuit development, ensuring equitable access and sustainable growth across all regions.

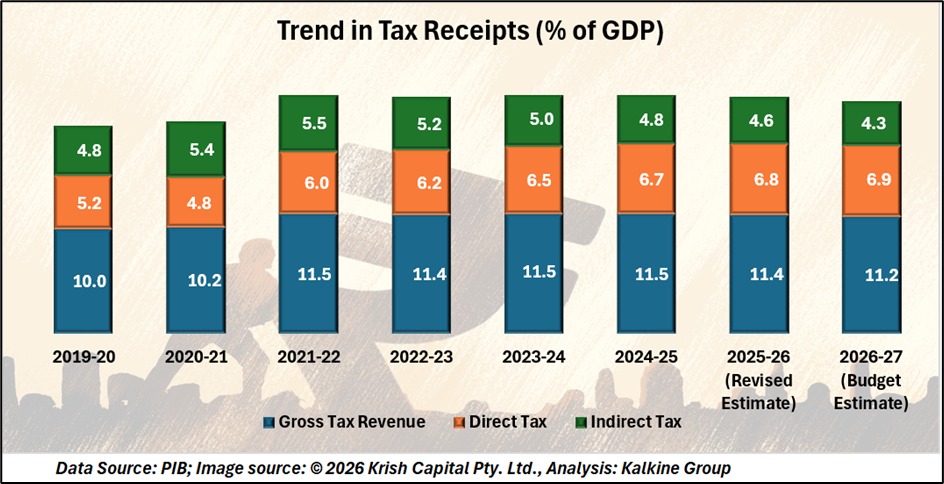

Tax Receipts

Tax Reforms for Simplicity, Compliance and Investment

Part-B of Union Budget 2026–27 introduces the New Income Tax Act, 2025, effective from April 2026, aimed at simplifying tax laws and improving compliance. Tax Collected at Source (TCS) on overseas tour packages has been rationalized to 2%, while TCS on Liberalised Remittance Scheme (LRS) remittances for education and medical purposes has been reduced from 5% to 2%.

To support the IT sector, a uniform safe harbour margin of 15.5% has been notified with the eligibility threshold increased from ₹300 crore to ₹2,000 crore. Minimum Alternate Tax (MAT) has been reduced to 14% and will become a final tax from April 2026.

Fiscal Deficit

A Forward-Looking Blueprint for India’s Next Phase

Overall, Union Budget 2026-27 presents a comprehensive blueprint that blends fiscal prudence with growth ambition. By aligning infrastructure, manufacturing, human capital, and tax reforms under a clear national vision, the Budget seeks to firmly place India on the path toward becoming a Viksit Bharat by 2047.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.