Geopolitical Tensions Ignite Silver Surge, Driving Indian ETFs to New Peaks

Source: shutterstock

Silver markets witnessed an exceptional rally on January 21, 2026, with prices reaching all-time highs across domestic and international platforms. On India’s Multi Commodity Exchange (MCX), silver futures for March delivery crossed ₹3.33 lakh per kilogram, This historic rise was driven by escalating geopolitical tensions between major economies, renewed tariff threats, and growing uncertainty surrounding global trade and monetary policy.

As risk appetite weakened in equity markets, investors increasingly turned to precious metals for stability. Silver, with its dual role as both a safe-haven and an industrial metal, benefited more aggressively than gold during this phase.

Indian Silver ETFs Deliver Exceptional Returns

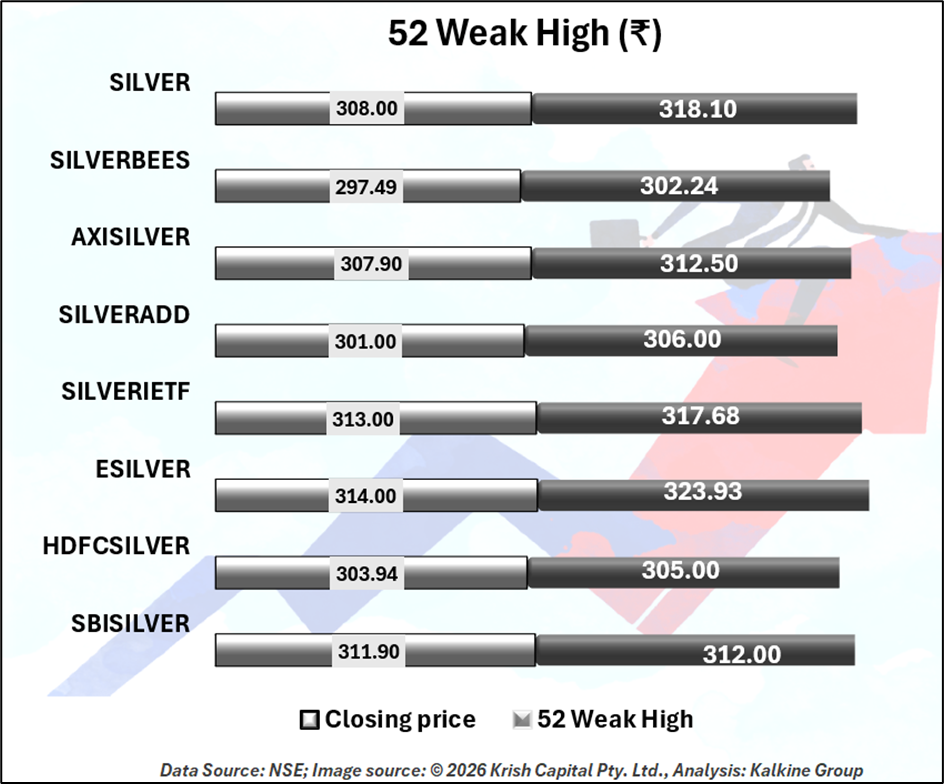

The surge in silver prices translated directly into strong gains for Indian silver exchange-traded funds. Leading products such as Tata Silver ETF, SBI Silver ETF, HDFC Silver ETF, Axis Silver ETF, DSP Silver ETF, and Kotak Silver ETF traded near their lifetime or 52-week highs.

Outstanding Performance

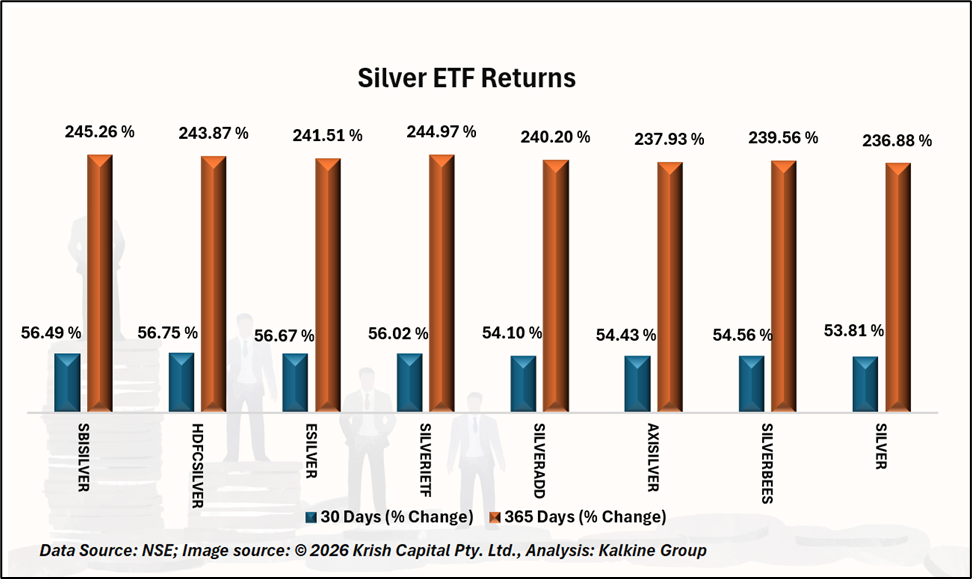

Several of these funds delivered returns exceeding 50% over the past 30 days, while one-year gains crossed the 200% mark, reflecting extraordinary momentum.

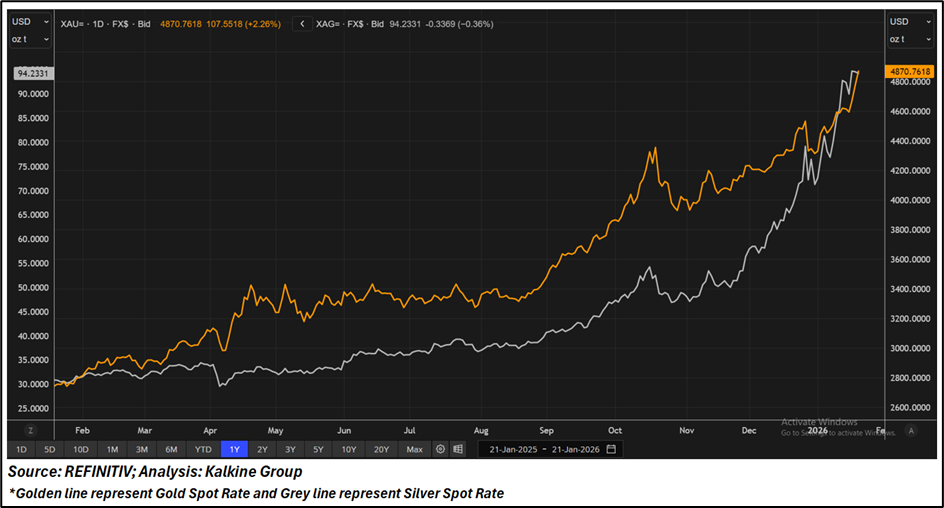

Silver Steals the Shine from Gold

Silver’s outperformance compared to gold is not accidental. While expectations of lower global interest rates have supported precious metals broadly, silver has an added advantage due to its expanding industrial usage. The metal plays a critical role in renewable energy systems, solar panels, electric vehicles, electronics, and advanced manufacturing.

This rising industrial demand, combined with limited new supply, has tightened market fundamentals. As a result, silver prices have shown sharper upside movements than gold, which is primarily driven by investment and central bank demand. This dynamic explains why silver ETFs have significantly outperformed gold ETFs over the past year.

Assets Under Management

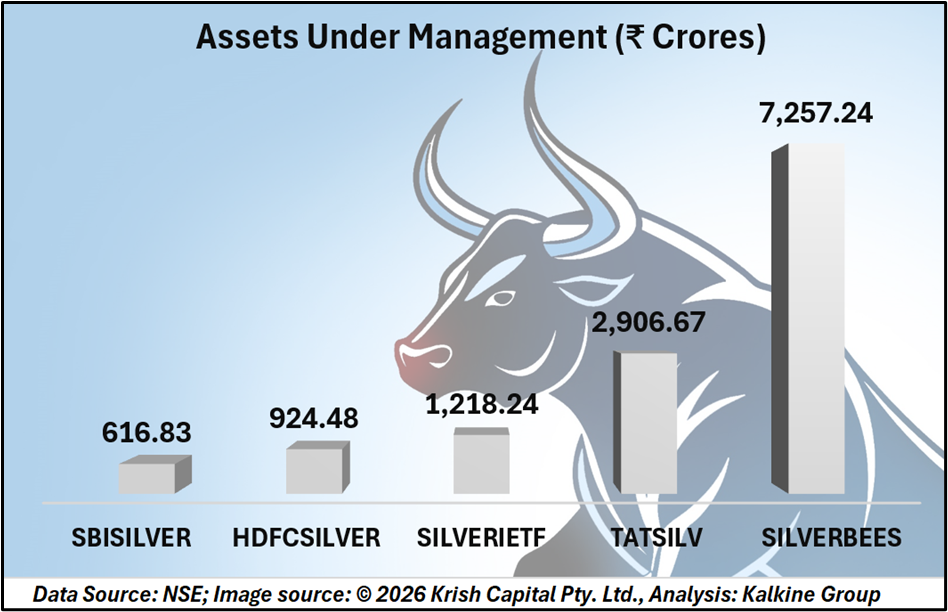

SILVERBEES stood out as the most actively traded silver ETF in India, with assets under management surpassing ₹7,200 crore. High liquidity, strong investor participation, and tight tracking of silver prices have made SILVERBEES the preferred choice for many market participants. Other large funds, such as Tata Silver ETF, also crossed ₹2,900 crore in assets, highlighting aggressive inflows into the segment.

Conclusion

Silver has become very attractive for investors as it works both as a safe place to park money and as an important industrial metal. Global uncertainty and market volatility pushed investors toward precious metals, and silver performed better than gold. Demand for silver is rising due to its use in solar panels, electric vehicles, and electronics, while supply remains limited. This strong demand helped silver ETFs in India deliver outstanding returns and attract heavy investor interest. Although prices may move up and down in the short term, silver’s long-term outlook remains positive and supportive for diversified portfolios.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.