India’s copper sector is witnessing a sharp surge in consumption, reflecting the country’s accelerating infrastructure push and the growing adoption of clean energy technologies. According to the International Copper Association (ICA India), demand climbed 9.3% year-on-year to 1,878 kilo tonnes (KT) in FY25, up from 1,718 KT in FY24 a significant indicator of India’s industrial momentum.

Infrastructure and Manufacturing Drive Demand Expansion

Copper’s demand trajectory is closely tied to India’s construction, power, and manufacturing activity. The building construction sector expanded nearly 11%, while infrastructure grew by about 17%, supported by large-scale public investments in transport, housing, and smart city projects.

The renewable energy segment, a key consumer of copper for transmission and turbine components, has also emerged as a steady driver amid India’s clean energy transition. Meanwhile, consumer durables such as air conditioners, fans, and refrigerators saw nearly 19% growth in copper use, as domestic consumption rebounded on the back of improved urban and rural demand.

Global Shortfall Meets India’s Supply Constraints

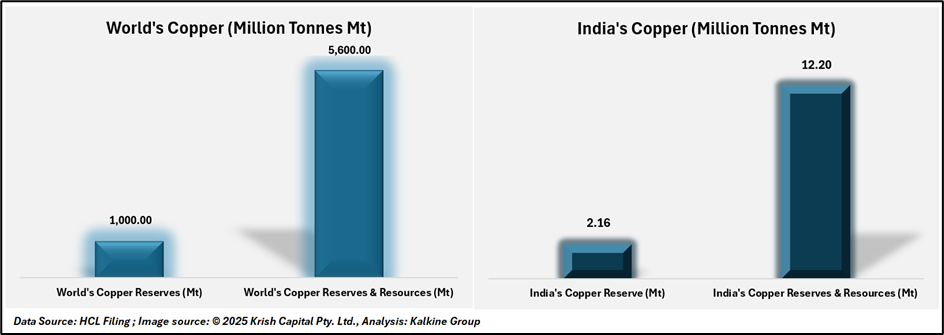

Despite the surge in demand, India’s domestic production and reserves remain modest. The country holds just 0.2% of global copper reserves, amounting to 2.16 million tonnes, and around 12.2 million tonnes of total resources a small fraction of global identified reserves of 1,000 Mt and total resources of 5,600 Mt.

India’s copper production stood at 25.24 KT in FY 2024–25, equivalent to only 0.12% of global output. This mismatch between consumption and domestic availability has deepened reliance on imports, particularly for refined copper, as demand from infrastructure and green energy sectors outpaces supply growth.

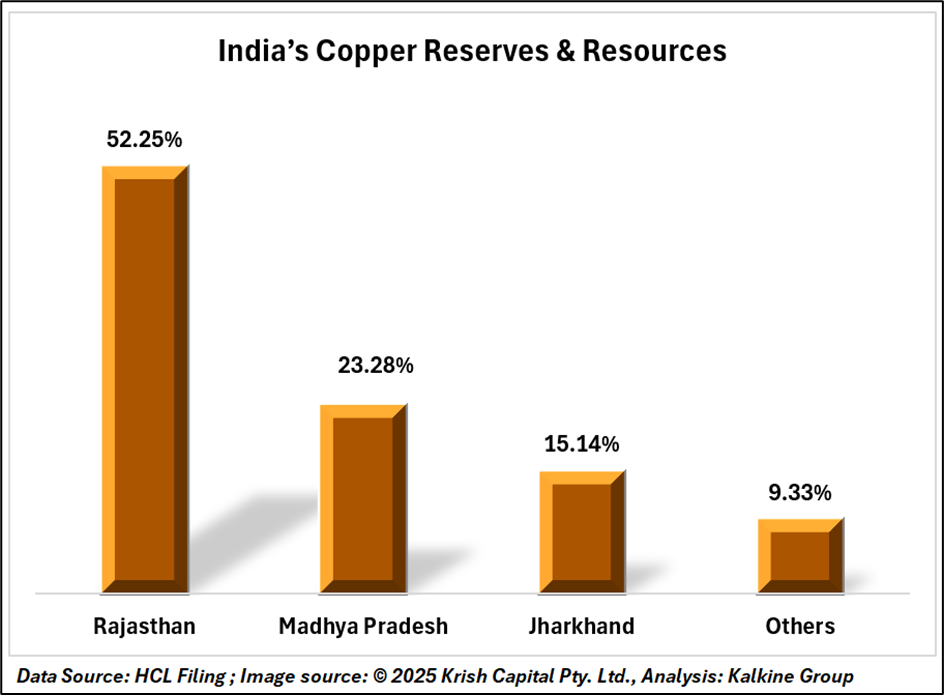

All India Reserve

Within India, Rajasthan accounts for over 52% of the country’s total copper ore reserves, followed by Madhya Pradesh (23%) and Jharkhand (15%). These states remain central to India’s mining potential, though operational capacity and exploration investments lag behind global peers.

Global Context: China Dominates, India Trails in Consumption

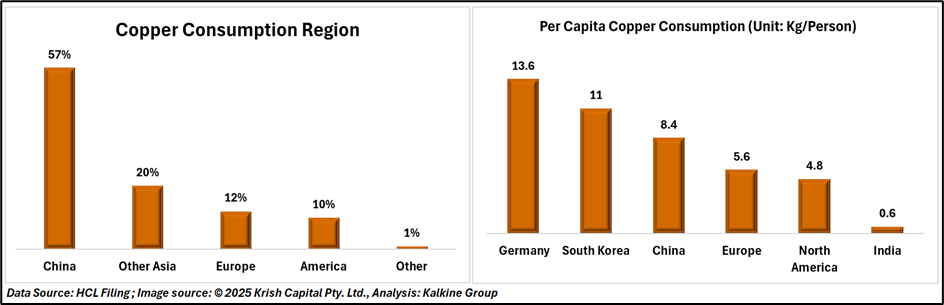

Globally, China continues to dominate copper consumption with a 57% share, reflecting its vast industrial and renewable energy base. Other Asian economies contribute 20%, while Europe and the Americas account for 12% and 10%, respectively.

In per capita terms, Germany (13.6 kg) and South Korea (11 kg) lead global consumption, with the world average at 3.2 kg per person. India’s per capita copper use, however, remains among the lowest at 0.6 kg, indicating substantial untapped potential as industrialisation and electrification continue to expand.

Strategic Imperatives: Building a Self-Reliant Copper Future

ICA India has underscored the importance of strengthening the domestic copper ecosystem to align with the government’s “Viksit Bharat 2047” vision. This involves enhancing refining capacity, recycling infrastructure, and exploration investment to reduce import dependency.

Conclusion

As India transitions to an energy-efficient and digital economy, copper’s role as a critical enabler powering electric vehicles, renewable grids, and modern construction — will only grow. However, bridging the gap between demand acceleration and limited domestic reserves will be essential to ensure sustainable and cost-competitive growth in the years ahead.