India’s Retail Investing Slows as New Demat Accounts Fall 33% in 2025

Source: shutterstock

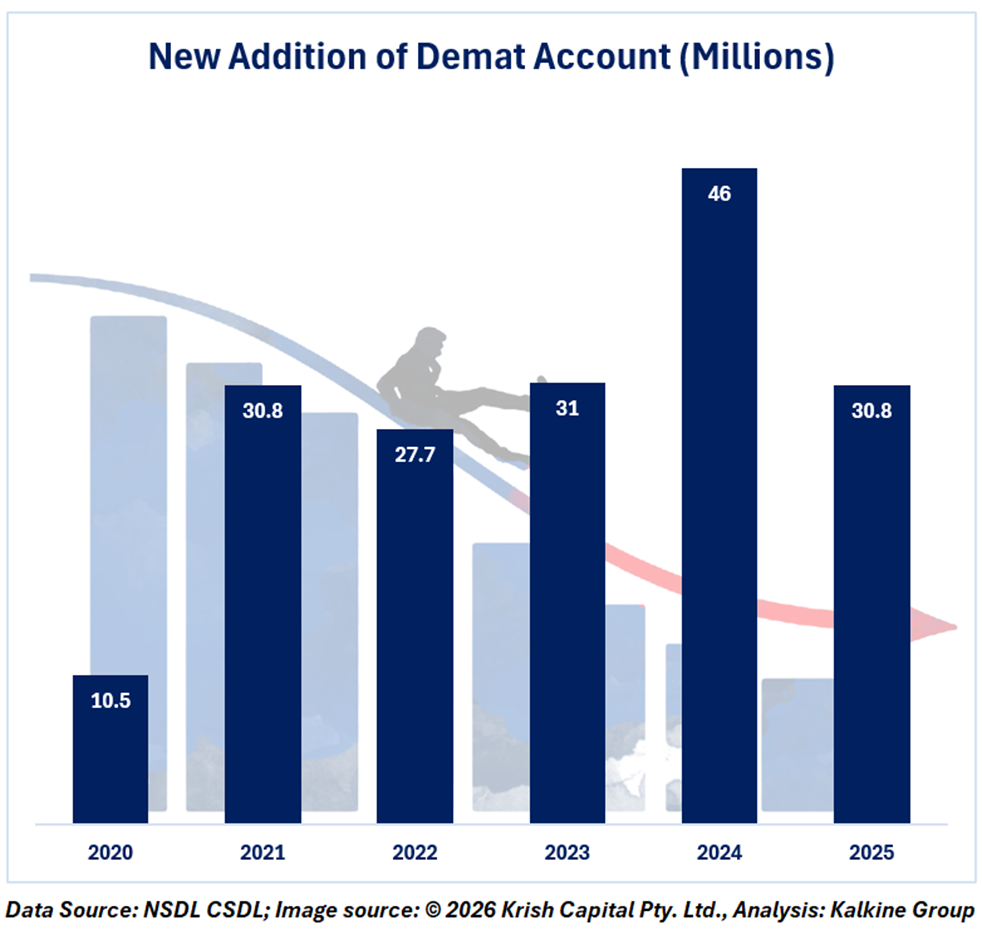

India’s retail participation slowed in 2025, with new demat accounts dropping nearly 33%. NSDL and CDSL data show that 30.63 million new accounts were added, over 15 million fewer than the 46 million opened in 2024. This is the first annual decline since 2021, highlighting how market swings and modest returns affected investor interest.

Total Demat Accounts Still on the Rise

Even with fewer new accounts, the total demat account base grew to 215.93 million by the end of 2025, up from 185.3 million in 2024. This shows that the overall investor base continues to expand, even if fresh registrations are slowing.

Market Fluctuations Keep Investors Cautious

The stock market had a mixed performance in 2025. Sensex and Nifty ended the year with modest gains of around 10%, while the BSE MidCap index rose just 1%, and the BSE SmallCap index fell roughly 5%. Analysts pointed to market volatility, geopolitical tensions, foreign investor outflows, subdued corporate earnings, and high valuations as reasons for the slowdown. IPOs continued, but several new listings reported muted or negative returns, limiting enthusiasm among retail investors.

NSDL’s Wide Reach Across India

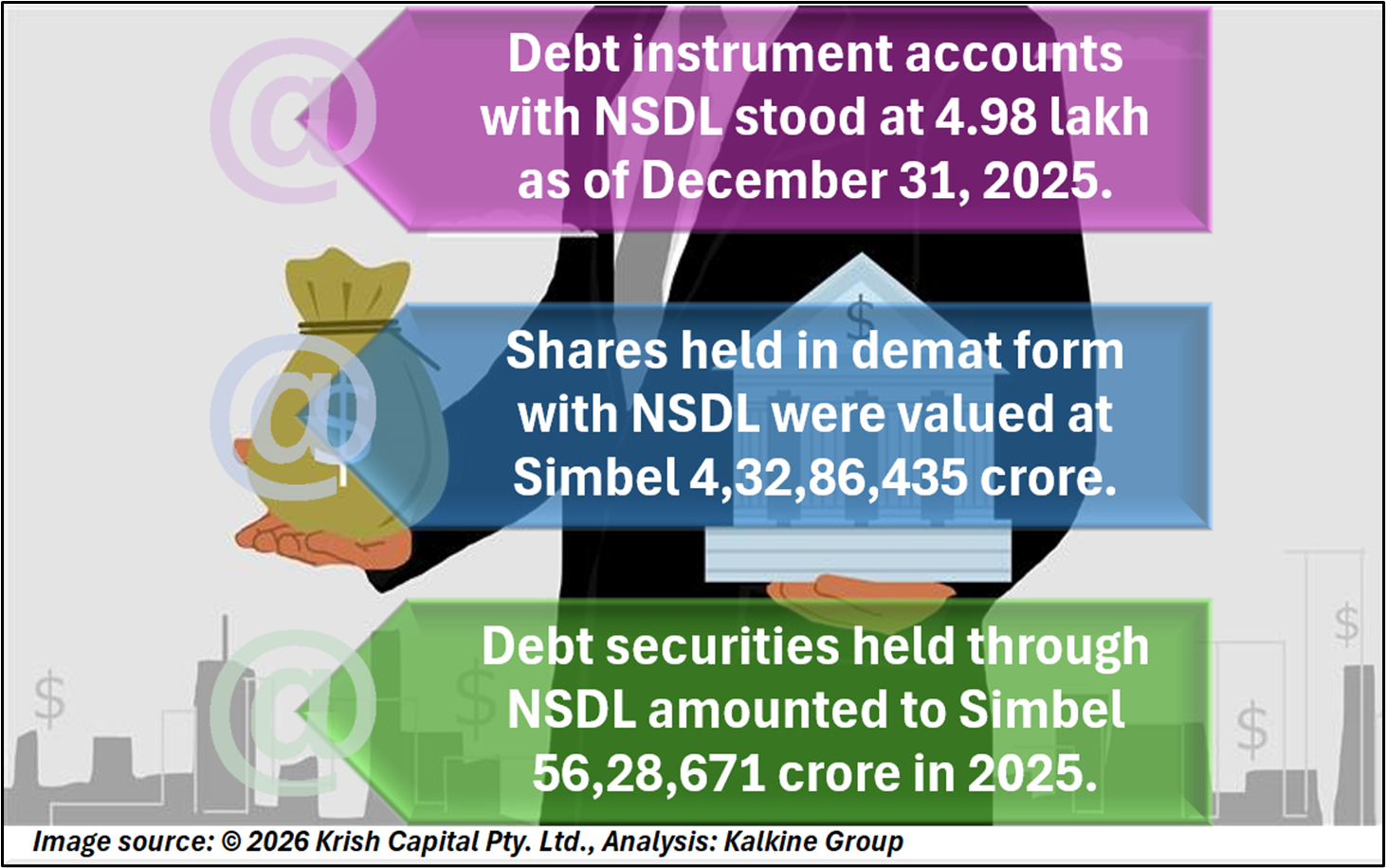

NSDL plays a key role in India’s securities market. By December 31, 2025, it had 4.32 crore active client accounts and 4.98 lakh debt instrument accounts. Since November 1996, NSDL has averaged 5,892 accounts opened daily, covering 99.36% of PIN codes. Its network includes 300 Depository Participants (DPs) and 56,858 service centres across 2,060 cities and towns.

NSDL has dematerialized about 11,439 crore certificates, with over 37,356 companies having more than 75% of shares in demat form. Total securities stood at Simbel 5,29,67,000 crore (US$ 5,890 billion), including shares worth Simbel 4,32,86,435 crore and debt instruments of Simbel 56,28,671 crore. Other instruments include commercial papers at Simbel 4,88,033 crore and sovereign gold bonds at Simbel 23,348 crore.

Record Settlements in December

In December 2025, NSDL settled 2,316 crore equity shares worth Simbel 8,42,275 crore. NSE accounted for 2,199 crore shares valued at Simbel 8,08,124 crore, and BSE handled 117 crore shares worth Simbel 34,151 crore. Debt and bond settlements reached Simbel 1,70,803 crore, underlining NSDL’s crucial role in managing both equity and debt transactions.

Conclusion

The fall in new demat accounts in 2025 reflects a cautious phase for retail investors amid market volatility and modest returns. While fewer people opened fresh accounts, the total investor base continued to grow, showing long-term confidence in equities. As markets stabilize and earnings improve, retail participation is likely to pick up again, supporting India’s broader capital market growth.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.