Trump’s New Tariff Push Targets Key Partners, Raises Global Trade Risks

Source: Shutterstock

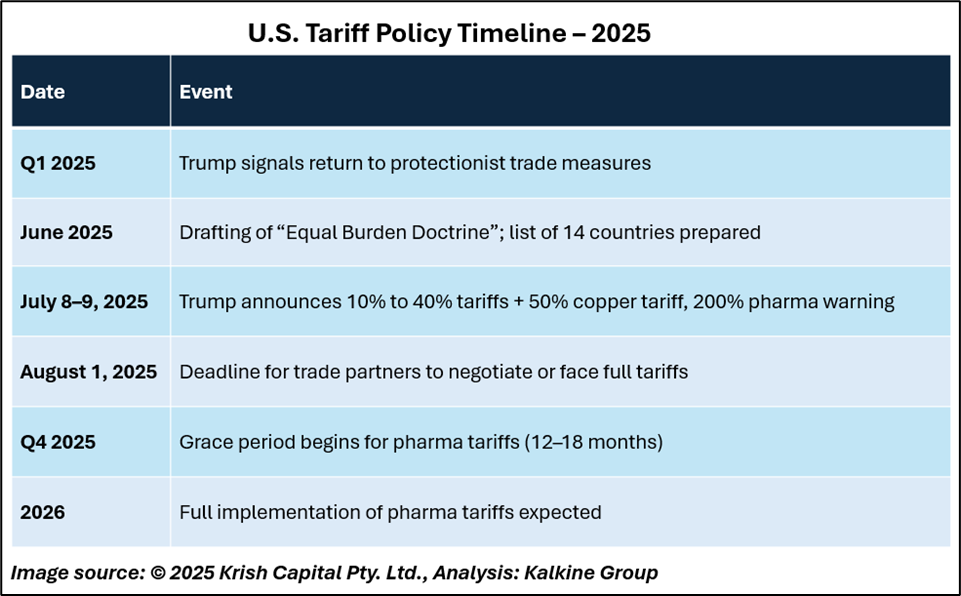

U.S. President Donald Trump reignited trade tensions on Monday, announcing the first wave of what he calls the “Equal Burden Doctrine” a trade policy framework that aims to impose tariffs mirroring or exceeding those levied by U.S. trading partners. The measures, which target 14 countries, could lead to tariff rates as high as 40%, with up to 200% duties proposed for imported pharmaceuticals after a one-year grace period.

While Trump signaled flexibility by indicating potential for further negotiations before an August 1 deadline, the scale and intent of the plan mark a significant escalation in his administration’s protectionist stance. At the core of this doctrine is the principle that if foreign nations maintain high tariffs or subsidies, the U.S. will match or exceed them in response.

U.S. Tariff Strategy

Trump's approach represents a departure from multilateral trade norms, opting instead for a unilateral, retaliatory strategy rooted in Section 301 of the U.S. Trade Act, bypassing the World Trade Organization (WTO). This new strategy is broader in scope than earlier measures and targets strategic sectors such as copper, steel, autos, pharmaceuticals, lumber, and semiconductors.

A 50% tariff on copper imports is already being prepared, while new levies on pharmaceuticals will take effect in 12–18 months unless production is relocated to the U.S. Trump’s language emphasizes a shift from retaliation to equalization, calling it “fairness through matching burden.”

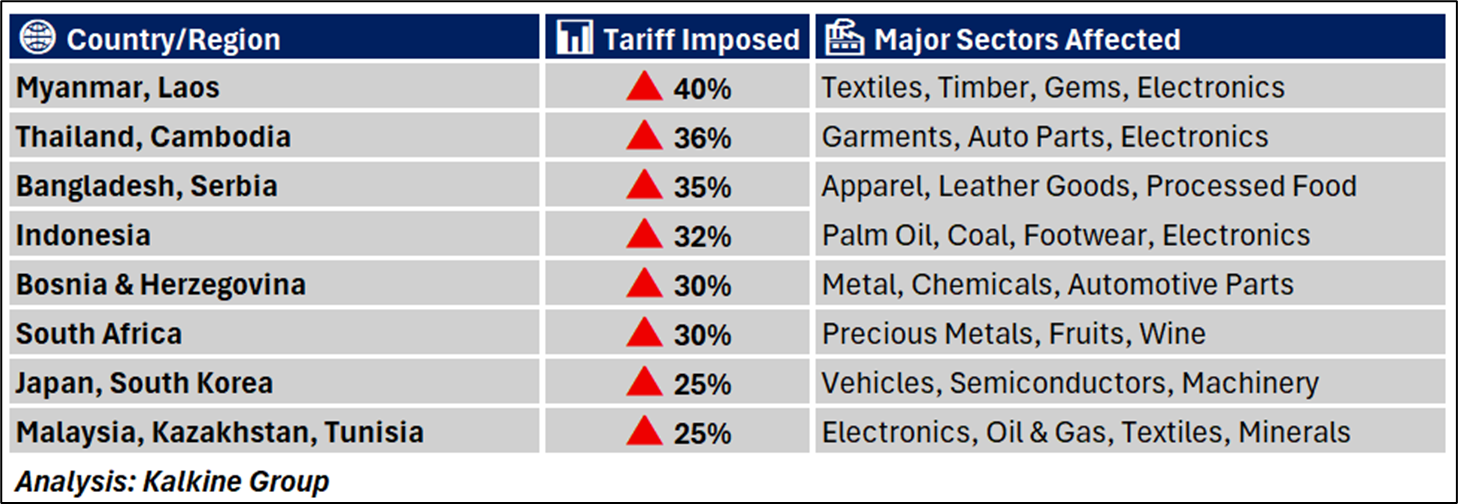

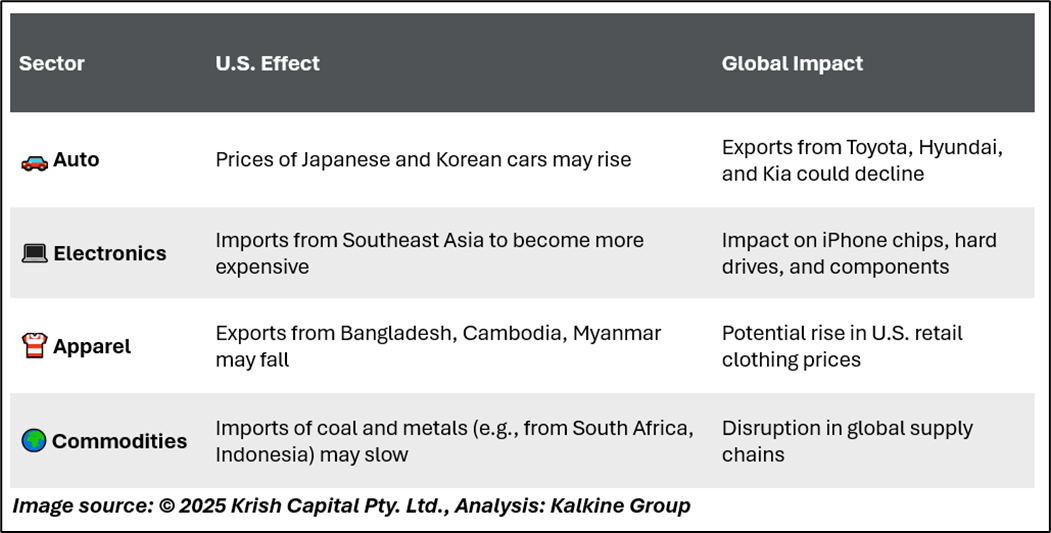

Japan and South Korea, both top U.S. trading partners, are among the countries most affected. Their major exports to the U.S. include automobiles (Toyota, Hyundai, Kia), electronics (Samsung, Sony), and machinery. Trump argues the persistent U.S. trade deficit with these nations reflects structural unfairness that undermines domestic industries.

Global Supply Impact

The policy has far-reaching consequences for countries that became major beneficiaries of U.S. supply chain diversification away from China. Emerging economies like Thailand, Indonesia, and Malaysia, which attracted investment post-deglobalization, now face potential trade barriers from the same companies they helped relocate.

South Africa and Tunisia criticized the measures as unilateral and unjust, questioning the alignment of Trump’s policies with global trade commitments. While India was not included in this round of tariffs, Trump stated that a bilateral deal with India was close, focusing on agriculture, pharmaceutical exports, and digital services.

India’s delicate position balancing potential U.S. trade gains with its leadership in BRICS and South-South cooperation means it must tread cautiously in ongoing talks. For BRICS+, ASEAN, and Global South-led initiatives, the new tariffs threaten to fragment alternative trade architectures, particularly those built in response to Western supply chain shifts.

Economic Fallout

In the U.S., the immediate economic impact includes upward pressure on inflation due to higher import costs for copper, consumer goods, and medical products. While some domestic manufacturers could see a boost, downstream industries may face cost volatility, and retaliatory actions are likely.

There is also growing concern that U.S. agricultural exports, particularly corn, soy, and dairy, could become targets for retaliatory tariffs from affected nations.

The WTO faces another stress test. Trump's bypass of the WTO's tariff-setting framework in favor of national legislation like Section 301 could lead to dispute filings at the WTO’s Dispute Settlement Body, potentially widening the rift between major economies and multilateral institutions.

Conclusion

Trump's “Equal Burden Doctrine” introduces a new phase of U.S. trade protectionism, one that moves beyond China and extends to a wider group of partners. While the strategy may address long-standing concerns over trade imbalances and domestic industry competitiveness, it introduces substantial risks including inflation, retaliatory tariffs, and strained global supply chains. As the August deadline approaches, the path forward will depend on whether partners negotiate or retaliate and how global institutions respond to this shift in trade governance.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.