Trump’s Tariff Threat Against BRICS - India Weighs Economic Risks and Diplomatic Options

Source: shutterstock

Former U.S. President Donald Trump has renewed trade friction by proposing an additional 10% tariff on countries backing what he labeled the "anti-American" BRICS alliance. This statement targets countries perceived to be aligning against U.S. interests. As BRICS (Brazil, Russia, India, China, and South Africa) expands its global influence and adds new members like Iran and Egypt, the implications for India both as a BRICS member and a major U.S. trade partner are multifaceted and consequential.

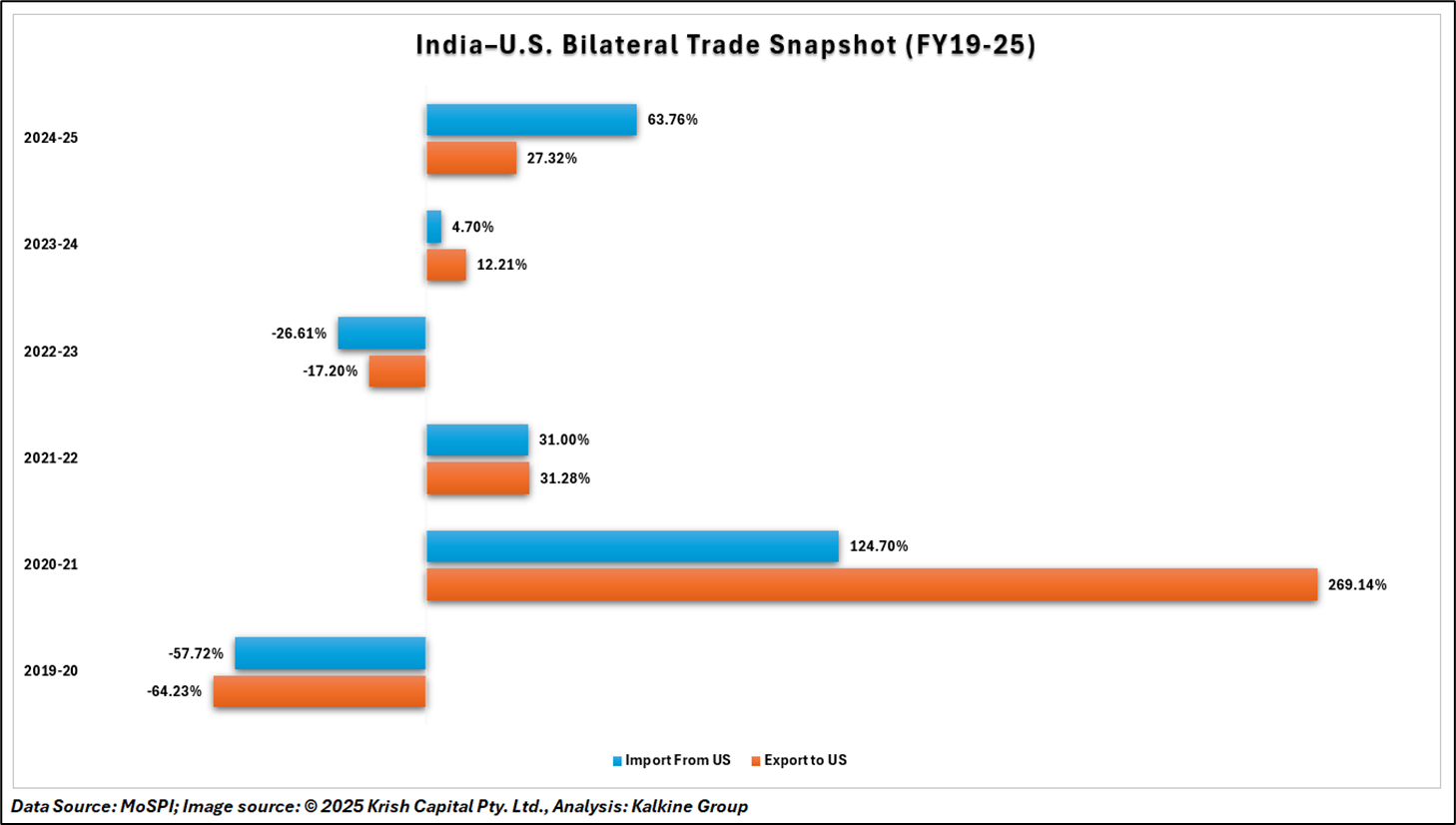

India’s Trade Ties with the U.S. Face Uncertain Terrain

The U.S. is India’s largest trading partner, with bilateral trade crossing USD 128 billion in FY24. Exports from India to the U.S. include pharmaceuticals, textiles, machinery, and software services. An additional 10% tariff could significantly impact price competitiveness for Indian exporters, especially small and medium enterprises already coping with high logistics and compliance costs.

While Trump has not singled out India directly, his characterization of BRICS as an “anti-American alliance” places New Delhi in a precarious position. Unlike China and Russia, India has maintained strategic neutrality, advocating for multipolarity without adopting an overtly anti-U.S. stance. Nonetheless, a blanket tariff policy risks collateral damage to Indian trade interests.

BRICS Expansion and India’s Diplomatic Balancing Act

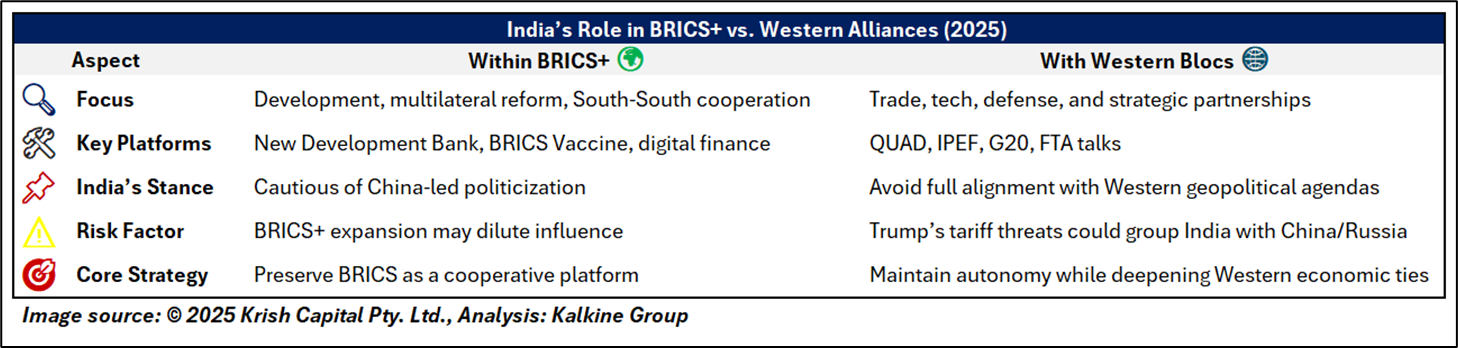

The transformation of BRICS into BRICS+ with new members like Saudi Arabia, Egypt, and Iran has significantly boosted the bloc’s geopolitical influence. Collectively, the group now represents more than 40% of the world’s population and nearly one-third of global GDP. India, however, remains cautious about the overt politicization of BRICS, especially when it aligns more closely with China’s global strategy.

India’s vision for BRICS has focused on development, multilateral reform, and financial cooperation through platforms like the New Development Bank. Any narrative portraying BRICS as adversarial to the West undermines India’s objective of maintaining balanced relations with both blocs.

Trump’s remarks, therefore, complicate India’s diplomatic strategy. Being clubbed with China or Russia in a punitive trade approach could pressure India to publicly clarify its role in BRICS potentially alienating one partner to appease the other.

Domestic Sectors That May Bear the Brunt

India’s export-driven sectors are also navigating other global headwinds like EU carbon taxes, stricter compliance norms, and slowing global demand. A fresh tariff layer could force Indian companies to either absorb costs or lose market share.

Additionally, rising trade tensions could trigger investor unease. India, positioned as a key manufacturing hub under the “China+1” strategy, may see that narrative lose momentum if U.S. frictions escalate—potentially dampening foreign direct investment (FDI) inflows.

Conclusion

Donald Trump’s proposed tariffs on BRICS-aligned nations signal rising trade tensions. For India, balancing ties with both BRICS and Western allies is crucial. While BRICS supports multipolarity, India’s economic growth relies heavily on Western trade and investment. To avoid fallout, India must uphold strategic autonomy, diversify exports, and fast-track trade deals like the India-EU FTA. Proactive diplomacy and resilient trade strategies will be vital if U.S. protectionism resurfaces under a Trump presidency.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.