Upcoming Debt Survey Could Influence India GDP Estimates in FY28

Source: shutterstock

India’s national accounts framework is scheduled for an update in February 2026, with FY2022–23 adopted as the new base year. The revised series will initially continue to rely on survey weights derived from 2019 data. Officials have indicated that a further revision in FY28 remains possible, subject to an evaluation of whether results from the next All India Debt and Investment Survey can be integrated into the accounts framework.

The potential reassessment reflects caution over capturing post-pandemic changes in household savings and investment behaviour. Any subsequent update would depend on evidence of structural shifts identified through expanded household-level datasets rather than assumptions or projections.

Role of the Debt and Investment Survey

The All India Debt and Investment Survey is scheduled to be conducted from July 2026 to June 2027. Its findings could affect estimates of household investment and gross fixed capital formation, components that play a role in calculating overall GDP. Updated survey results may also enable revisions to construction-sector benchmarks, which are used to estimate value added within the sector.

Officials have noted that broader and more current survey coverage is expected to strengthen the methodology used in future national accounts, improving consistency between household balance sheets and macroeconomic aggregates.

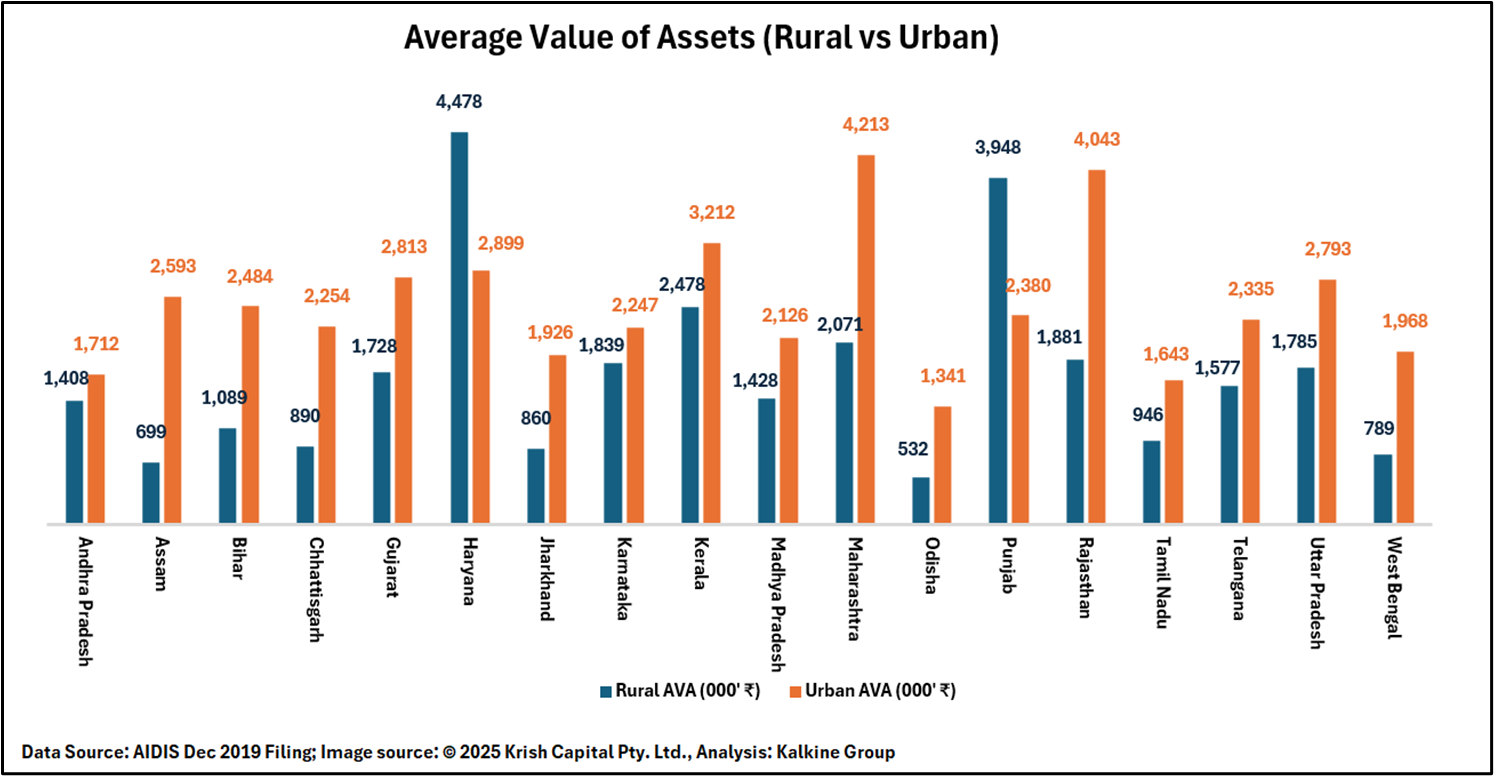

Asset Distribution Across States

State-level data on average asset values highlight clear rural–urban differences. Rural average asset values range from ₹532k in Odisha to ₹4,478k in Haryana. In urban areas, average asset values range from ₹1,341k in Odisha to ₹4,213k in Maharashtra.

Across most states, urban households report higher average asset values than rural households, although the scale of the gap varies significantly by region. These differences provide context for understanding savings capacity, borrowing patterns, and investment behaviour across states.

Indebtedness by Asset Holding Class

Data as of 30 June 2018 show that the incidence of indebtedness rises with higher asset holding classes in both rural and urban areas. In rural regions, the incidence of indebtedness increases from 21.6% in the lowest asset class to 49.8% in the highest. Urban areas show a rise from 9% to 29.5% across the same spectrum.

Average debt levels also increase steadily with asset holdings in both rural and urban households. These patterns indicate that higher asset ownership is associated with greater access to credit, alongside higher absolute debt levels.

Conclusion

India’s GDP series update and the upcoming Debt and Investment Survey highlight ongoing efforts to refine national accounts. Post-pandemic household savings and investment patterns may influence future revisions. State-level asset and debt data show clear rural–urban disparities. Expanded survey coverage is expected to improve accuracy of GDP and sectoral estimates.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.