What Budget 2026 Changed for Cigarette Makers — And Why It Matters?

Source: shutterstock

The Union Budget 2026 has delivered one of the sharpest indirect tax interventions the tobacco sector has seen in years, materially reshaping the cost structure for cigarette manufacturers. Alongside a sweeping increase in levies on smokeless tobacco, the government has introduced a new excise duty on cigarettes over and above an elevated GST rate, tightening the regulatory screws on the industry.

Sharp Hike in NCCD Signals Tougher Stance

The government has raised the National Calamity Contingent Duty (NCCD) on chewing tobacco, jarda, scented tobacco and allied products to 60% from 25%, effective May 2026. While the hike directly targets smokeless tobacco, it reinforces the policy intent to progressively lift the overall tax burden on tobacco consumption. For cigarette manufacturers, this signals a persistent regulatory overhang, increasing the probability of further interventions over the medium term.

Industry-Wide Implications

Cigarettes are a highly taxed and price-sensitive category. Historically, steep and abrupt tax hikes have led to three immediate consequences:

Company-Specific Impact

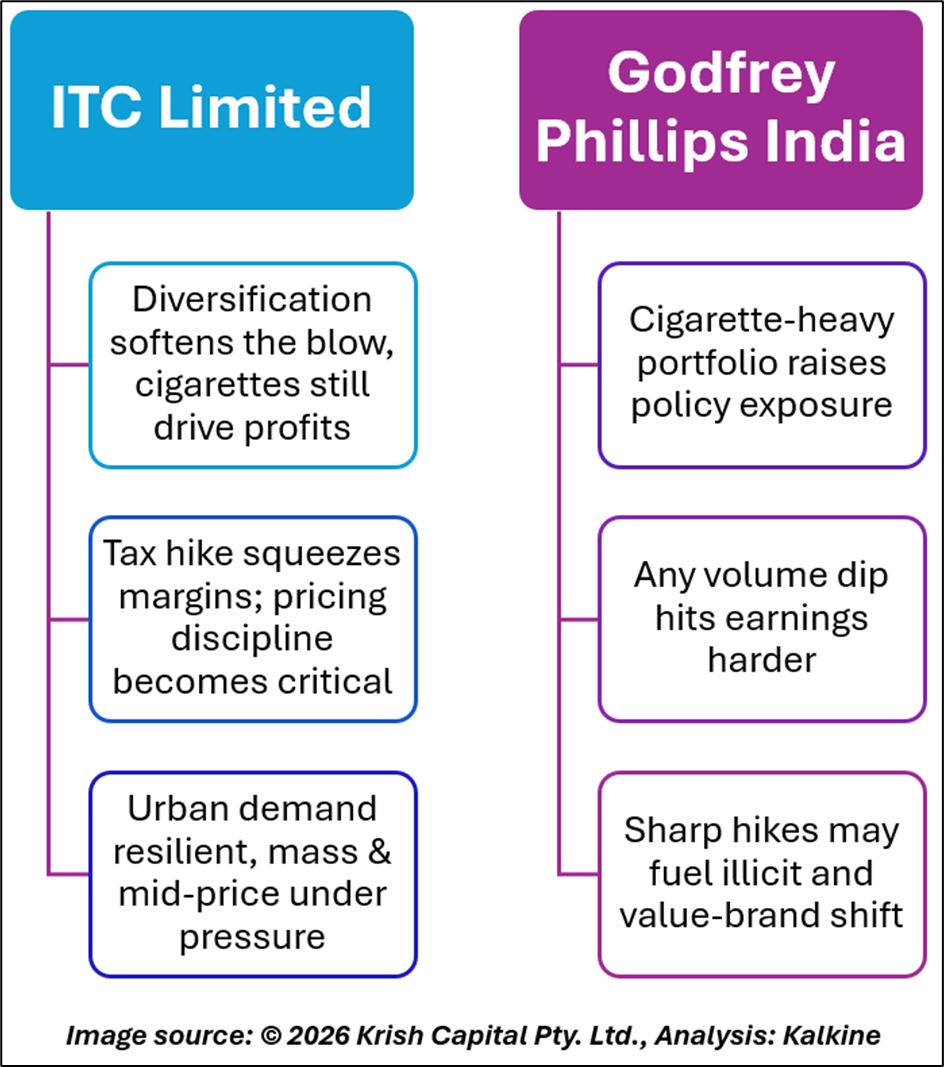

Cost Inflation of 22% to 28% for Key Segments

The revised duty structure translates into a 22% to 28% increase in overall costs for cigarettes in the 75mm to 85mm length category, a core segment for most manufacturers. The sharp rise significantly limits the industry’s ability to absorb costs internally, pushing companies towards price hikes.

Cigarettes longer than 75 mm which account for roughly 16% of volumes for ITC Limited are expected to see price increases of ₹2 to ₹3 per stick, potentially testing demand elasticity in premium and mid-premium categories.

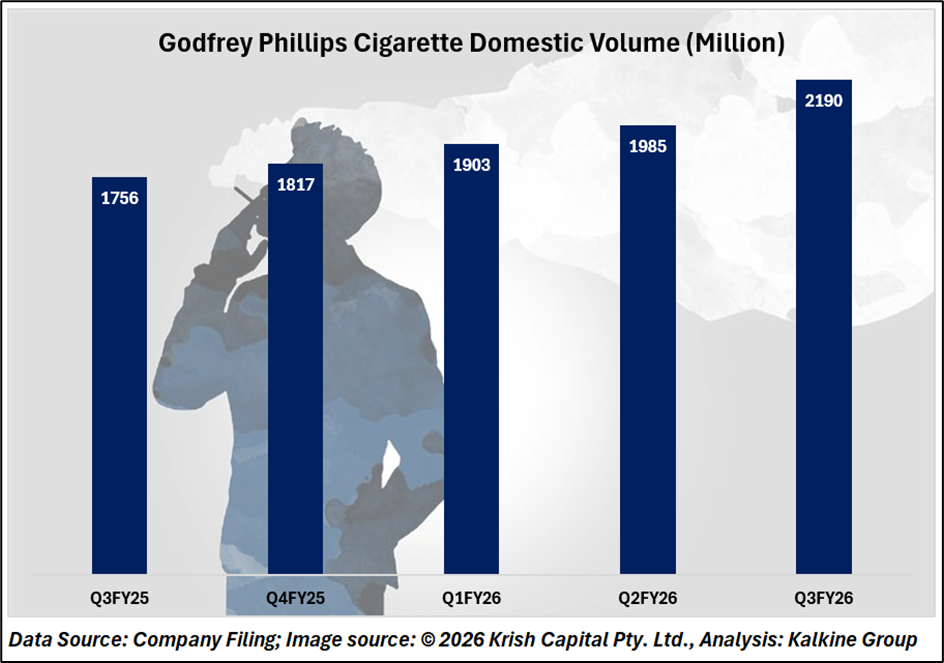

Godfrey Phillips India Cigarette Domestic Volume

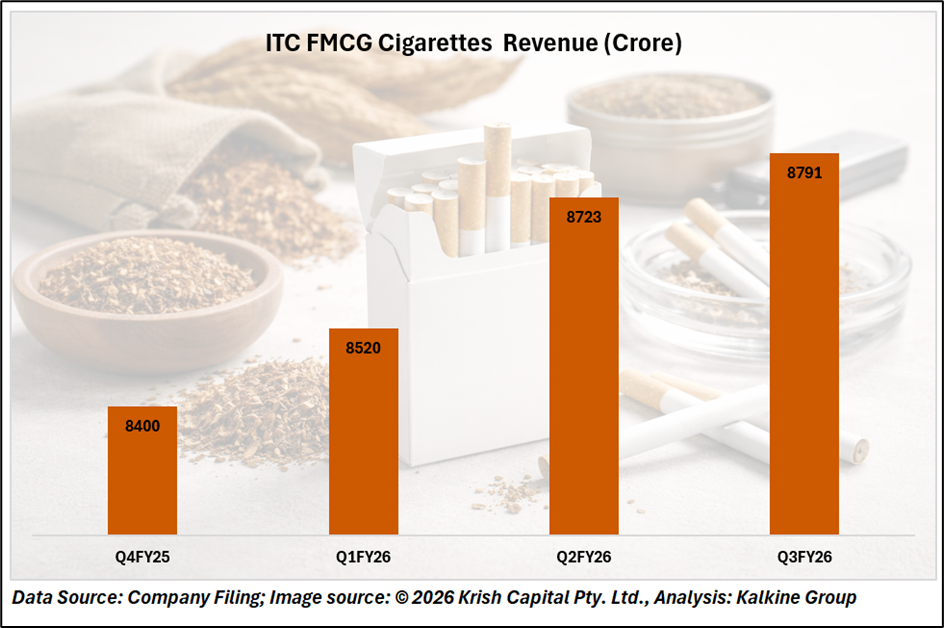

ITC FMCG Cigarettes Revenue

Medium-Term Sector Outlook

Over the medium term, cigarette companies are likely to adopt a calibrated strategy combining staggered price hikes, tighter cost control, and portfolio rationalisation. However, growth rates are expected to remain subdued compared to the pre-Budget trajectory. Regulatory overhang will also keep valuation multiples capped, despite strong cash flows.

From a policy standpoint, higher taxes may boost government revenues initially, but sustained increases risk widening the gap between legal and illicit consumption a structural challenge for the industry.

Conclusion

Union Budget 2026 marks a clear inflection point for India’s cigarette industry. The sharp rise in excise duty and NCCD reinforces regulatory risk, compresses near-term margins, and raises demand elasticity concerns. While leading players retain pricing power and cash-flow strength, volume growth and valuations are likely to remain under pressure amid a structurally tighter policy environment.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.