What’s Powering Bajaj Housing Finance’s Consistent Growth in Q3 FY26?

Source: shutterstock

Bajaj Housing Finance Limited has reported a robust performance in Q3 FY26, demonstrating significant growth in its Assets Under Management (AUM) and profitability while maintaining strong asset quality. The company continues to leverage its diversified mortgage portfolio, digital initiatives, and risk-focused lending practices to deliver sustainable performance.

Strong AUM Growth and Portfolio Diversification

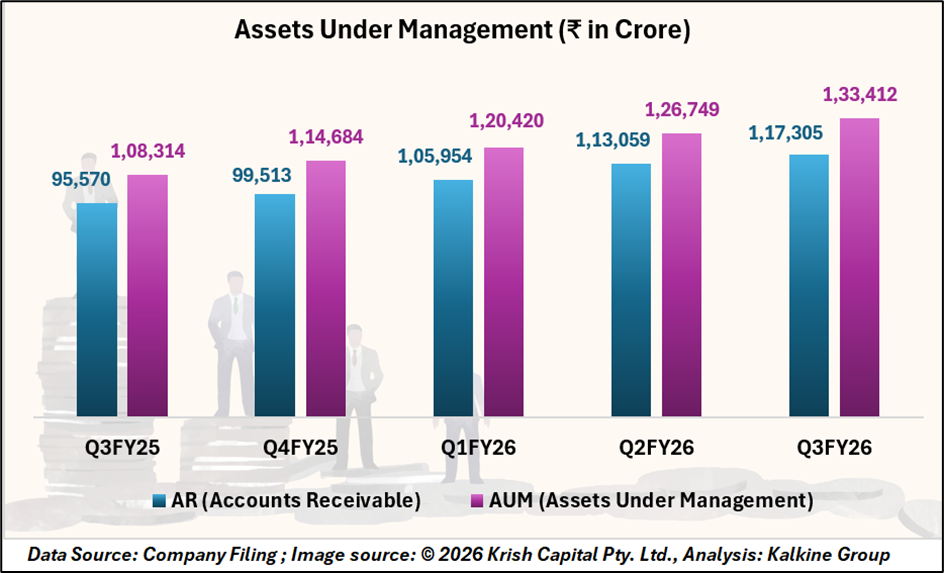

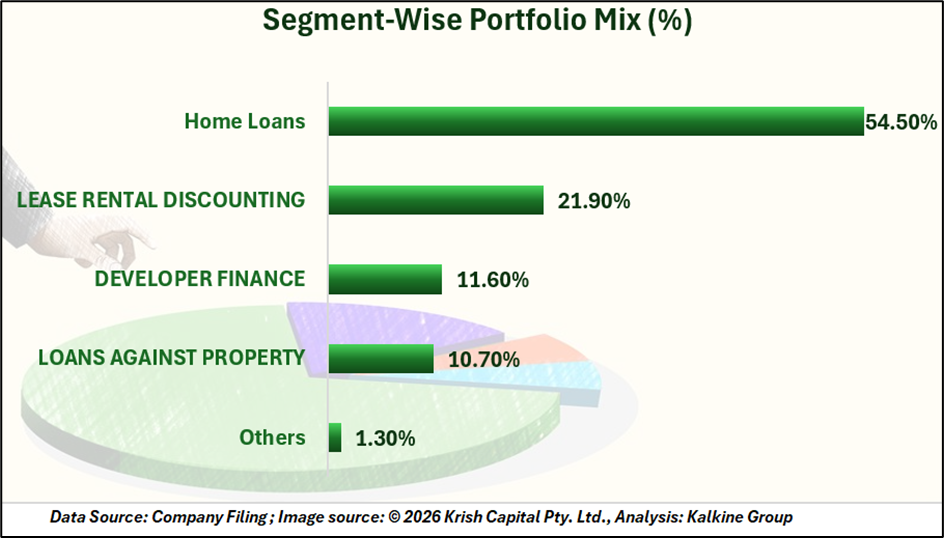

Bajaj Housing Finance Limited’s AUM reached ₹1,33,412 crore in Q3 FY26, a 23% increase from ₹1,08,314 crore in Q3 FY25. This growth was primarily driven by higher disbursements across key segments, including home loans, loans against property (LAP), developer finance, and lease rental discounting (LRD). Home loans continue to dominate the portfolio, contributing 54.5% of total AUM, followed by LRD at 21.9%, developer finance at 11.6%, and LAP at 10.7%.

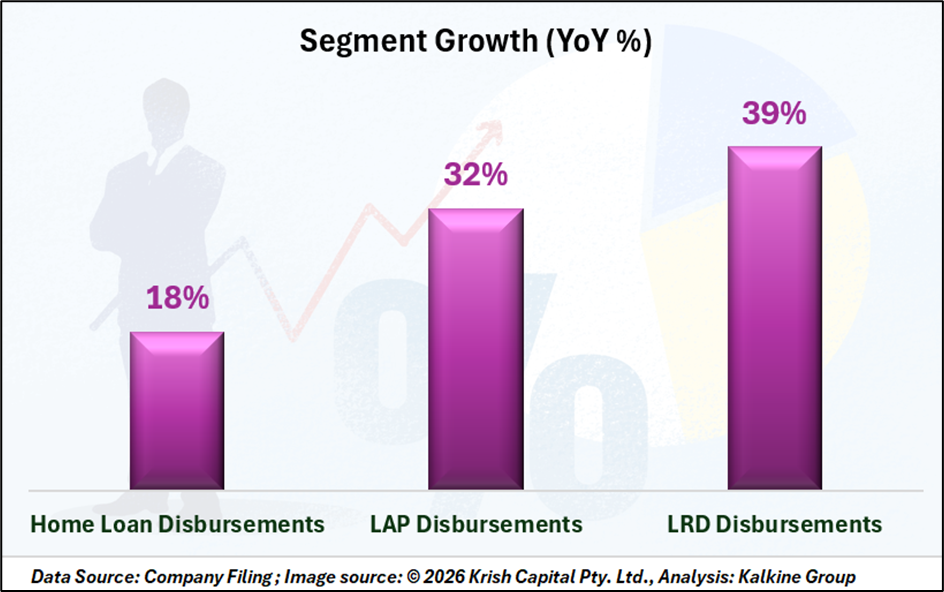

Disbursements grew 32% YoY to ₹16,545 crore, reflecting the company’s continued momentum in retail and commercial mortgage segments. Home loan disbursements increased by 18%, LAP by 32%, and LRD by 39% compared to Q3 FY25. The company’s omnichannel sourcing strategy, including digital partners, developer counters, and self-sourcing, has further strengthened its market reach.

Healthy Asset Quality and Risk Management

Bajaj Housing Finance Limited maintained strong asset quality with Gross NPA at 0.27% and Net NPA at 0.11%. Annualized credit cost stood at a low 0.19%, reflecting disciplined underwriting and active portfolio monitoring. Stage-2 assets were ₹437 crore (0.37% of AUM), and Stage-3 Provision Coverage Ratio (PCR) improved to 58.76%.

Profitability and Efficiency Metrics

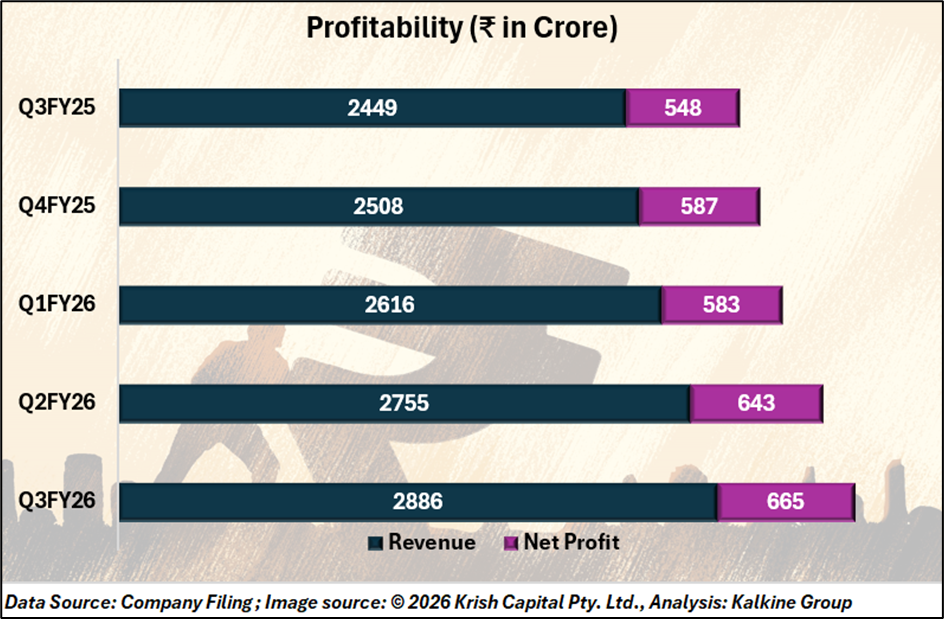

Bajaj Housing Finance Limited delivered strong profitability in Q3 FY26, reporting Profit Before Tax of ₹865 crore and Profit After Tax of ₹665 crore, both up 21% YoY. Net Interest Income increased 19% to ₹963 crore, supported by stable net interest margins of 4.0% despite slight pressure on spreads after the policy rate cut.

Treasury, Funding, and Capital Position

Bajaj Housing Finance Limited’s diversified borrowing mix—comprising banks, money markets, and National Housing Bank (NHB) funding—supports its long-tenor lending strategy. The company’s liquidity coverage ratio stood at 146%, well above regulatory requirements, and the Capital to Risk-weighted Assets Ratio (CRAR) was robust at 23.15%, with Tier-1 capital at 22.69%.

The strong capital position, combined with prudent leverage (5.5x), allows BHFL to sustain growth while maintaining regulatory compliance and financial stability.

Strategic Outlook

For FY26, Bajaj Housing Finance Limited anticipates AUM growth of 21–23%, with Opex to NTI remaining around 20–21% due to investments in non-metro markets and strategic business units. The company expects GNPA, credit cost, and PCR to remain within guidance, and RoA to remain stable at 2.0–2.2%. BHFL’s focus on prime home loans and LRD as anchor products, coupled with a full mortgage product suite, positions it for scalable and profitable growth across urban and tier-4 markets.

Technical Summary

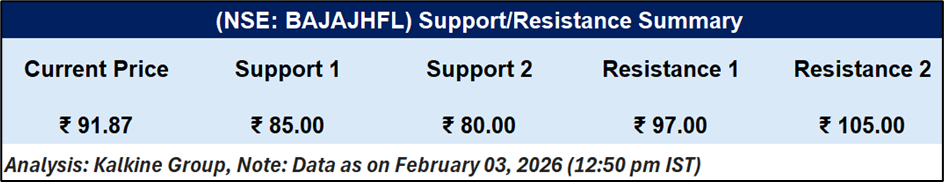

Bajaj Housing Finance Ltd. remains in a broader downtrend, trading below its 50-day SMA, which continues to cap upside. Recent price rebound indicates short-term buying interest, supported by RSI near 49 suggesting stabilisation from oversold levels. Sustained strength above the moving average is required to signal trend reversal; otherwise, volatility may persist.

Bottom Line: Growth With Guardrails Intact

Bajaj Housing Finance’s Q3 FY26 performance reinforces its positioning as a high-quality mortgage lender, combining strong AUM and profit growth with disciplined risk management.

Healthy asset quality, robust capital buffers, and diversified funding provide downside protection, while steady disbursement momentum and strategic focus on prime housing and LRD support sustainable, long-term growth despite near-term market volatility.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.