EVs and Two-Wheelers Spark Major Growth in India’s November 2024 Auto Sales

Source: Shutterstock

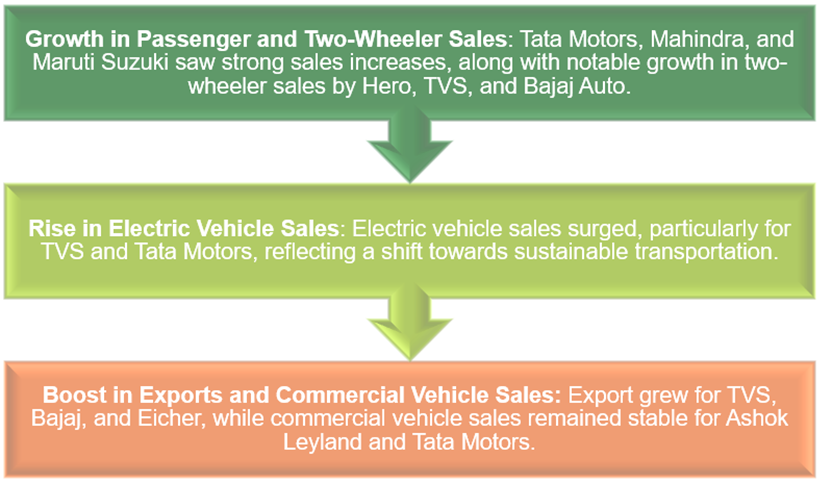

Key Highlights

Image source: © 2024 Krish Capital Pty. Ltd., Analysis: Kalkine Group

India is a vast market due to its large population, and the automobile industry is one of the biggest and most technologically advanced sectors. The Indian automobile industry has long been a key indicator of the nation's economic health, contributing significantly to both economic development and technological innovation.

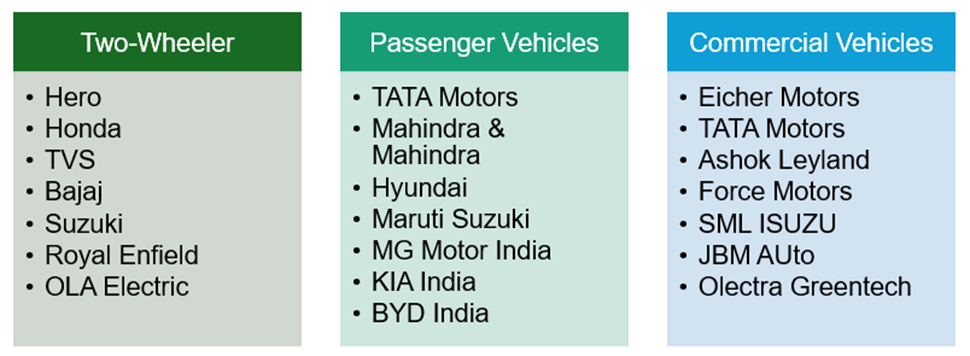

India's automobile market is diverse, with the population divided into three categories: lower class, middle class, and upper class. The demand for two-wheelers is growing rapidly, primarily due to the increased focus on rural markets by companies, as well as the large middle class and the young population. Passenger vehicles also play a significant role in the growth of the automobile sector, driven by urbanization and rising disposable incomes, among other factors. Additionally, the demand for commercial vehicles is increasing with the growth of logistics and passenger transportation.

Major Players in Market

Image source: © 2024 Krish Capital Pty. Ltd., Analysis: Kalkine Group

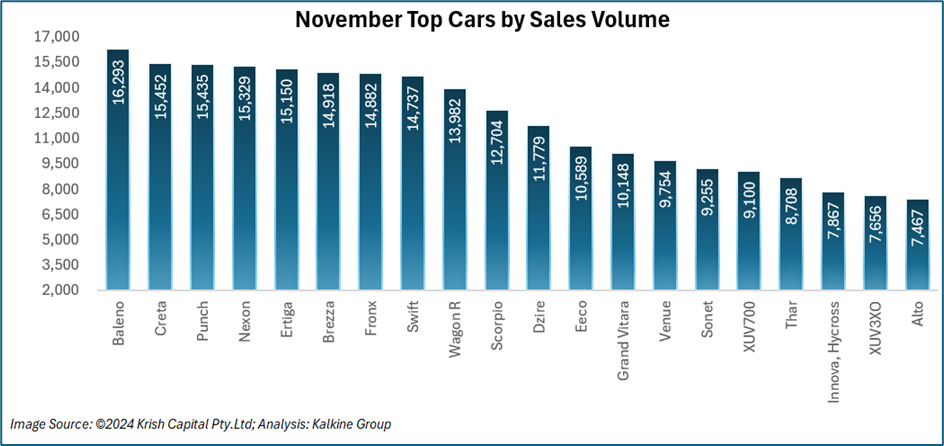

Let’s talk about November sales numbers

Automotive sales in November 2024 marked another month of significant growth, driven by multiple factors including consumer confidence, festive demand, and an evolving shift toward electric vehicles (EVs). The month showcased a diverse range of vehicles, from compact cars to electric options, with the market responding positively to various trends.

Passenger Vehicles

- Tata Motors reported total sales of 74,753 units in November 2024

Tata Motors reported a 2% year-on-year (YoY) increase in total passenger vehicle (PV) sales, which reached 47,117 units in November 2024, compared to 46,143 units in November 2023. Additionally, Tata Motors' electric vehicle (EV) sales rose by 9%, reaching 5,202 units in November 2024, up from 4,761 units in November 2023.

- Mahindra & Mahindra (M&M) reported total sales of 79,083 units in November 2024

Mahindra & Mahindra reported a total of 46,222 SUVs in November, reflecting a growth of 16%. The company’s total vehicle sales, including exports, reached 47,294. Domestic sales of commercial vehicles amounted to 22,042 units. In total, Mahindra's sales volume for November 2024 stood at 79,083 units, including exports.

Additionally, Mahindra’s farm equipment sector recorded 31,746 domestic tractor sales in November 2024, with exports totalling 1,632 units. The total tractor sales for the month, including both domestic and export figures, reached 33,378 units.

- Maruti Suzuki reported total sales of 181,531 units in November 2024

Maruti Suzuki India Limited recorded total sales of 181,531 units. This total includes 144,238 units sold domestically, comprising 141,312 passenger vehicles (PV) and 2,926 light commercial vehicles (LCV), along with 8,660 units supplied to other OEMs and 28,633 units exported. The company's total domestic sales for the month amounted to 152,898 units.

- Hyundai Motor India Limited total sales of 61,252 units in November 2024

Hyundai Motor India Limited (HMIL) recorded total sales of 61,252 units in November 2024. Of this, 48,246 units were sold domestically, while 13,006 units were exported. The contribution of SUVs to domestic sales remained robust, accounting for 68.8% of the total in November 2024.

Two-Wheeler and Three Wheelers

- Eicher Motor (Royal Enfield) total sales of 82,257 units in November 2024

Royal Enfield sold 82,257 motorcycles, marking a 2% increase compared to the 80,251 units sold in the same month last year. Additionally, the company exported 10,021 motorcycles during the month, reflecting a significant growth of 96% compared to 5,114 units exported in the same period the previous year.

- Hero MotoCorp total sales of 425,856 units in November 2024

Hero MotoCorp achieved total sales of 459,805 units, comprising 425,856 motorcycles and 33,949 scooters. The company's domestic sales for the month were 439,777 units, while exports contributed 20,028 units.

- TVS Motor Company achieved total sales of 401,250 units in November 2024

Two-wheeler sales increased by 12%, rising from 352,103 units in November 2023 to 392,473 units in November 2024. Domestic sales grew by 6%, from 287,017 to 305,323 units. Motorcycle sales rose by 4%, from 172,836 units to 180,247 units, while scooter sales saw a 22% jump, increasing from 135,749 units to 165,535 units.

Electric vehicle sales surged by 57%, from 16,782 units in November 2023 to 26,292 units in November 2024. Exports also grew by 25%, rising from 75,203 units to 93,755 units. Two-wheeler exports saw a notable increase of 34%, climbing from 65,086 units to 87,150 units.

Three-wheeler sales totaled 8,777 units in November 2024, compared to 12,128 units in November 2023.

- Bajaj Auto total sales of 421,640 units in November 2024

The total sales comprised 240,854 units sold domestically, and 180,786 units exported. In November 2024, the company sold 368,076 two-wheelers and 53,564 commercial vehicles.

Commercial Vehicle

- Eicher Motor total sales of 5,574 units in November 2024

In November 2024, Eicher Trucks and Buses recorded total sales of 5,359 units, with 4,957 units sold domestically and 402 units exported. Meanwhile, Volvo Trucks and Buses achieved total sales of 215 units during the same month.

- Tata Motors total sales of 27,636 units in November 2024

Commercial vehicle (CV) sales saw a 1% YoY decline, totalling 27,636 units in November 2024, down from 28,029 units in November 2023

- Ashok Leyland total sales of 14,137 units in November 2024

Total domestic sales amounted to 12,473 units, including 7,913 M&HCV units and 4,560 LCV units. Export sales totaled 1,664 units, with 1,263 M&HCV units and 401 LCV units.

Stocks Technical Analysis

Tata Motors Ltd. (NSE: TATAMOTORS), currently trading at ₹791.30 (13 December 2024, 03:29 PM IST), shows recovery signs, trading above the 21-day EMA but below the 50-day EMA (₹842.56), indicating short-term momentum. The RSI at 43.19 reflects weakening bearish pressure. Key support lies at ₹750-760, with resistance at ₹810-820. A breakout above ₹820 may target ₹850-870, while a dip below ₹750 could test ₹700.

Source – Refinitiv, Analysis – Kalkine Group

Mahindra & Mahindra Ltd. (NSE: M&M), currently trading at ₹3,086.60 (13 December 2024, 03:29 PM IST), is holding above a key horizontal support level and an ascending trendline, suggesting the potential for upward movement. However, despite the bullish candlestick pattern, the stock remains below the 21-period Simple Moving Average (SMA), which could act as near-term resistance. The RSI at 60.03 shows strong bullish momentum, but the failure to break above ₹3,090 may signal a reversal. A dip below ₹3,000 could lead to further downside, testing ₹2,900. Traders should watch for a breakout above ₹3,090 for confirmation of bullish continuation, but failure to breach this level could set up a short opportunity.

Maruti Suzuki Ltd. (NSE: MARUTI) is currently trading at ₹11,276.55 as of 13 December 2024, 03:29 PM IST), above a key horizontal support and an ascending trend line, signaling potential for upward momentum. The stock is supported by the 21-period Simple Moving Average (SMA) and shows bullish strength, as indicated by its Relative Strength Index (RSI) of 50.23. Immediate support is at ₹11,000, and resistance lies at ₹11,360, with a breakout potentially targeting ₹11,700. A dip below ₹10,870 could test ₹10,700. The overall outlook is optimistic, with the potential for further gains if resistance is overcome.

Conclusion

November 2024 saw strong growth across various segments of India's automotive market, driven by consumer demand, festive season boosts, and a rising interest in electric vehicles. Major players like Tata Motors, Mahindra & Mahindra, Maruti Suzuki, and Hyundai reported notable sales increases in both passenger and commercial vehicles. The two-wheeler market also experienced substantial growth, with companies such as Hero MotoCorp, TVS Motor, and Bajaj Auto leading the way. Electric vehicle sales surged, reflecting the ongoing shift towards sustainable mobility. Overall, the Indian automobile industry continues to expand, driven by evolving consumer preferences, urbanization, and technological advancements.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.