How Digital Adoption and Market Growth Are Fueling Demat Account Expansion in India?

Source: shutterstock

India’s stock market participation has witnessed a remarkable transformation over the past decade, largely driven by the rising number of Demat accounts. A Demat (Dematerialized) account allows investors to hold securities electronically, simplifying the trading process for equities, bonds, and other financial instruments. This shift towards digital financial management has made stock market participation more accessible, encouraging millions to engage with India’s thriving capital markets.

Growth Trends: A Closer Look at the Numbers

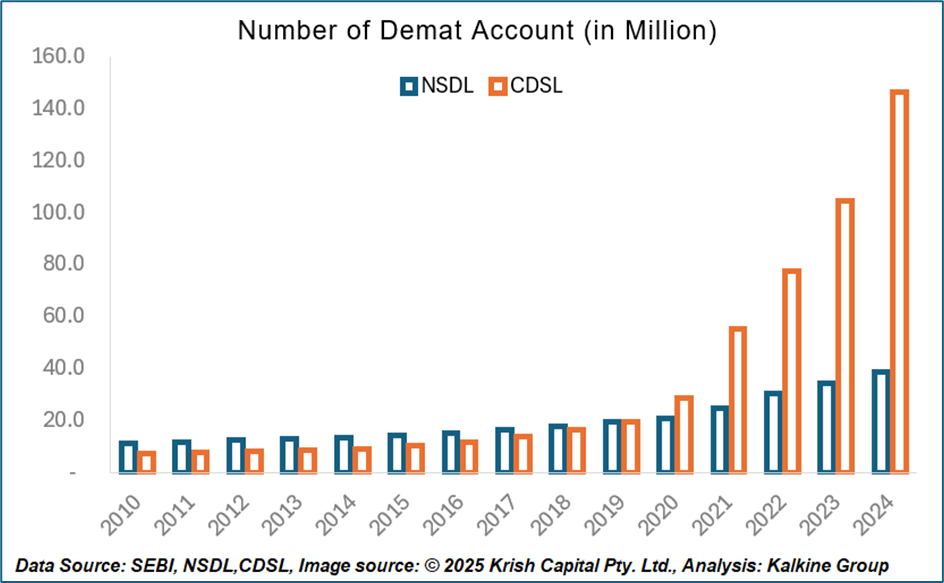

Between 2010 and 2024, India witnessed significant growth in the number of Demat accounts, reaching 185.3 million accounts by 2024, which represents a 33% increase compared to the previous year. This remarkable rise is not only due to increased stock market participation but also the convenience and simplicity that Demat accounts offer for managing and trading various financial assets.

Both NSDL and CDSL have shown impressive growth. As of December 2024, NSDL recorded 38.8 million accounts, reflecting a 12.1% year-on-year increase, while CDSL reached 146.5 million accounts, experiencing a significant 39.9% growth. Though CDSL leads in terms of account numbers, the strong performance of NSDL indicates a healthy level of diversification in India's financial market.

The years 2020 and 2021 marked a turning point for Demat account growth, largely due to the acceleration of digital adoption during the COVID-19 pandemic. In 2020, the total number of Demat accounts surged by 26.7%, with CDSL experiencing an impressive 46.7% rise. This trend continued into 2021, with the total number of accounts increasing by 61.6%, driven by retail investors attracted to the market amid lower interest rates and growing awareness of investment opportunities.

While the year-on-year growth rates have varied, recent years have seen strong, sustained increases, especially for CDSL. NSDL’s growth has been more stable, while CDSL has experienced higher, though sometimes more volatile, growth. For example, in 2023, CDSL grew by 34.4%, whereas NSDL’s growth was 13.8%. This variation can be attributed to factors such as investor preferences, platform convenience, and increasing financial literacy among the population.

In December 2024, the growth in new Demat account openings slowed, with 9.77 million accounts opened, compared to 13.25 million in the previous quarter (September 2024). However, despite this decline in the short term, the overall trend for Demat account growth remains positive. Over the years, the number of Demat accounts in India has consistently risen, reflecting the expanding participation in the market. Quarterly fluctuations, driven by factors such as market sentiment, volatility, and regulatory changes, are normal. Nonetheless, the general upward trend signifies a steady increase in investor engagement with India’s capital markets. This long-term growth highlights the growing adoption of digital financial tools and supports the broader movement towards greater financial inclusion across the country.

Factors Driving the Growth of Demat Accounts

Challenges and Opportunities Ahead

Conclusion

The growth of Demat accounts in India reflects a shift towards digital financial participation, with a positive long-term trend despite short-term fluctuations. Driven by market activity, digital adoption, and supportive policies, the future looks promising. Addressing challenges like financial literacy and cybersecurity, along with expanding connectivity, will continue to foster financial inclusion and empower more investors in India's capital markets.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.