India Defence Sector and Stocks Boom - From Tactical Spark to Structural Tailwind

Source: shutterstock

India’s defence sector is experiencing a sharp and sustained rally a shift driven by strategic imperatives, rising geopolitical tensions, and a significant policy push under the Atmanirbhar Bharat framework. What began as a tactical trade has evolved into a long-term structural opportunity.

Post-Operation Sindoor: Sector in Spotlight: The recent India-Pakistan military exchange, dubbed Operation Sindoor, acted as a turning point. While the probability of a full-scale war remains low, 2025 has witnessed an uptick in cross-border violations along the Line of Control (LoC). In response, the Indian Armed Forces have deployed calibrated military operations while simultaneously ramping up procurement of high-tech surveillance, border defence systems, and offensive capabilities.

External Triggers: Middle East Instability & Strategic Exposure: Rising instability in the Middle East has emerged as a major tailwind for Indian defence stocks. With India heavily reliant on the region for oil imports and home to millions of its citizens, the escalating Israel–Iran tensions and Red Sea disruptions have sharpened the focus on national security. This has prompted renewed urgency in strengthening naval and missile defence systems, maritime surveillance, and strategic mobility. As a result, companies involved in indigenous defence manufacturing, shipbuilding, and advanced weapon systems have seen a surge in orders and investor interest turning geopolitical risk into a structural growth catalyst for the sector.

Budget Support: Defence Takes Centre Stage: In the Union Budget for FY2025, the Indian government allocated ₹6.81 lakh crore to the Ministry of Defence a record high, representing 13.45% of the entire Union Budget. This is the single-largest allocation to any ministry, underscoring national security’s growing importance in India’s economic and geopolitical strategy.

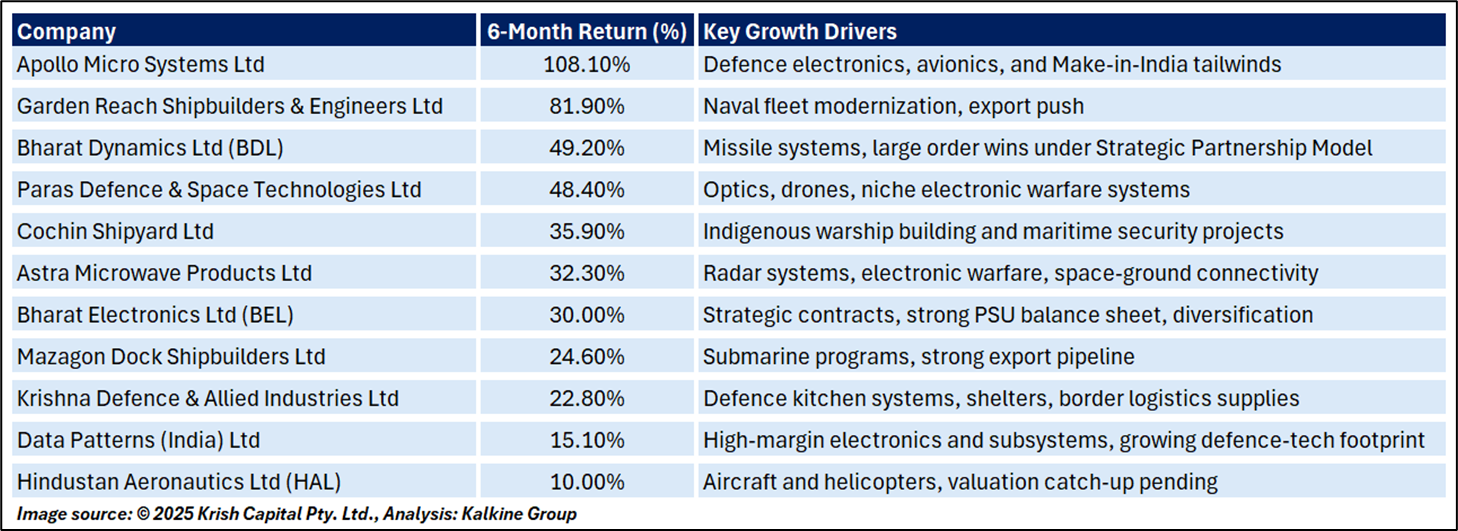

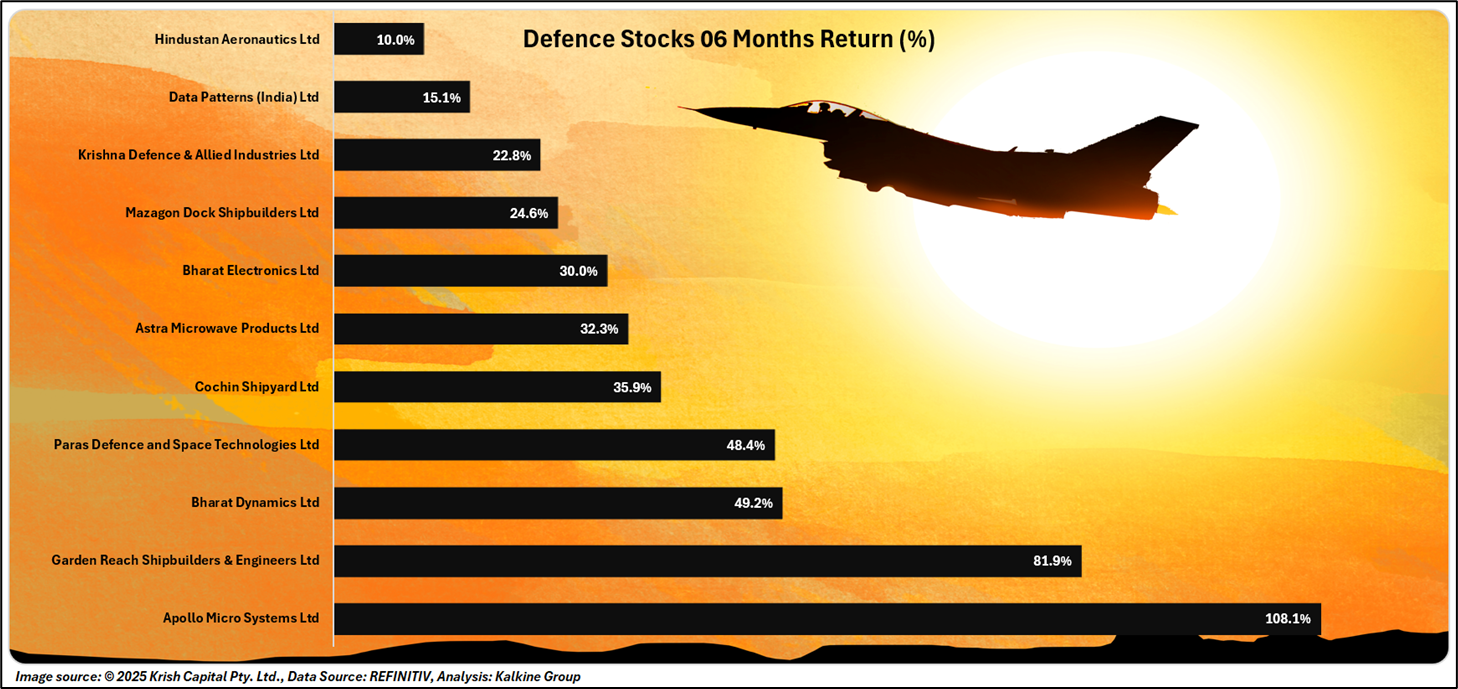

The Defence Rally and Key Stock Movers: India’s defence stocks have delivered stellar returns over the last six months, fuelled by geopolitical urgency, government-backed indigenisation, and accelerating order flows. As the sector moves from narrative to numbers, investor appetite has surged — and for good reason.

Investors looking to participate in India’s growing defence sector can do so through a range of targeted ETFs and mutual funds that offer diversified exposure to leading defence companies. Some of the prominent options include the Motilal Oswal Nifty India Defence ETF, Motilal Oswal Nifty India Defence Index Fund – Direct Growth, Aditya Birla Sun Life Nifty India Defence Index Fund – Direct Growth, and the Groww Nifty India Defence ETF FoF – Direct Growth. These funds track the Nifty India Defence Index, which includes key players such as HAL, BEL, BDL, and Mazagon Dock. By investing through these instruments, investors can gain cost-effective and professionally managed access to a sector benefitting from strong government support, rising exports, and long-term strategic relevance.

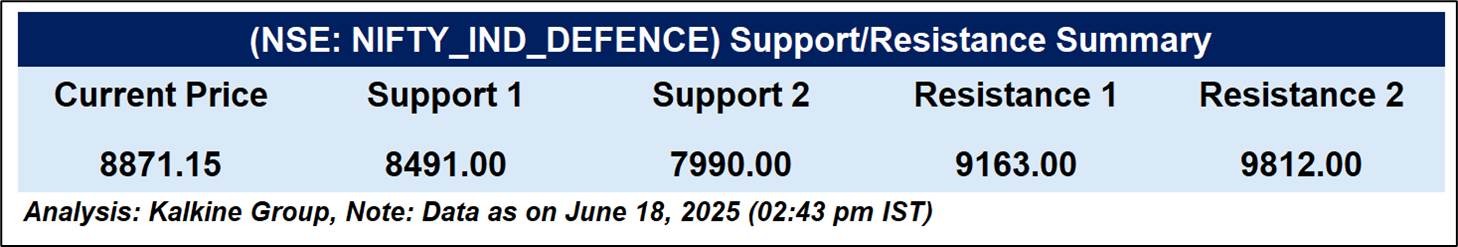

Technical Summary:

The Nifty India Defence Index remains in a strong uptrend, currently trading at ₹8,871.15 well above its 51-day EMA of ₹7,903.63, signaling sustained bullish momentum. While RSI at 64.5 suggests the rally is cooling off slightly, the overall structure remains positive. Key support lies at ₹8,491, with resistance at ₹9,163. Investors can consider buy-on-dips near support, as the sector continues to benefit from robust fundamentals and policy tailwinds.

Conclusion: India’s defence sector has moved beyond short-term triggers to become a structurally promising investment theme, backed by strong policy support, rising geopolitical relevance, and a surge in indigenous capabilities. With robust stock performance, dedicated index funds, and favourable technical momentum, the sector offers a compelling opportunity for long-term investors seeking both growth and strategic exposure. As global tensions persist and national security becomes an economic priority, defence may remain a resilient and rewarding bet.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.