Sanathan Textiles' 32% Listing Day Gain - Analyzing the Stock’s Long-Term Outlook

Source: shutterstock

Sanathan Textiles is a prominent Indian company with a significant presence in the polyester, cotton, and technical textile sectors. The company operates across all three yarn verticals within a unified corporate structure, positioning it for strategic growth and expansion into various market segments. This diversification enables Sanathan Textiles to cater to a wide range of industries and meet the needs of a broad customer base.

As of June 30, 2024, Sanathan Textiles offers over 2,800 active yarn product varieties and more than 30,000 SKUs, with the capacity to produce an extensive range of over 14,000 yarn varieties and 190,000 SKUs. This product diversity supports its reach across numerous applications in various industries.

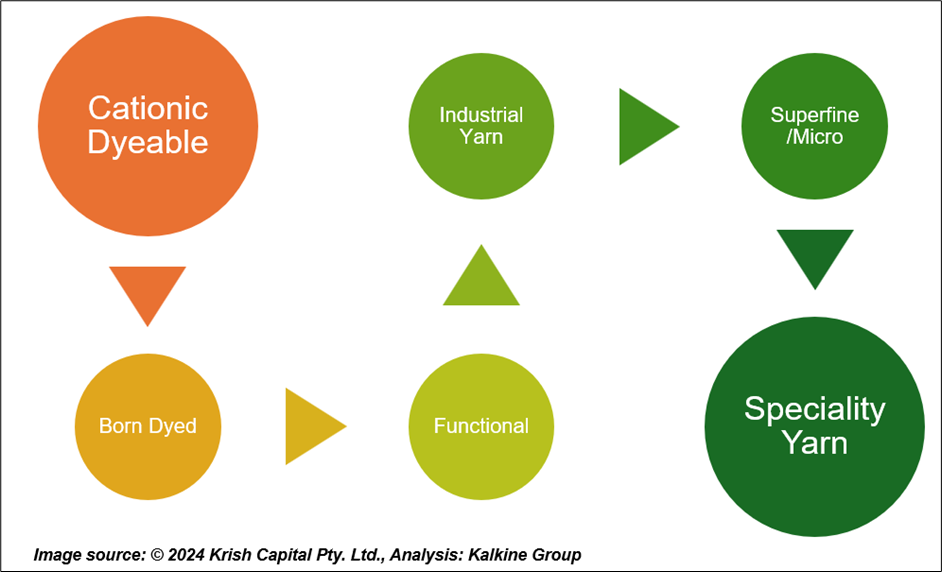

The company places a strong emphasis on value-added products, including dope dyed, superfine/micro, functional, industrial, and technical yarns, along with cationic dyeable and specialty yarns. These products are developed through comprehensive in-house research and development, reinforcing Sanathan Textiles’ commitment to quality and innovation.

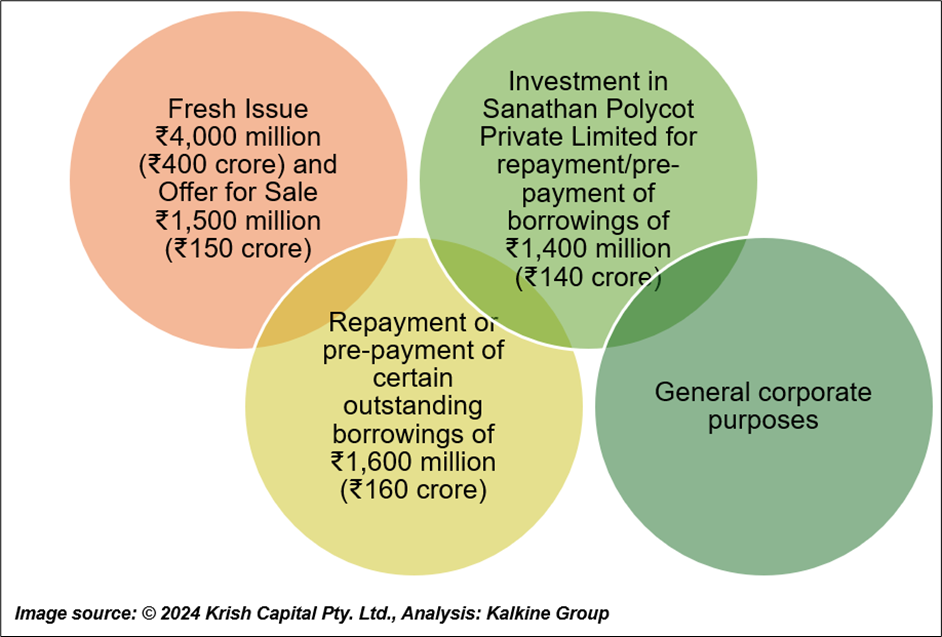

Looking ahead, Sanathan Textiles plans to use the funds raised through its IPO to fuel its growth. The company intends to expand its operations, reduce existing debt, and invest in its subsidiary to further strengthen its position in the textile industry, paving the way for long-term business development.

Sanathan Textiles IPO: Strong Debut with 32% Premium on Listing Day

Sanathan Textiles' IPO, which opened on December 19th and closed on December 23rd, made its highly anticipated debut on the stock exchanges on December 27th, 2024. The price band for the IPO was set between ₹305 and ₹321 per share, with a minimum lot size of 46 shares. The offering saw an overwhelming response, with the overall IPO being subscribed 35.12 times. Retail investors subscribed 8.93 times, while Qualified Institutional Buyers (QIBs) oversubscribed by 75.62 times, and Non-Institutional Investors (NIIs) subscribed approximately 42.21 times.

On listing day, Sanathan Textiles shares opened at ₹422.30 on the NSE, reflecting a 32% premium over the issue price. However, the stock closed the day at ₹388.35, indicating a slight pullback from the opening gains.

Breakdown of Sanathan Textiles ₹5,500 Million IPO Proceeds

Focus on Innovation: Advancing Product Development and Diversification

Company Financials

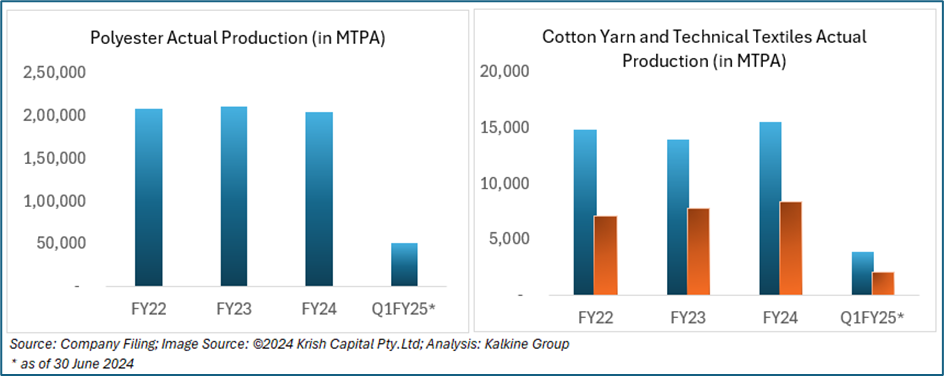

The company’s production data shows stability and growth across Polyester, Cotton Yarn, and Technical Textiles. Polyester, the largest contributor, rose from 2,08,316 MTPA in FY22 to 2,11,611 MTPA in FY23 but dipped to 2,04,447 MTPA in FY24, with Q1 FY25 at 51,057 MTPA. Cotton Yarn declined from 14,907 MTPA in FY22 to 13,959 MTPA in FY23 but rebounded to 15,564 MTPA in FY24, with Q1 FY25 at 3,892 MTPA. Technical Textiles grew steadily from 7,171 MTPA in FY22 to 8,460 MTPA in FY24, reaching 2,112 MTPA in Q1 FY25. Overall, the company maintains a strong performance, with scope for improvement in Polyester output.

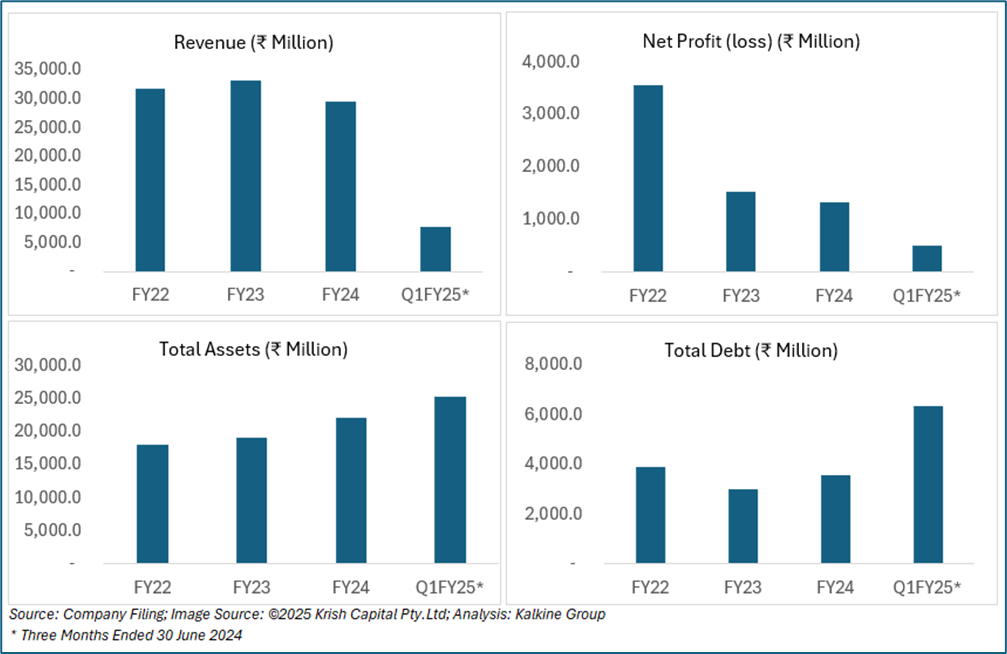

The company’s financial performance reflects mixed trends over recent years. Revenue grew from ₹31,853.2 million in FY22 to ₹33,292.1 million in FY23 but declined to ₹29,575.0 million in FY24, with Q1 FY25 revenue at ₹7,811.3 million. Net profit dropped sharply from ₹3,554.4 million in FY22 to ₹1,527.4 million in FY23 and ₹1,338.5 million in FY24, while Q1 FY25 profit stood at ₹500.7 million. Earnings per share followed a similar trend, falling from ₹49.40 in FY22 to ₹18.60 in FY24. Total assets grew steadily, rising from ₹17,964.7 million in FY22 to ₹25,295.3 million in Q1 FY25, driven by an increase in total liabilities, which rose from ₹8,098.3 million in FY22 to ₹12,046.4 million in Q1 FY25. Notably, total debt nearly doubled in Q1 FY25 to ₹6,346.7 million. Cash reserves, however, declined significantly from ₹181.9 million in FY22 to ₹79.3 million in Q1 FY25, highlighting potential liquidity challenges.

Hold or Sell Sanathan Textiles Stock?

The company’s strong IPO debut with a 32% premium and its diversified portfolio indicates long-term potential. However, declining profits, rising debt, and low cash reserves present short-term risks. Its robust product range and market presence support growth prospects, making it a hold for long-term investors.

Conclusion

Sanathan Textiles demonstrates strong long-term potential due to its diverse portfolio, strategic IPO debut, and focus on innovation with value-added products. While the company shows promise with a broad market presence and solid growth in certain product segments, short-term risks such as declining profits, rising debt, and diminishing cash reserves cannot be ignored. For long-term investors who believe in the company's expansion plans and market positioning, holding the stock could be a viable option. However, those with a focus on short-term gains may want to monitor the company's financial health closely before making any decisions.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.