India’s IPO Boom - 2024 Sees Record-Breaking Activity with ₹1.48 Lakh Crore Raised

Source: Shutterstock

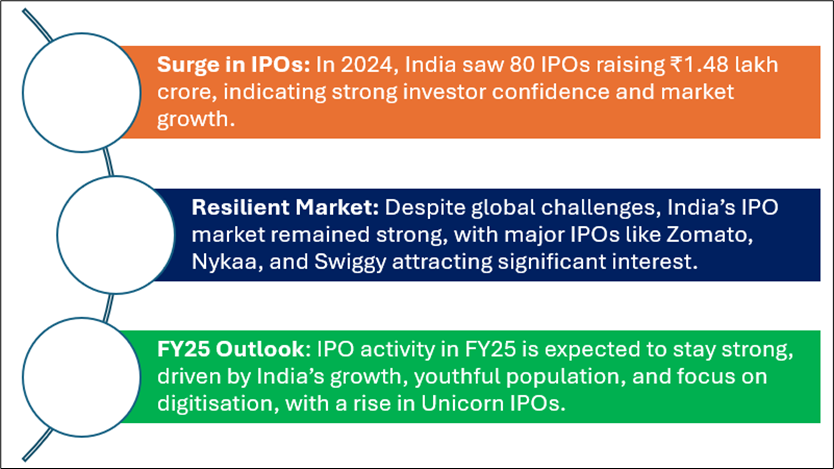

Key Highlights

Image source: © 2024 Krish Capital Pty. Ltd., Analysis: Kalkine Group.

India, a rapidly growing economy and a leading market in the emerging world, has seen strong investor interest in its stock market and financial instruments, especially after the Covid-19 pandemic. Both the economy and stock markets have experienced remarkable growth in recent years.

IPO Historical Performance (from 2021 to 2024)

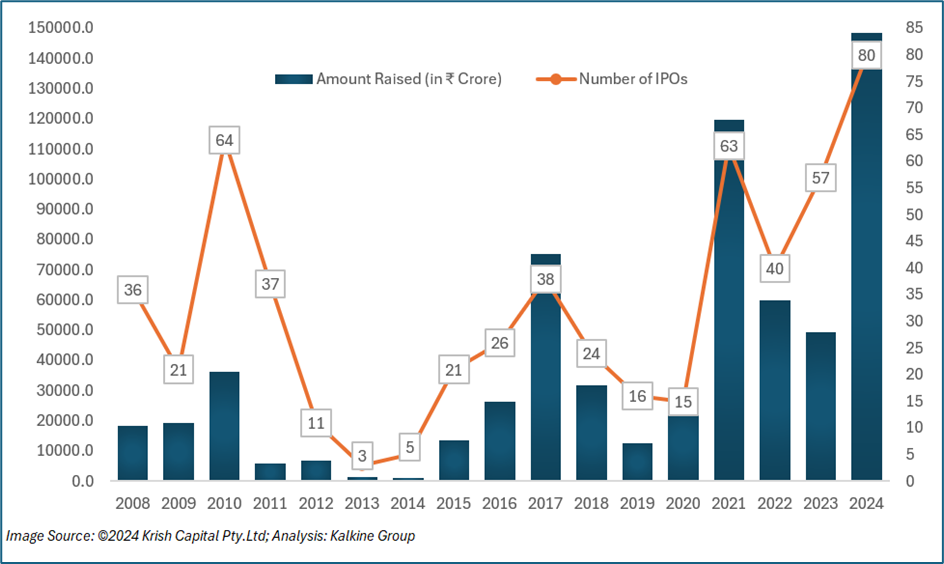

2021 - In 2021, India witnessed 63 IPOs, raising approximately ₹1.20 lakh crore, marking a historic year in terms of both the number of IPOs and funds raised. This surge was driven by strong market conditions and heightened investor interest. Prominent IPOs like Zomato, Nykaa, and Policybazaar garnered significant attention and delivered impressive returns.

2022 - In 2022, despite a more challenging environment, 40 IPOs raised around ₹59,939 crore. Although the number of IPOs was lower than in 2021, the market remained relatively resilient despite global uncertainties such as inflation, interest rate hikes, and geopolitical tensions. Major IPOs such as LIC, Delhivery, and Adani Wilmar were among the largest offerings of the year.

2023 - In 2023, the IPO market continued to recover, with 57 IPOs raising approximately ₹49,437 crore. Despite global market volatility, investor sentiment remained positive, particularly in sectors like technology, consumer goods, and financial services. Notable IPOs like Tata Technologies, JSW Infra, and India Shelter Finance Corporation Limited stood out, attracting strong investor interest.

2024 - In 2024, the IPO market experienced a significant surge, with 80 IPOs raising ₹1,48,471 crore, marking a notable increase in both the number of listings and funds raised. This strong performance reflects investor confidence and a positive market outlook, as the IPO market continues to demonstrate robust growth despite ongoing global challenges. Noteworthy IPOs like NTPC Green Energy, Niva Bupa Health Insurance, and Swiggy were successfully listed, and upcoming IPOs such as Vishal Mega Mart (₹8,000 crore) and MobiKwik (₹572 crore) are going to get listed in December 2024.

The impressive number of IPOs in 2024 indicates a strengthened market and growing investor interest. This year also saw a record number of filings, with 143 Red Herring Prospectuses (DRHPs) submitted to SEBI, further highlighting the IPO market’s vibrant activity.

2025 Outlook

In 2025, IPO activity in India is expected to remain strong, as the country continues to attract investors looking for long-term growth. This trend is likely to persist throughout the year. The growth in IPOs is driven by companies aiming to capitalize on India's robust economic expansion, youthful demographic, and the government’s focus on advancing digitisation. A thriving IPO market reflects the potential of innovative businesses, providing investors with profitable exit options and fostering more risk-taking, which in turn supports the growth of India's startup ecosystem. The Indian startup sector is seeing a much-needed revival, marked by a rise in Unicorn IPOs. This resurgence is expected to broaden the market, offering better price discovery and value for new-age businesses.

Conclusion

India's IPO market has seen impressive growth, fueled by strong investor confidence and a thriving startup ecosystem. With record IPO activity in 2024 and continued optimism for 2025, the market reflects India's long-term growth potential. The rise in IPO activity, particularly from unicorns and innovative businesses, highlights the growing market and its ability to offer profitable opportunities for investors. As the country continues to focus on digitization and economic development, the IPO market is set to play a crucial role in shaping India's financial future.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.