Maximize Your Portfolio: India’s Leading Mutual Funds to Watch

Source: shutterstock

The mutual fund market in India offers a wide variety of investment options across Large Cap, Multi Cap, Small Cap, and Large & Mid Cap categories. Whether you're focused on capital preservation, long-term growth, or aggressive wealth creation, this month’s top-performing funds based on 5-year returns offer valuable guidance for investors at all stages.

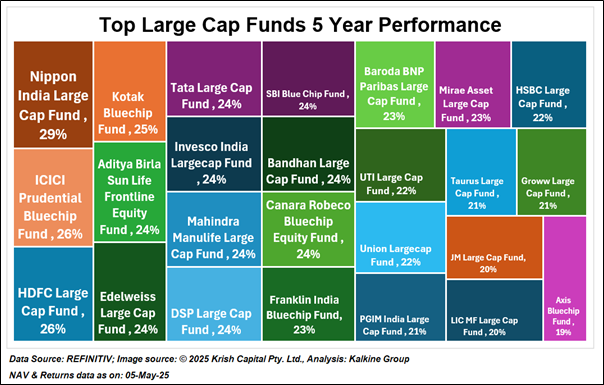

Large Cap Funds: Stability with Steady Returns

Large Cap funds are ideal for investors prioritizing stability while aiming for moderate growth. As of May 2025, the leading performers in this category are:

- ICICI Prudential Blue-chip Fund and HDFC Large Cap Fund both deliver an impressive 26% return over five years, reflecting their consistent and effective large-cap investment strategies.

- Nippon India Large Cap Fund closely follows with a 25% return, offering strong diversification across top-tier companies.

- Axis Blue-chip Fund, with a 19% return, trails behind. While lower in performance, it may suit conservative investors who value safety and reduced volatility.

Overall, the range of returns (19% to 26%) shows that fund manager expertise and stock selection significantly influence performance in this otherwise stable segment.

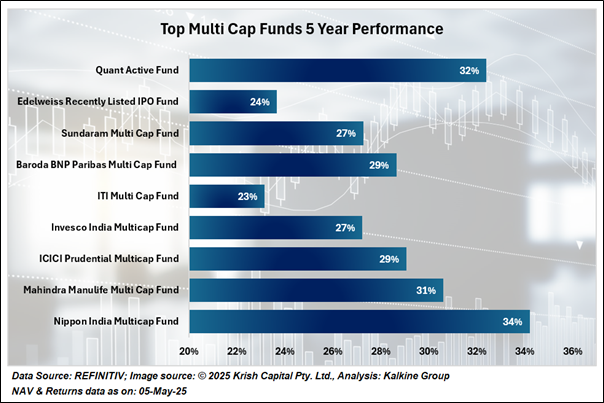

Multi Cap Funds: Diversified Growth Opportunities

Multi Cap funds allocate assets across large, mid, and small-cap companies, creating a balanced portfolio structure.

- Nippon India Multi Cap Fund leads with a stellar 34% 5-year return, signaling effective allocation and market timing across segments.

- Quant Active Fund follows with 32%, supported by a strong track record in active stock-picking.

- Invesco India Multicap Fund and ITI Multi Cap Fund report 27% and 23%, respectively offering decent, though relatively moderate, returns within the category.

For investors seeking a diversified approach with long-term growth potential, this category continues to show strong promise.

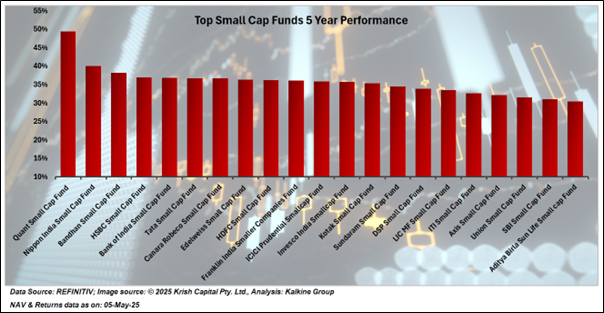

Small Cap Funds: High Risk, High Reward

Small Cap funds cater to aggressive investors aiming for maximum growth, often at the cost of higher volatility.

- Quant Small Cap Fund stands out with an exceptional 49% return over five years, underscoring the strength of its high-growth stock selection.

- Nippon India Small Cap Fund posts a solid 40% return, maintaining its position as a reliable choice in the category.

- Aditya Birla Sun Life Small Cap Fund delivers a 30% return, reflecting a more cautious but still rewarding approach.

The significant spread in returns (30% to 49%) highlights the importance of selecting proven funds when navigating the volatile small-cap space.

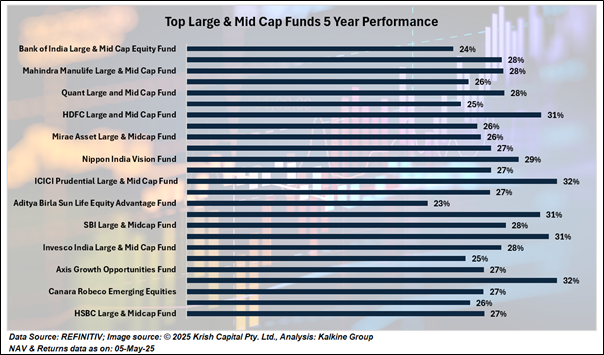

Large & Mid Cap Funds: Balancing Growth and Stability

These funds combine the steady nature of large caps with the growth potential of mid-caps, offering a balanced investment experience.

- Motilal Oswal, ICICI Prudential, and HDFC Large & Mid Cap Funds each deliver a strong 32% 5-year return, making them standout picks for moderate-risk investors.

- SBI Large & Midcap Fund and Bandhan Core Equity Fund closely follow with 31% returns, also offering compelling growth prospects.

- Aditya Birla Sun Life Equity Fund, with a 23% return, may appeal to more conservative investors looking for a slower but steady growth path.

The performance range (23% to 32%) reflects the careful balance this category strikes between safety and opportunity.

Conclusion

The Indian mutual fund landscape offers a wide range of options catering to different risk appetites and investment goals. Large Cap funds provide stability with moderate growth, while Small Cap funds offer high returns at higher risk. Multi Cap and Large & Mid Cap funds strike a balance between growth and stability, appealing to investors seeking diversification. With top performers delivering impressive returns across categories, investors must carefully align their choices with their risk tolerance and long-term objectives. Regardless of the category, strategic selection and a long-term perspective remain key to maximizing returns in today’s evolving market.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.