BTC Hits $76.5K, ETH $2.3K: Crypto Stabilizes After Volatile Week

Source: shutterstock

Highlights

- The global cryptocurrency market cap stood at $2.66 trillion, showing a 2.4% change in 24 hours.

- Bitcoin and Ether posted daily gains despite remaining lower on weekly and year-to-date metrics.

- Digital assets advanced even as US equity indices closed in negative territory.

Cryptocurrencies showed stabilization signs on Wednesday, with modest gains fuelled by improving global risk sentiment and selective buying. Traders stayed cautious on near-term direction amid recent drops and mixed equity market moves.

Global Crypto Market Overview

According to data from CoinGecko at the time of writing on 4 February, the global cryptocurrency market capitalisation stood at $2.66 trillion, marking a 2.4% change over the past 24 hours. Market activity remained mixed, with leading tokens attempting to recover some recent losses after sharp drawdowns earlier in the month.

Bitcoin and Ether Attempt a Recovery

Bitcoin was trading at $76,430.76, up $739.74 or 0.98% as of 8:18 am UTC on 4 February. Despite the daily gain, the largest cryptocurrency remained down 9.14% over the past five days, 12.56% year-to-date, and 16.35% over the past month, highlighting the extent of recent volatility.

Technical Chart for BTC

Ether, the second-largest cryptocurrency by market value, rose 1.79% to $2,270.45 by 8:34 am UTC. However, Ether continued to trade well below recent levels, showing a 15.99% decline over five days and a 23.48% drop year-to-date.

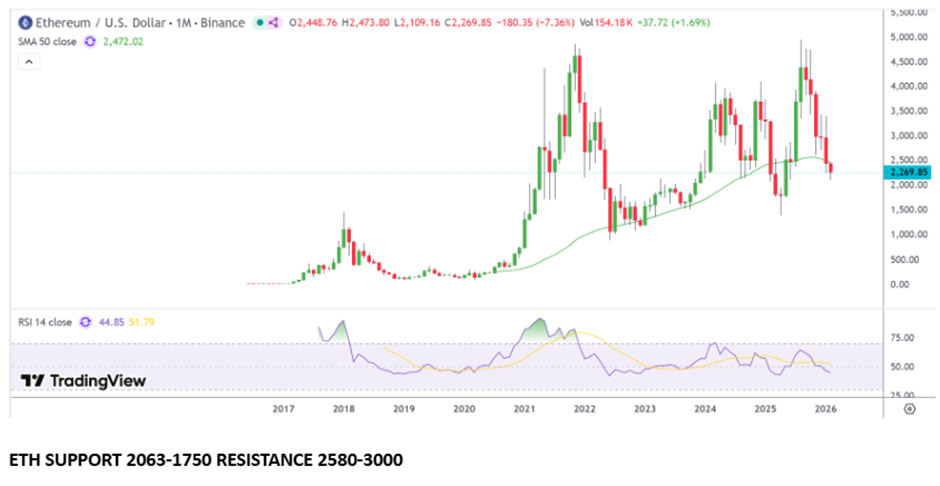

Technical Chart for ETC

Altcoins Trade Mixed

Among major altcoins, XRP was trading at $1.60, up 1.81% during the session, while Binance Coin (BNB) gained 0.85% to $760.41.

Divergence From US Equity Markets

Cryptocurrencies advanced even as US equities ended lower on 3 February. The S&P 500 declined 0.84% to 6,917.81, while the Nasdaq Composite dropped 1.43% to 23,255.19. The Dow Jones Industrial Average also closed lower, slipping 0.34% to 49,240.99.

The pullback in equities was led by technology stocks, with market participants reacting to concerns that rapid advances in artificial intelligence could disrupt traditional software-as-a-service revenue models.

Crypto markets steadied midweek as leading tokens attempted a rebound following recent volatility. While Bitcoin, Ether, and select altcoins recorded gains, broader participation remained measured amid ongoing uncertainty across global financial markets. The divergence between digital assets and US equities continues to be closely monitored as investors assess near-term market direction.

FAQ Section

Q1. Why did crypto prices stabilise on Wednesday?

Crypto prices stabilised amid a tentative improvement in risk sentiment after sharp declines earlier in the week.

Q2. How did Bitcoin and Ether perform?

Bitcoin rose to $76,430.76 and Ether climbed to $2,270.45, although both remained lower over longer timeframes.

Q3. How did US stock markets perform during this period?

US equity indices ended lower, with declines in the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.