10% Fall, now a Standstill — What’s Next for Hindustan Unilever?

Source: Shutterstock

Financial Highlights – Hindustan Unilever (NSE: HINDUNILVR)

- Steady annual growth: Consolidated revenue for FY25 rose to Rs 63,121 crore from Rs 61,896 crore a year earlier, reflecting consistent top-line expansion.

• Profitability intact: Net profit for FY25 increased to Rs 10,679 crore, up from Rs 10,286 crore year-on-year.

• Stable quarterly performance: For the quarter ended September 2025, consolidated revenue stood at Rs 16,241 crore.

• Earnings resilience: Net profit for the same quarter came in at Rs 2,697 crore, highlighting stable margins and operational consistency.

Hindustan Unilever (NSE: HINDUNILVR)

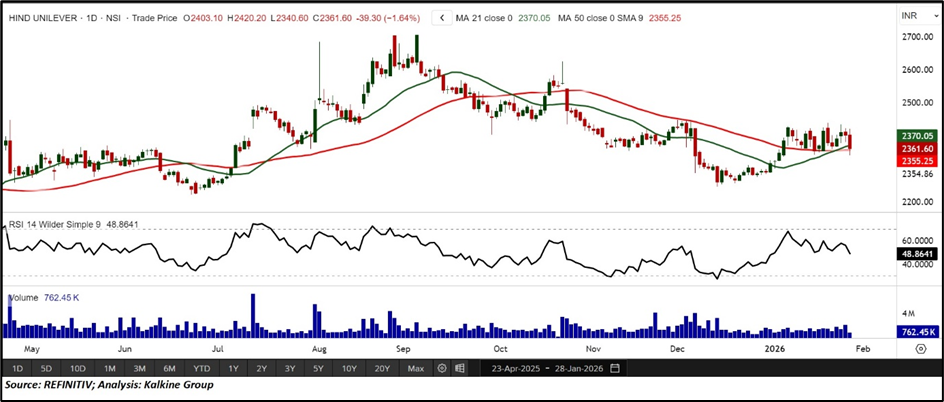

On 28 January 2026, shares of Hindustan Unilever were trading lower at Rs 2,361.60, down 1.64% during the afternoon session on the NSE, with about 1.33 million shares exchanged. The stock remains over 10% below recent highs, as market attention shifts toward the next quarterly results scheduled for 12 February 2026.

Technical View: HINDUNILVR Bottoming Out as Price Holds Above 50-SMA

From a technical perspective, Hindustan Unilever is showing early signs of base formation near its 50-day moving average on the daily chart, suggesting the broader structure remains supported and a technical rebound is possible. Following the sharp decline, price action now reflects a stabilisation phase rather than an immediate extension lower. The 14-day RSI at 48.86 sits in neutral territory, indicating momentum could gradually improve. Support is seen near INR 2,250.00 and INR 2,100.00, while resistance is placed around INR 2,550.00 and INR 2,750.00.

Bottom Line:

Hindustan Unilever appears to be entering a stabilisation phase after a double-digit correction, with prices holding above the 50-day average and momentum indicators neutralising. While near-term consolidation may persist, the broader structure remains supported, leaving scope for a gradual recovery as markets look ahead to the upcoming quarterly results.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.