6 Indian Stocks Defying Market Noise, Holding Strong Above 200-DMA

Source: shutterstock

On December 19, 2025, 6 NSE-listed stocks with a market capitalization above ₹1,000 crore rose more than 3% and were trading above their 200-periods simple moving average (SMA). The 200 SMA is the average of a stock’s closing prices over the last 200 trading days. Traders use it to gauge the overall trend of a stock. When a stock remains above its 200-day SMA, it generally indicates a long-term upward movement.

Technical Analysis:

AEROFLEX is currently priced at ₹196.90 and is holding above its 200-periods simple moving average(SMA). If the price moves down, it may find support near ₹175, with the next level around ₹162. On the upside, the stock may face resistance around ₹216, followed by ₹230. These levels give a basic view of where the price could move in the near term.

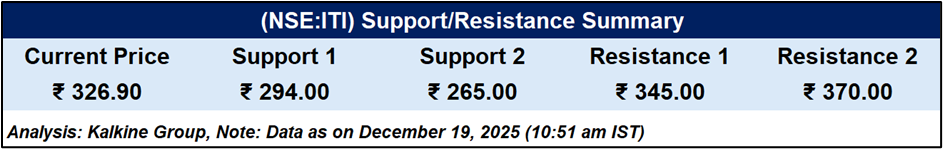

ITI is trading at ₹326.90 and is above its 200 periods simple moving average(SMA). This shows the stock is holding above a key long-term reference level. Immediate support is seen around ₹294, with another support near ₹265. On the higher side, ₹345 is the first resistance level, followed by ₹370. These support and resistance levels help outline the stock’s short-term price range in a simple and clear way.

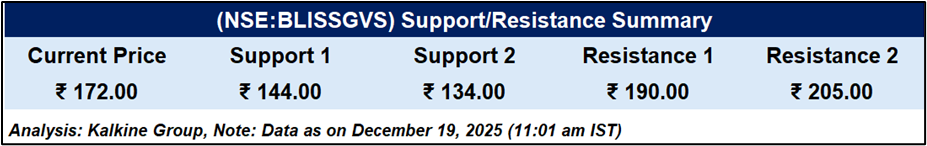

BLISSGVS is currently trading at ₹172.00, above its 200-periods simple moving average (SMA). The stock shows support levels at ₹144 and ₹134, where price could find stability if it moves lower. On the upside, resistance levels are at ₹190 and ₹205, Keeping an eye on these levels provides a clear view of the stock’s potential price movements in the near term.

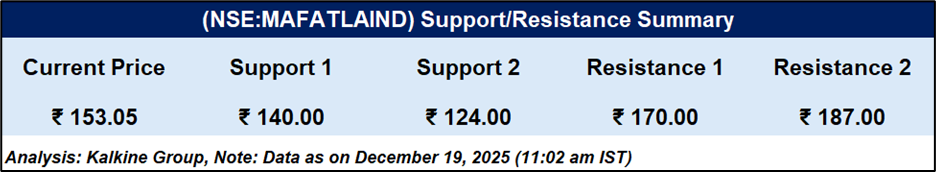

MAFATLAIND is trading at ₹153.05 and is positioned above its 200 periods simple moving average (SMA) Key support levels are seen at ₹140 and ₹124, where the price has shown buying interest in the past. On the higher side, resistance levels are identified at ₹170 and ₹187. These support and resistance levels outline the stock’s likely trading range in the near term.

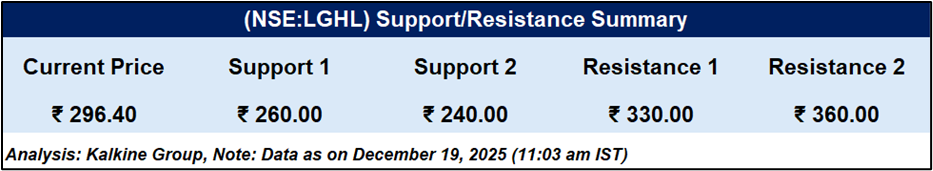

LGHL is trading at ₹296.40 and remains above its 200 periods simple moving average(SMA), reflecting a steady long-term trend. The stock shows nearby support around ₹260 and ₹240, which mark important reference levels. On the higher side, ₹330 and ₹360 stand out as key price points to watch.

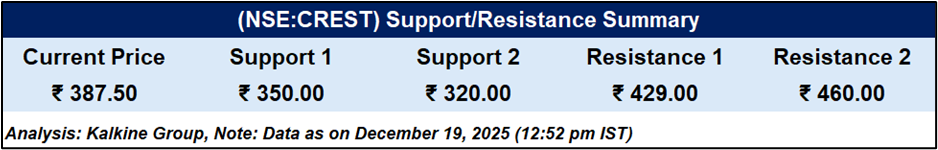

CREST Ventures is trading at ₹387.50 and remains above its 200-periods simple moving average (SMA), indicating a stable long-term price structure. The 200 SMA continues to act as an important reference point for assessing the broader trend. Immediate support levels are seen around ₹350 and ₹320. On the higher side, resistance levels are placed near ₹429 and ₹460. Price action is likely to show activity around these levels.

Conclusion:

Overall, these six NSE stocks trading above their 200-periods simple moving average(SMA) and posting gains of over 3% indicate a positive market tone for the session. Staying above the 200 SMA average suggests that the broader trend remains supportive, while the presence of clearly defined support and resistance levels points to controlled price movement rather than sharp volatility. In the near term, market participants may continue to track these levels for cues on whether the momentum sustains or consolidates.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.