Adani’s New Copper Smelter Stalls as Global Supply Crunch Hits Hard

Source: shutterstock

Gautam Adani’s $1.2B copper smelter in Gujarat, operated by Kutch Copper Ltd., has struggled to source sufficient raw material since commencing operations in June. According to customs data cited by Bloomberg, the plant has imported approximately 147,000 tons of copper concentrate in the ten months to October, significantly below the 1.6M tons needed annually to run at full capacity. In comparison, rival Hindalco Industries Ltd. imported over 1M tons during the same period.

Global Market Pressures

The shortfall comes amid a constrained global copper supply, triggered by operational disruptions at key mines managed by Freeport-McMoRan, Hudbay Minerals, Ivanhoe Mines, and Chile’s state-owned Codelco. At the same time, China’s rapid expansion of its smelting sector has compressed refining margins worldwide, leading some smelters to reduce output or temporarily halt operations.

Impact on Operations and Costs

The constrained feedstock supply has pushed treatment and refining charges to record lows, creating cost pressures for smelters. For Kutch Copper, which has plans to double capacity to 1M tons per year within four years, the slower ramp-up is increasing operational costs and delaying the timeline to reach profitability.

Supplier Details and Domestic Pressures

Customs data shows Kutch Copper received 4,700 tons from BHP Group, supplemented by shipments from Glencore and Hudbay. India’s limited domestic ore reserves, combined with rising demand from construction, power, and infrastructure sectors, is putting additional pressure on local metal producers to close the supply gap.

Financial Position

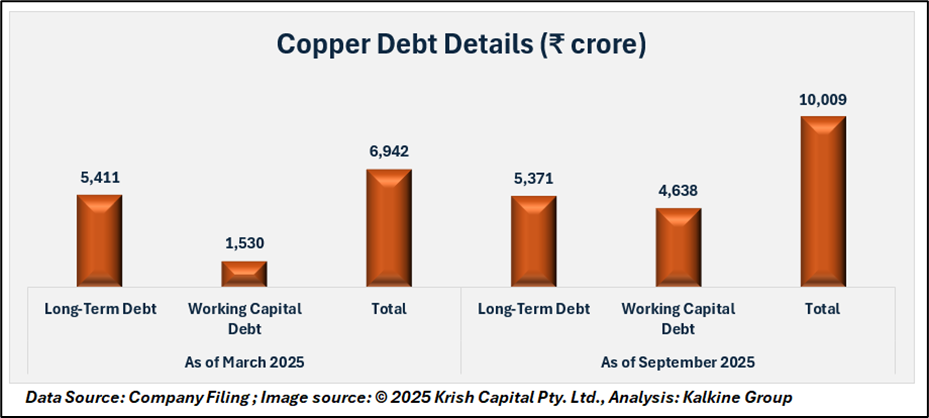

Kutch Copper’s debt position has grown over the past 18 months. As of Mar-24, the segment reported total debt of ₹ 3,578 crore, including ₹ 5,411 crore in long-term debt and ₹ 1,530 crore in working capital debt. By Mar-25, total debt increased to ₹ 6,942 crore, with long-term debt at ₹ 5,371 crore and working capital debt at ₹ 4,638 crore. As of Sep-25, total debt rose to ₹ 10,009 crore, reflecting the funding required to support operations and expansion plans.

Analyst Perspective

Bloomberg Intelligence analyst Grant Sporre noted that Adani’s smelter, being a new facility, could operate at a loss initially but is expected to be more efficient than some competitors over time. Sporre also highlighted that India may respond to supply constraints by adjusting tariffs to support domestic smelting operations.

Conclusion

Kutch Copper’s Gujarat smelter continues to face significant challenges in sourcing adequate raw material, operating well below capacity amid a tight global copper supply and low refining margins. The slow ramp-up, combined with rising debt, is delaying profitability, while domestic ore limitations and growing demand intensify pressure on the plant. How India and the global market respond to these supply constraints will play a key role in the smelter’s operational trajectory and financial performance.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.