Bajaj Auto Accelerates Growth with Strong Q3 Performance and Bold EV Expansion

Source: shutterstock

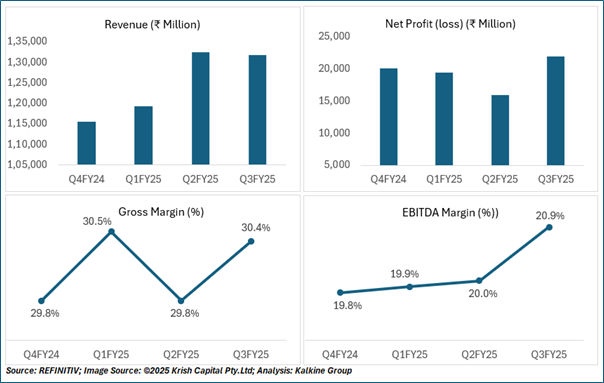

Bajaj Auto, one of India’s most renowned two-wheeler manufacturers, has posted impressive third-quarter earnings for FY25, with robust performance across its key business segments, particularly the rapidly expanding electric vehicle (EV) division. The company reported an 8% year-on-year increase in consolidated net profit, amounting to Rs 2,196 crore, while its consolidated revenue from operations also saw an 8% rise, reaching Rs 13,169 crore for the quarter.

A Strategic Shift Toward Electric Mobility

Bajaj Auto's Q3 earnings highlight impressive growth in its EV segment, now accounting for 45% of total revenue, up from 30% last year. The company’s electric two-wheeler business delivered 100,000 units, doubling its market share, while the electric three-wheeler segment saw its market share triple. Moving from a loss to a marginally positive EBITDA, this growth solidifies Bajaj Auto’s leadership in the electric mobility space, positioning it as a key player in both domestic and global EV markets.

Solid Performance Despite Domestic Challenges

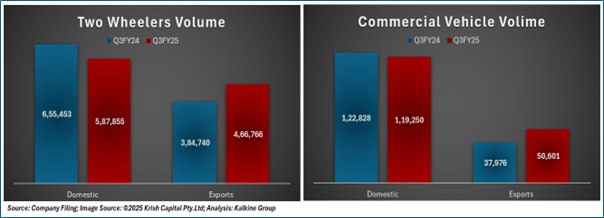

Despite facing challenges in the domestic market, Bajaj Auto reported a 2% year-on-year increase in overall volumes, reaching 12.24 lakh units for the quarter. A significant portion of this growth was fueled by the company’s export business, which continues to perform strongly. Notably, Bajaj Auto’s green energy portfolio, which now contributes 45% of its total revenue, played a pivotal role in stabilizing overall performance.

While domestic demand was somewhat subdued, the company’s focus on electric vehicles ensured that its green energy segment mitigated any potential downturn, allowing Bajaj Auto to maintain a balanced growth trajectory. This strategy has positioned the company to capitalize on the growing global demand for sustainable mobility solutions.

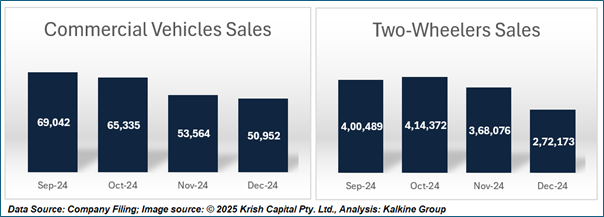

Between September and December 2024, both two-wheeler and commercial vehicle sales declined. Two-wheeler sales increased from 400,489 units in September to 414,372 units in October, likely due to the festival season in India. However, sales dropped significantly thereafter, reaching 272,173 units in December, a 26% decline from October. Commercial vehicle sales also followed a downward trend, from 69,042 units in September to 50,952 units in December, marking a 26% decrease. Despite the festival season boosting sales in October and November, the overall decline in December suggests other factors, such as market saturation or economic conditions, may have played a role.

Investor Confidence and Market Reaction

The solid Q3 performance and particularly the success of its EV division have been well-received by the market. Following the announcement of its earnings, Bajaj Auto’s stock surged nearly 5% in early trading on January 29, 2025. Investor sentiment has been overwhelmingly positive, with analysts highlighting the company’s clear strategy to strengthen its EV presence and expand its product portfolio in the coming years.

Technical Analysis

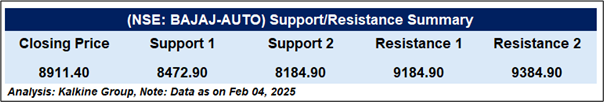

Bajaj Auto shows signs of a potential trend reversal after a downtrend since mid-October 2024. The stock has risen above the 21-day EMA at ₹8,692.24 and is testing the 50-day EMA at ₹8,947.83, indicating momentum shift. Immediate support is at ₹8,472.90 and ₹8,184.90, while resistance lies at ₹9,384.90 and a stronger barrier between ₹9,400-₹9,600. A breakout above ₹9,184 could push the stock higher, while failing to hold ₹8,472 may lead to lower support tests. The RSI at 59.50 signals strong bullish momentum, with a potential pullback if it exceeds 70. Rising volume suggests renewed buying interest, making upcoming resistance levels key for the stock’s next move.

With technical indicators supporting strong fundamentals, the stock maintains a bullish outlook.

E-Rickshaw Entry and Future Growth in Electric Mobility

Bajaj Auto is set to expand its electric mobility offerings by entering the e-rickshaw market by the end of Q4 FY25, targeting a market of 45,000 units per month. This move aligns with its strategy to tap into India’s growing demand for eco-friendly, low-cost transportation in urban and semi-urban areas. With its successful electric two-wheelers and three-wheelers, Bajaj Auto aims to strengthen its position in the evolving electric mobility space. The company’s strong Q3 FY25 results and focus on sustainable growth, innovation, and diversification ensure a promising future as it leads in both traditional and electric vehicle markets.

Conclusion

Bajaj Auto’s strong Q3 FY25 performance, driven by significant growth in its electric vehicle division, positions the company as a leader in the evolving electric mobility market. Despite challenges in the domestic market, the company’s focus on green energy and exports has helped maintain growth. With plans to enter the e-rickshaw segment and expand its electric offerings, Bajaj Auto is well-positioned for continued success in both traditional and electric vehicle markets, supported by strong investor confidence and positive market reactions.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.