Can Asian Paints Stock Stabilise After Slipping Into Oversold Territory?

Source: shutterstock

Asian Paints reported a resilient performance in Q3, and the nine months ended December 31, 2025, despite a shorter festive season and challenging market conditions, supported by steady volume growth across its decorative, B2B, and services businesses.

The company benefited from raw material deflation and sourcing efficiencies, which led to margin expansion even amid elevated competitive intensity. Continued investments in brand building, innovation, and technology-led services strengthened customer engagement and differentiation. Growth in international operations and improving profitability in the home décor business further supported overall momentum during the period.

Resilient Core Performance Despite Near-Term Challenges

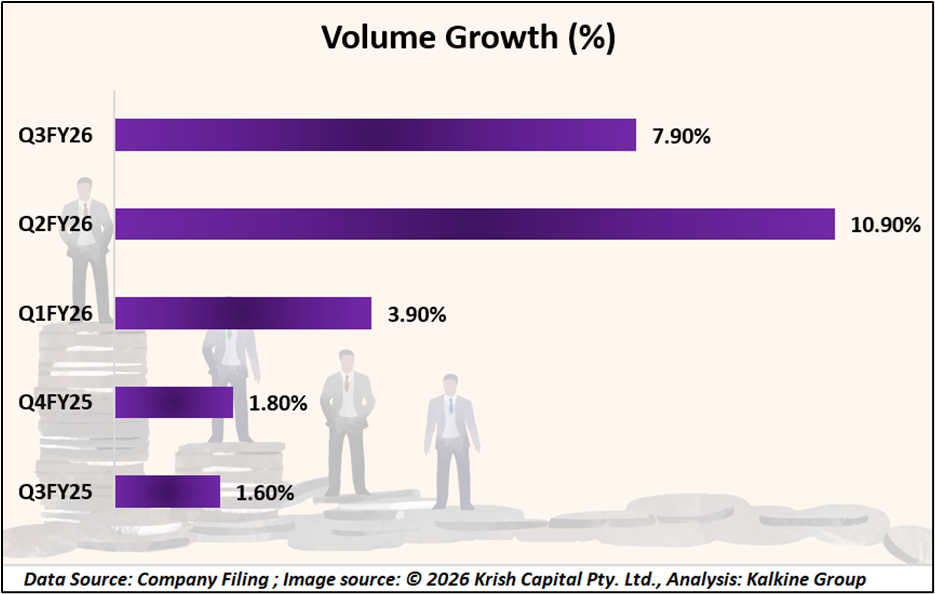

Asian Paints reported a resilient performance for Q3 and nine months ended December 31, 2025, despite a shorter festive season and prolonged monsoon impact in select regions. The India decorative business delivered high single-digit volume growth, with 9M FY26 volumes growing 7.9% compared to 1.6% in the previous year.

Rural markets marginally outperformed urban centres, while all product categories contributed to growth. Expansion in the PreLux portfolio supported improved realizations, alongside continued strengthening of the waterproofing category. Distribution expansion and steady traction in B2B projects, particularly in factories and government segments, further supported overall momentum.

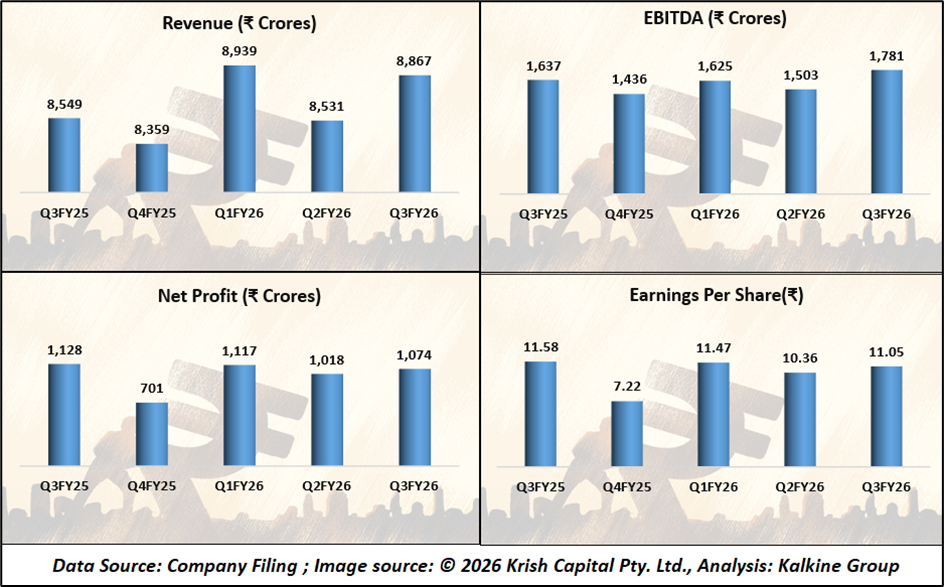

Margin Expansion and Improving Profitability

Services, B2B, and International Business Drive Momentum

Services and B2B initiatives continued to differentiate Asian Paints, with further scale-up of Beautiful Homes Painting Services supported by AI-led technology integration. The home décor business progressed toward profitability, with reduced losses in kitchens and PBT breakeven in the bath segment.

International business delivered 6.3% growth in INR terms, led by Sri Lanka, UAE, and Ethiopia, while PBT margin improved to 8.8%, up 140 basis points year-on-year, supported by material deflation and portfolio rationalisation. Looking ahead, the company remains focused on sustaining growth momentum amid competitive intensity and external uncertainties.

Broker Consensus Indicates Moderate Upside with Hold Stance

Analysts have a cautious but stable view on Asian Paints. The stock is rated HOLD with a target price of ₹2,725.25, showing about 8.3% upside. Strong brand value, large scale, steady demand recovery, and 11.3% long-term growth support its outlook.

Technical Summary

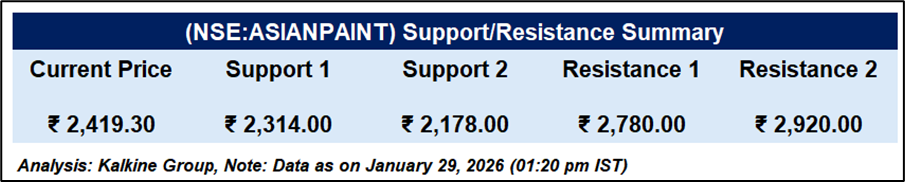

Asian Paints is showing early signs of testing a key support zone after falling about 3.68% in the latest session. On the daily chart, prices continue to trade above the 50-day moving average, which remains positioned below the current market price and offers immediate support.

However, momentum remains weak, with the 14-day RSI at 27.27, firmly in oversold territory, indicating selling pressure has been stretched but not yet stabilised. Support is seen near INR 2314.00 and INR 2178.00, while resistance is placed around INR 2780.00 and INR 2920.00, suggesting a cautious near-term setup as the stock attempts to find footing.

Conclusion

Asian Paints’ recent share price decline appears driven more by stretched valuations and short-term sentiment than by any fundamental weakness. Despite the sell-off pushing the stock into oversold territory, resilient operating performance, margin expansion, and strong brand leadership suggest potential stabilisation near key support levels.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.